The Clarion Investment Committee met on 21 November 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, political, and business snapshot

Economics

- Early estimates of business activity in November from surveys of purchasing managers suggest a sharp upturn in the US but contractions in the UK and euro area.

- The cryptocurrency Bitcoin reached a new record of over $99,000.

- UK inflation rose to 2.3% in the year to October, up from 1.7% in September, driven by higher domestic energy prices.

- Bank of England governor Andrew Bailey said that the Bank will take “a gradual approach to removing monetary policy restraint” in part due to potential inflationary effects of the Autumn Budget. Markets expect the Bank to maintain interest rates at their current level in December.

- UK retail sales fell by 0.7% between September and October, which was more than expected, as retailers reported that sales were affected by uncertainty about the Autumn Budget.

- UK government analysis estimates that cutting winter fuel payments could lead to an additional 50,000 pensioners falling into “relative poverty after housing costs” in 2024–25.

- UK pensions minister Emma Reynolds said the government may consider mandating pension funds to invest in the UK if current reforms do not boost investment.

- Official UK figures could have underestimated employment by 930,000 workers since 2019 due to low survey response rates, according to think tank the Resolution Foundation.

- The lobby group British Retail Consortium and 81 retail CEOs said that the recent Autumn Budget could lead to increased costs of up to £7 billion a year across the retail industry.

- Negotiated wages in the euro area increased 5.4% in the three months to September compared with the same period last year, the largest increase since 1993.

- Euro area consumer confidence fell more than expected in November to its lowest level in five months.

- The European Central Bank warned of deepening sovereign debt vulnerabilities in light of “policy and geopolitical uncertainty, weak fiscal fundamentals and sluggish trend growth”.

- The Royal Institution of Chartered Surveyors (RICS) said it expected UK house price growth to continue to gain momentum. In the rental market, the RICS expects prices to increase due to strong demand and falling numbers of rental properties entering the market.

- UK chancellor Rachel Reeves and governor of the Bank of England Andrew Bailey called for the UK to rebuild ties with the EU, saying “we must reset our relationship”.

- UK chancellor Rachel Reeves announced plans to merge 86 council pension schemes into eight pension “megafunds” in a bid to encourage UK investment.

- The UK ranked top of the International Energy Agency’s league table for improving energy efficiency. However, this was driven partly by a reduction in manufacturing output and warmer weather reducing the need for households to turn on their heating.

- Euro area industrial production fell more than expected in September, by 2% compared with the previous month, driven by falling production in Germany.

- German economic sentiment deteriorated in November, according to ZEW, underscoring the country’s continued economic weakness.

- European gas prices reached their highest level in a year amid concerns of supply disruption from Russia.

- Japan’s economy grew 0.2% in the third quarter this year, in line with expectations and supported by growth in consumer spending.

- A record 6.5 million people moved to OECD countries in 2023, a 10% increase on the previous record of 6 million in 2022.

- OPEC cut its growth forecast for global oil demand in 2024 for the fourth consecutive month amid weaker demand from China. The growth forecast for 2025 was also revised down.

Business

- The European Commission fined Meta €798 million, saying that “tying” its Facebook Marketplace classified ads service to its social media platform was in breach of competition rules.

- The Times reports that the UK government is preparing to relax quotas for sales of electric vehicles in response to claims that the current rules have “pushed carmakers to crisis point”.

- Pharmaceuticals manufacturer AstraZeneca put a £450 million investment plan for a new vaccine production factory in the UK under review, saying “we are reviewing the incentives for investment in the UK”. It also announced $3.5 billion of capital investment in the US by the end of 2026.

- UK health minister Wes Streeting said hospitals will be ranked in league tables, with “turnaround teams” deployed to failing trusts and more spending freedom for top performers, as part of reforms to improve NHS performance.

- Marks and Spencer overtook rival Waitrose in grocery market share in October, the first time outside of the Christmas period amid market-leading sales growth, The Telegraph reports.

- The air traffic control network failures in August 2023 affected 700,000 passengers and cost up to £100 million, according to a report commissioned by the Civil Aviation Authority.

- The UK’s Financial Conduct Authority fined Metro Bank £16.7 million due to a lack of appropriate systems and controls to adequately monitor transactions for money laundering risks.

- The UK approved five electricity cables, costing approximately £7 billion, to connect the UK with Ireland and continental Europe.

- The UK Post Office is seeking to sell or close 115 of its wholly owned branches as part of a wider strategic review, potentially affecting 1,000 jobs.

- The UK’s higher education regulator, the Office for Students, said “bold and transformative action” is required to address the financial sustainability of the sector.

- The credit rating of UK water company Southern Water was downgraded into junk territory by the credit rating agency Moody’s amid ongoing financial difficulties.

- Energy company Shell won an appeal in the Dutch courts against an order to cut greenhouse gas emissions by 45% by 2030, brought about by environmental group Friends of the Earth.

Global and political developments

- The US Republican Party retained their majority of the House of Representatives, giving them control of both chambers of Congress.

- US President-elect Donald Trump announced Marco Rubio as secretary of state, Matt Gaetz as attorney general, Fox News host Pete Hegseth as defence secretary and tech entrepreneur Elon Musk as co-leader of the new Department of Government Efficiency.

- Experts, including former UN secretary-general Ban Ki-moon, have called for an overhaul of the COP climate talks, saying “COP must shift away from negotiations to the delivery of concrete action”.

- German elections will take place next February after the current coalition of three parties collapsed.

- The Labour Party lost 24 of the 58 council seats it defended in local council by-elections since the Party came to power in July this year, according to research by analyst David Cowling.

Please click here to access the November Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary & strategy

- Three key developments, the UK Budget, the Trump Presidential victory and the Chinese economic stimulus, continue to elevate inflation expectations. Our conviction that interest rates and inflation will remain higher than market expectation for many years remains strong, and we continue to expect equities to outperform fixed interest assets.

- Nevertheless, we are monitoring long bond yields for any tipping point where equity risk suddenly accelerates, and sovereign bonds offer attractive above inflation returns. The market excitement following the US election is not a good environment for changing allocations and equity prices will settle as the implications become more apparent. The immediate market reaction to events often does not correlate with the longer-term trends that emerge so this is a time for careful consideration rather than knee-jerk reactions.

- We are thinking carefully about US and Asia markets and how the next Trump era may unfold. Similarly, we are considering if the UK budget has stalled the recent equity market progress or simply created a temporary pause.

- Fixed interest holdings are positioned with shorter durations, where yields tend to be higher and exposure to long-term inflation risk is reduced. This strategy aligns with our forecasts, which anticipate higher inflation than the current consensus.

Strategy

- The Investment Committee are maintaining their tactical position of being underweight US stocks and overweight Asia & Emerging Markets and broadly neutral on the UK, Europe and Japan.

- The Investment Committee remain cautious on the outlook for the US economy, concerned by unsustainably low consumer savings rates as well as by high levels of personal debt. The US government has its own debt issues too. It will need to tackle its fiscal deficit at some stage, providing a further drag on economic growth.

- Inflation is expected to persist and whilst it is likely to dip below 2% in the next few months, the long-term average is expected to be around the 3% level due to wage inflation. Historical high energy costs soon “fall out” of the inflation calculations and services inflation still high.

- A new interest rate-cutting cycle has begun and is expected to create optimism into 2025, but a higher interest rate and higher inflation environment will become the new norm.

- US big tech and large-cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future. Liquidity has been the most significant driver of returns to date but there remains a downside risk to high PE stocks.

- Chinese economy is stagnant but recent announcements of fiscal and monetary stimulus may provide relief.

- It will take a full economic cycle for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- After extensive changes to the underlying funds in recent weeks the Investment Committee are very comfortable with the present position and no further fund changes were proposed.

Since December 2023, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize-winning economic research. Factor investing involves trusting the market but tilting the investment choice towards smaller companies, value companies (those trading at a discount) and profitable companies. The evidence shows that over the long-term, these types of investments outperform the typical index tracking and actively managed funds.

Clarion is accessing these factor-based investments through Dimensional Fund Advisors. At present, Dimensional is the only investment manager in the UK which offers this type of investment. Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

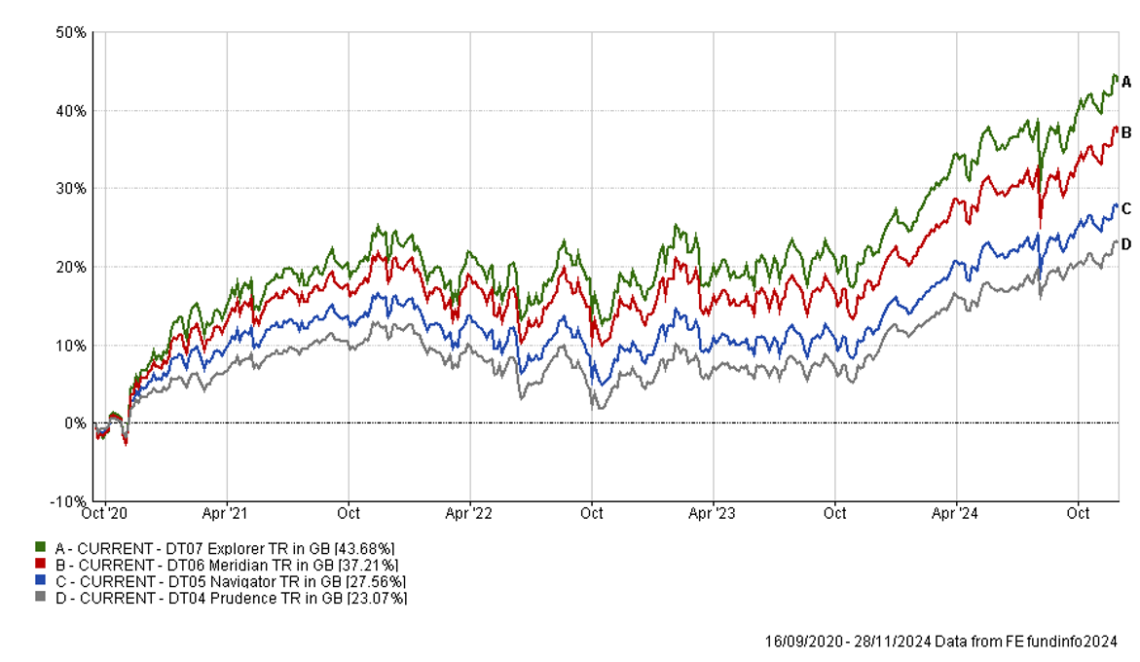

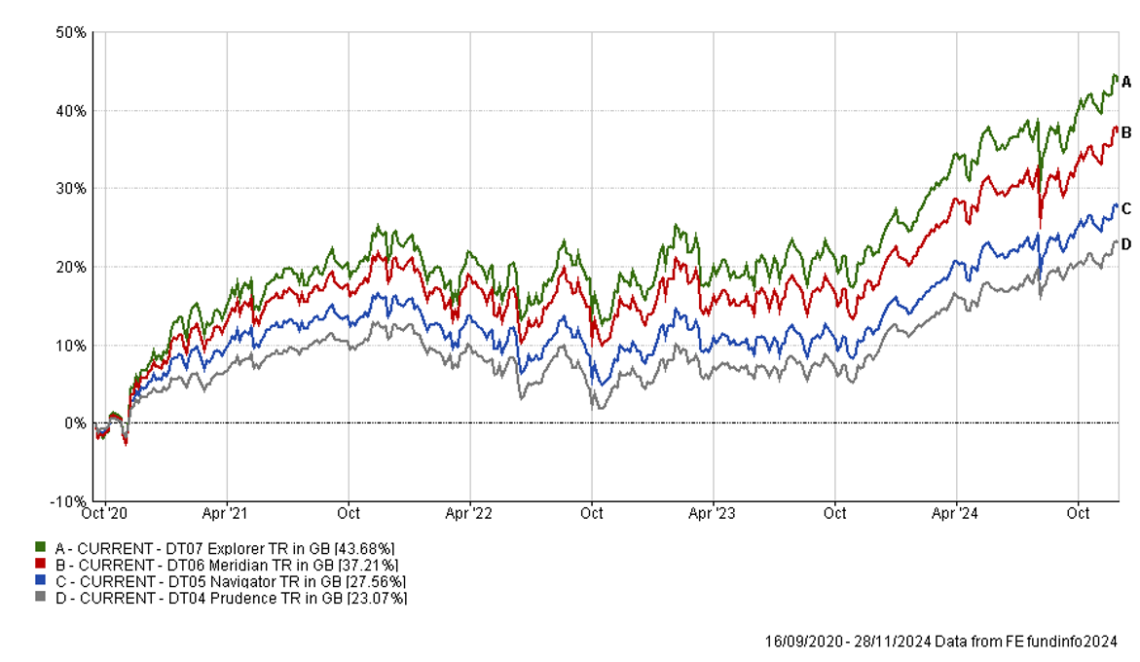

The performance of the CURRENT portfolios back tested since the start of the available data in September 2020 is shown in the chart below. This is assuming that we made the recent changes at that time and then adopted the buy and hold approach favoured when using evidence-based factor investing.

Clarion Funds & Discretionary Portfolios:

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

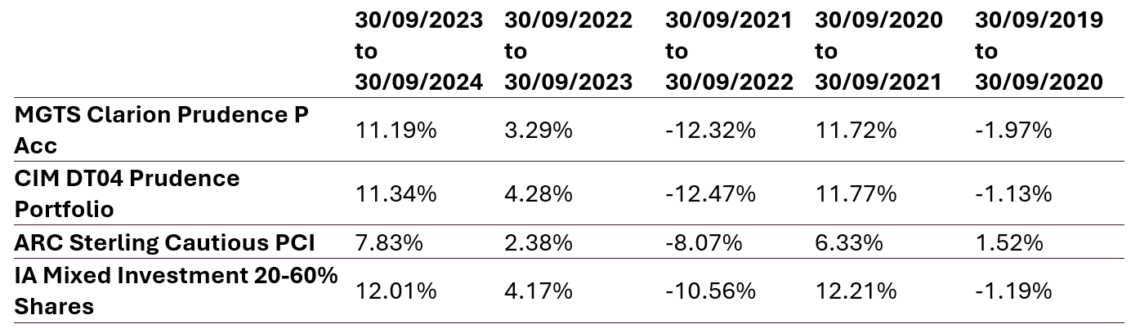

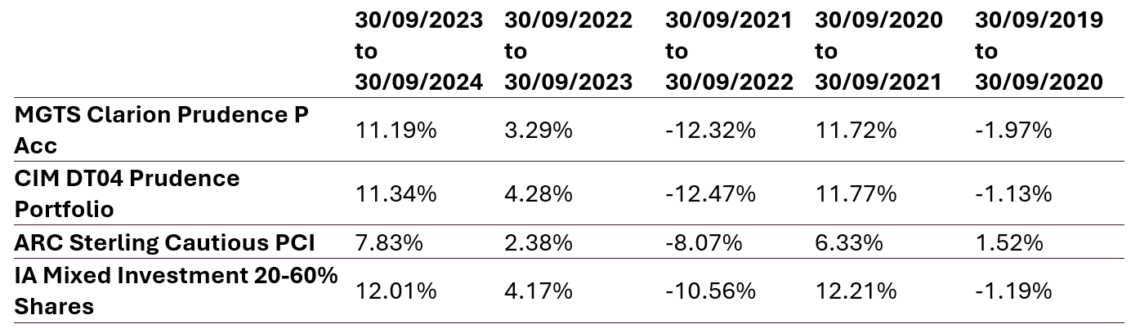

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

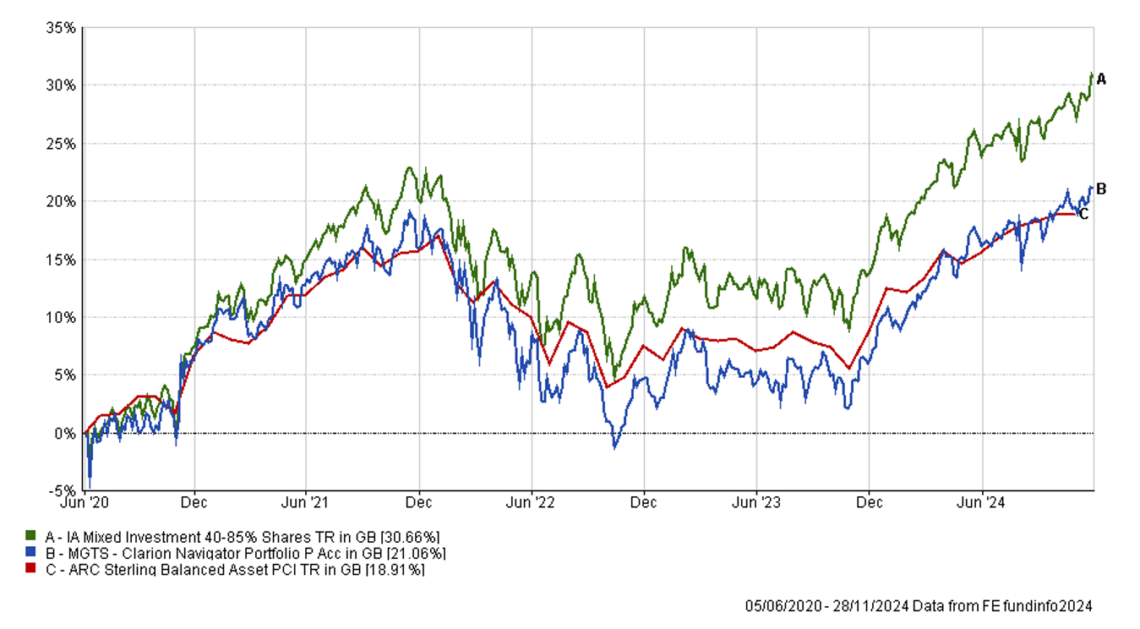

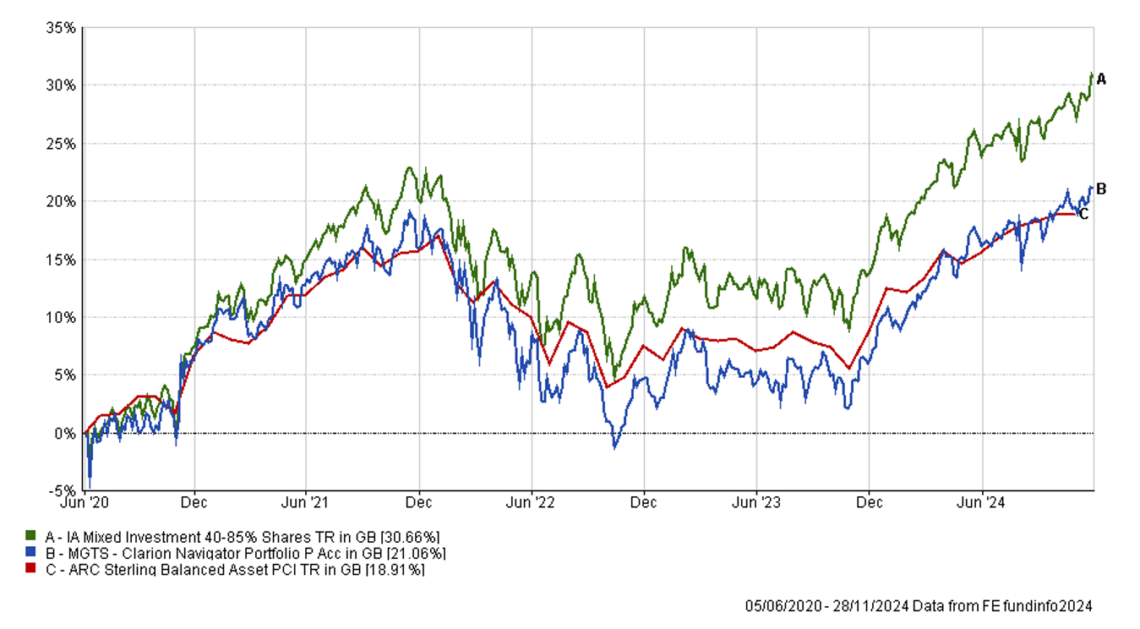

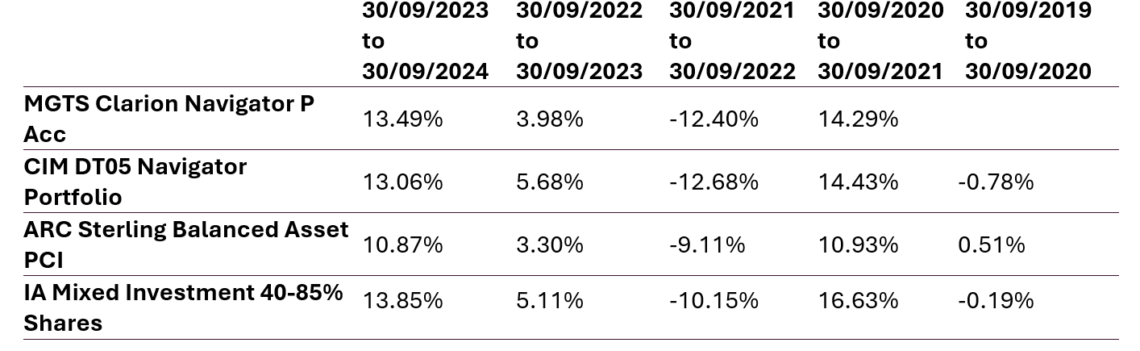

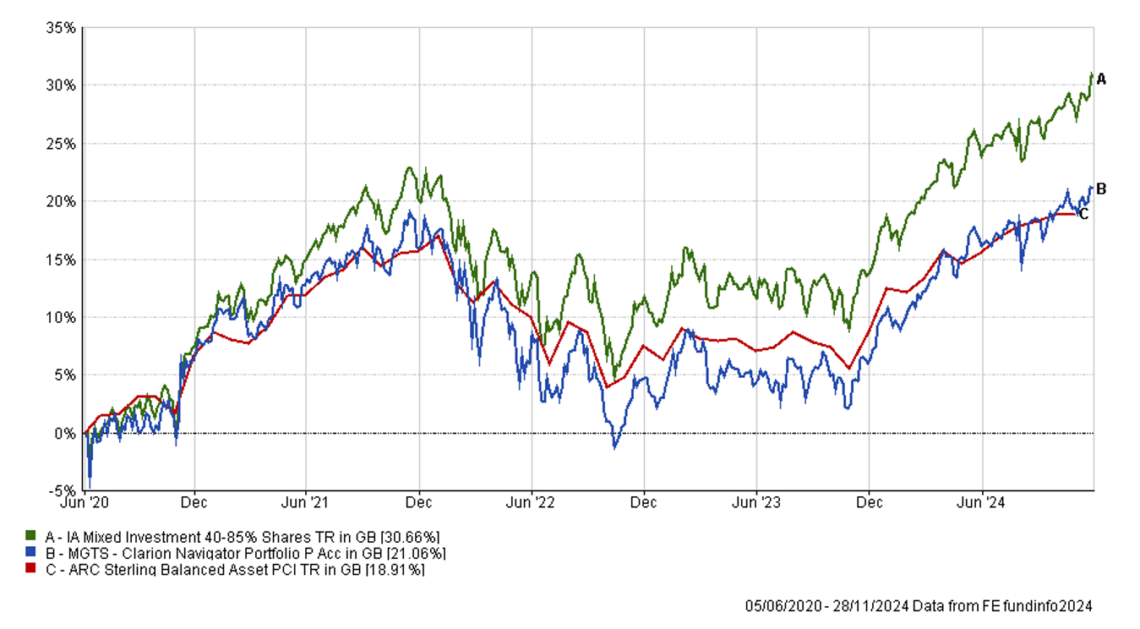

Navigator Fund & Managed Portfolio

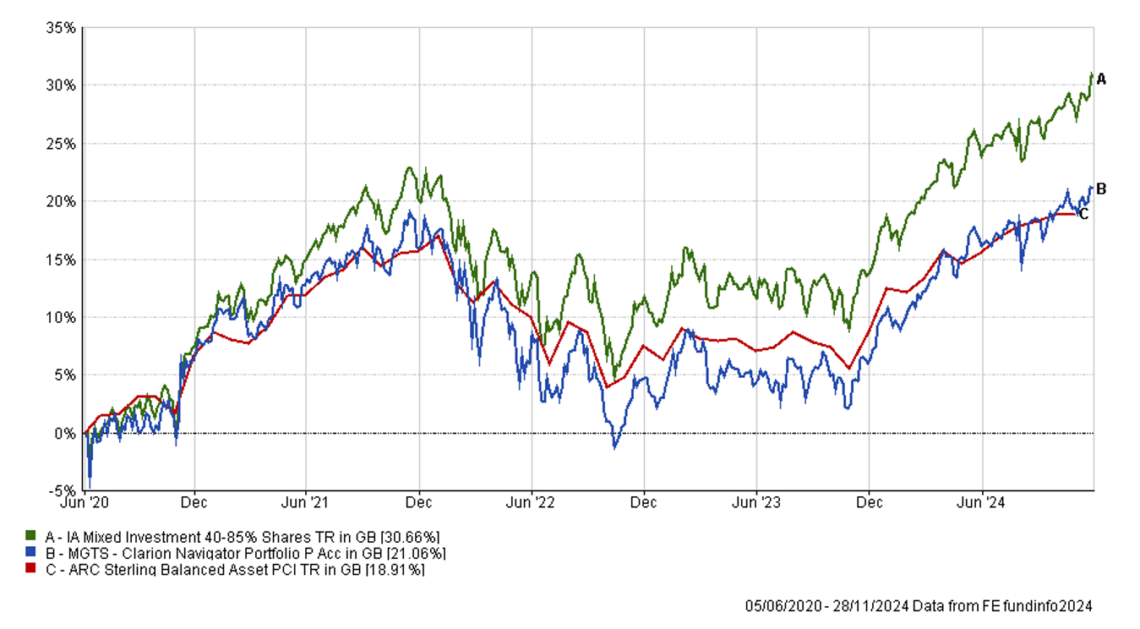

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

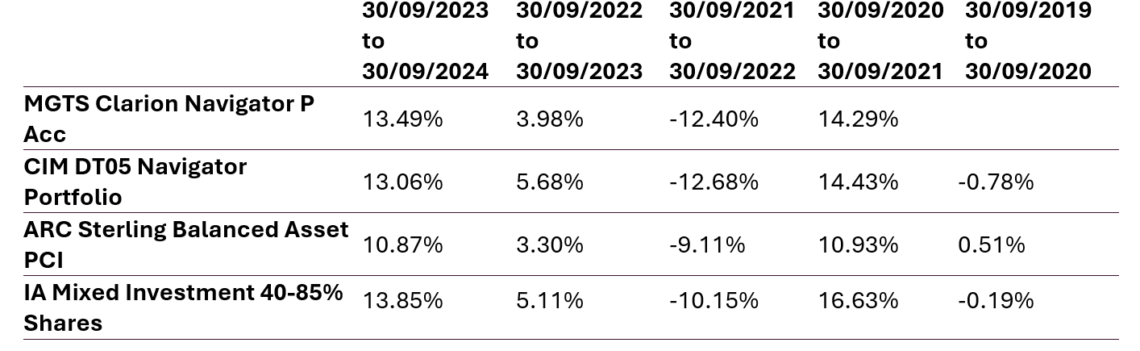

The table below shows the annualised performance to the last quarter end:

Changes to the Navigator Fund & Portfolio

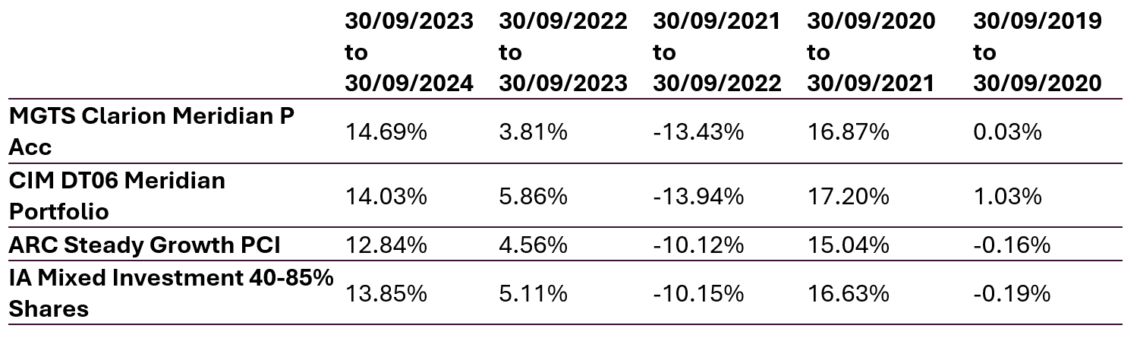

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

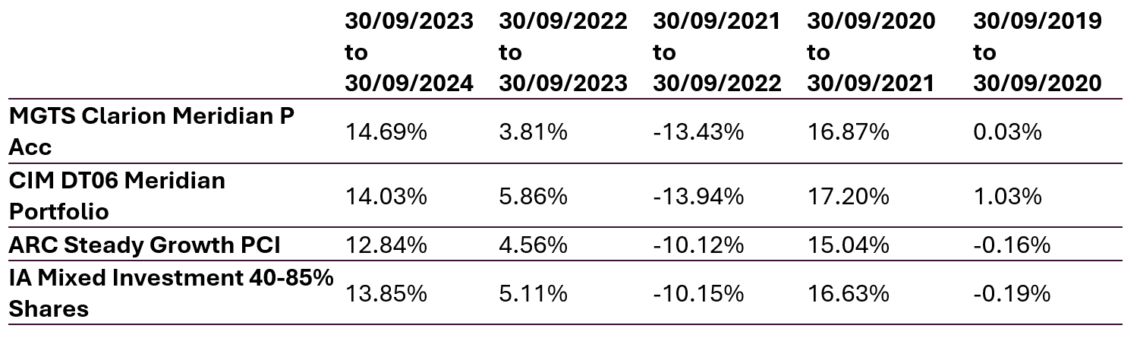

The table below shows the annualised performance to the last quarter end:

Changes to the Meridian Fund & Portfolio

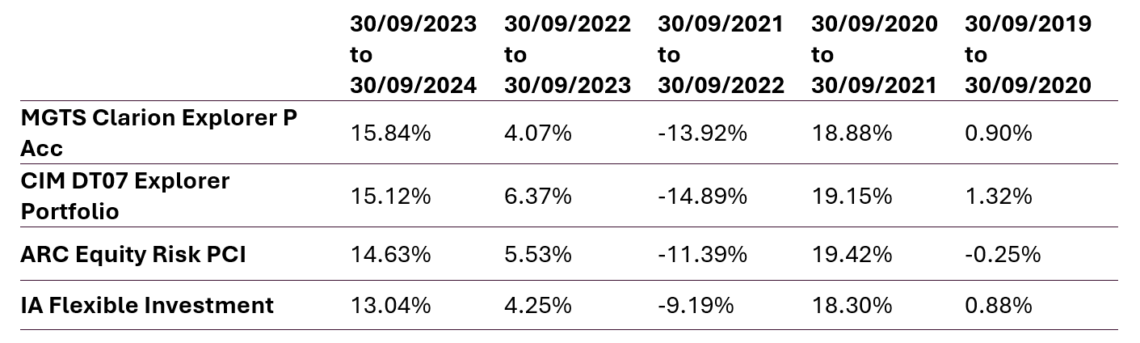

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

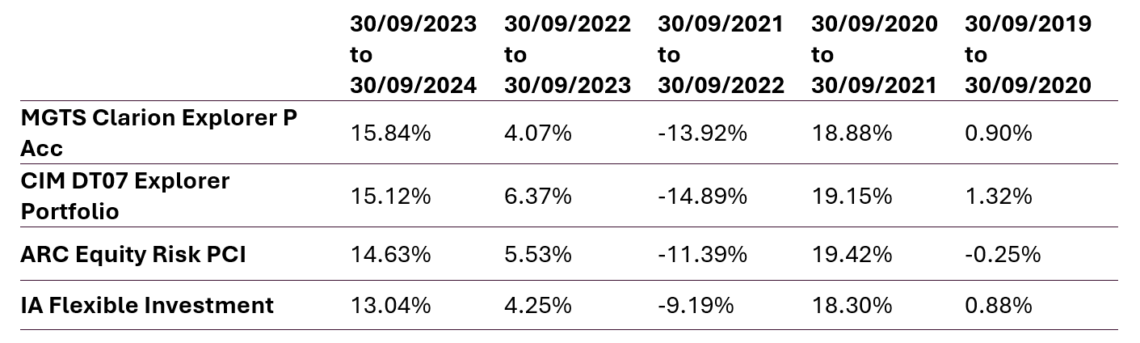

The table below shows the annualised performance to the last quarter end:

Changes to the Explorer Fund & Portfolio

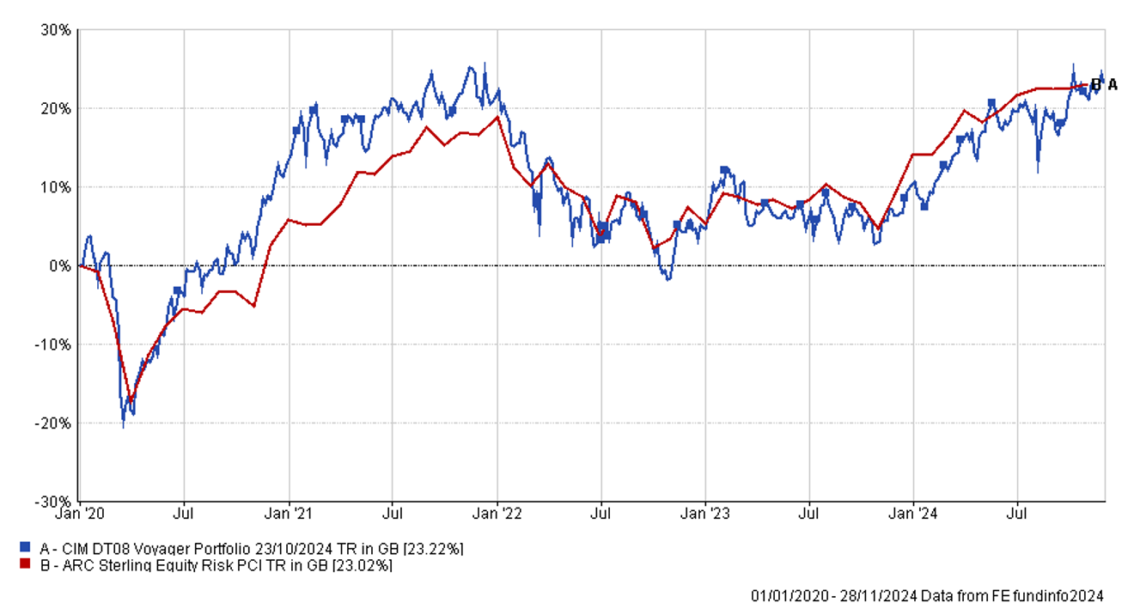

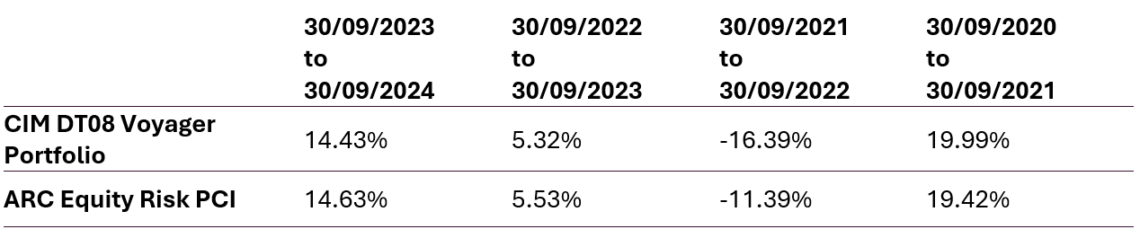

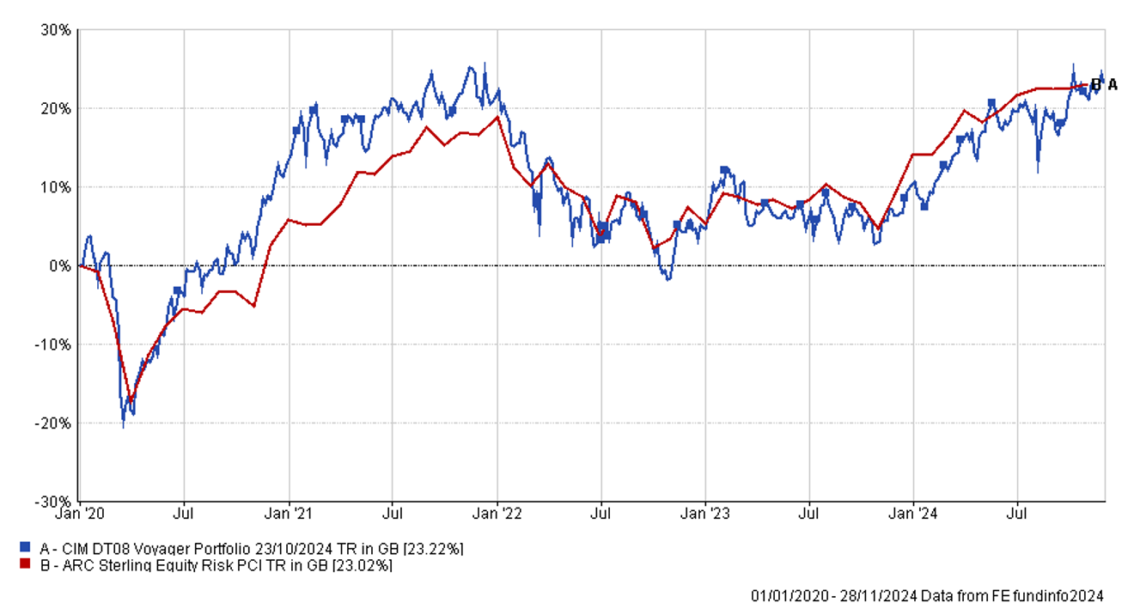

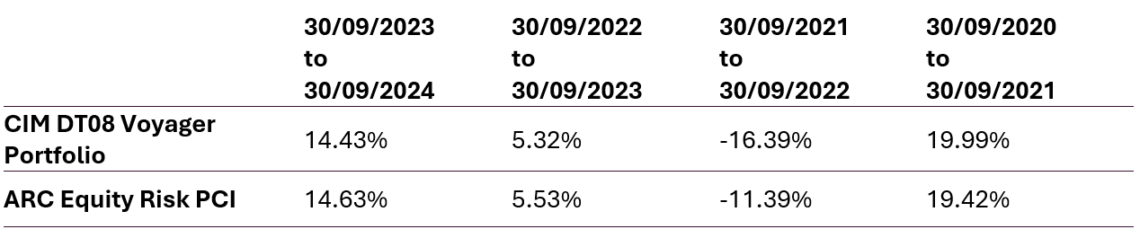

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Voyager Portfolio

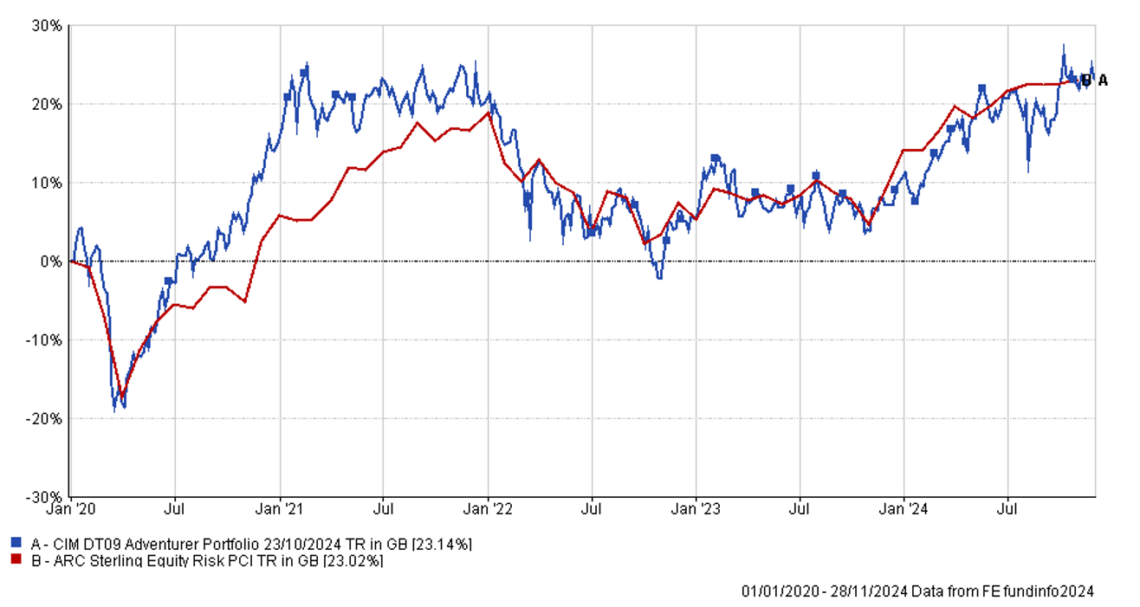

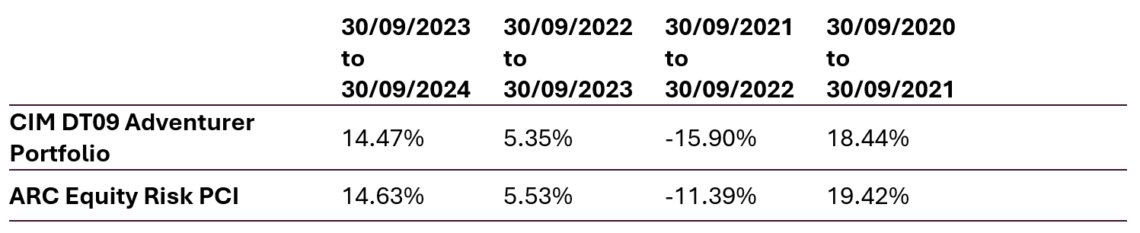

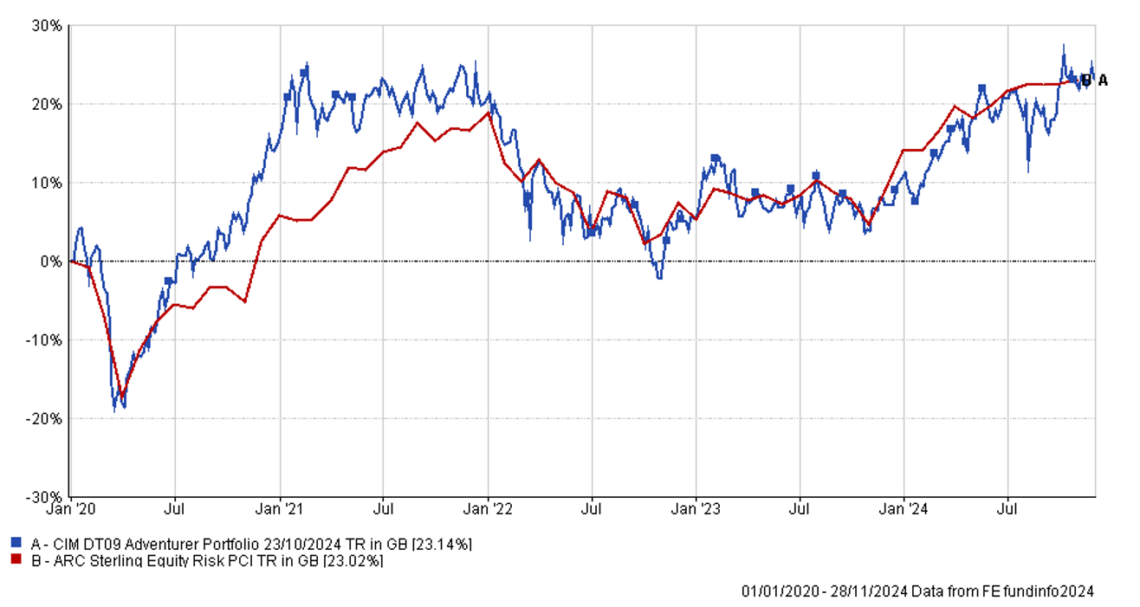

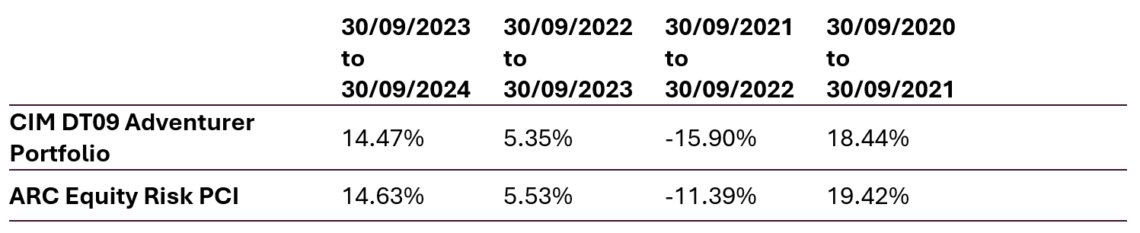

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Adventurer Portfolio

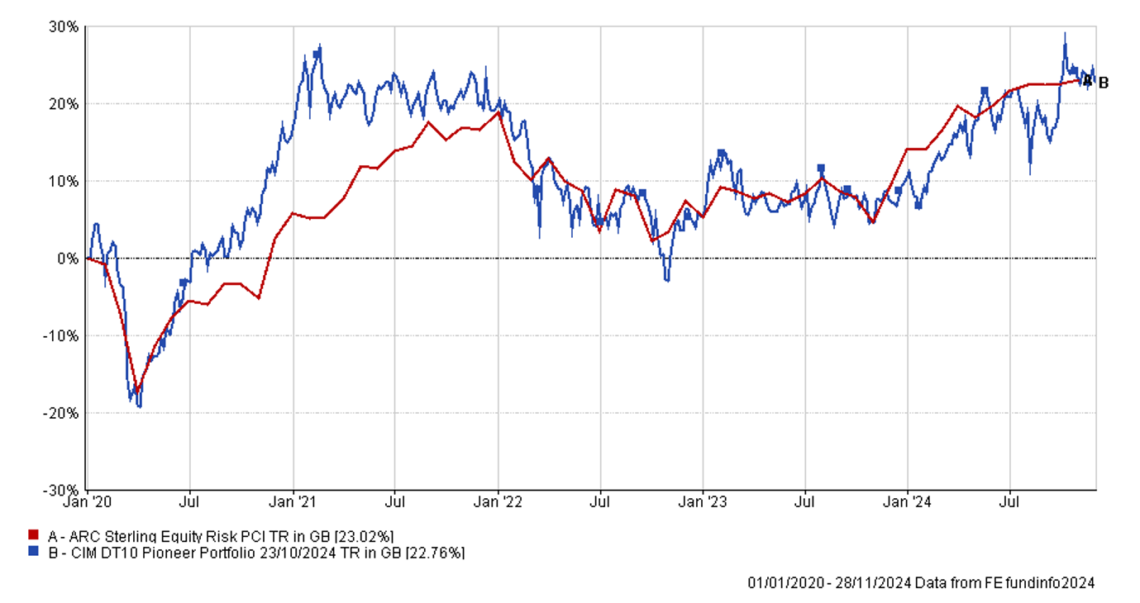

Pioneer Managed Portfolio

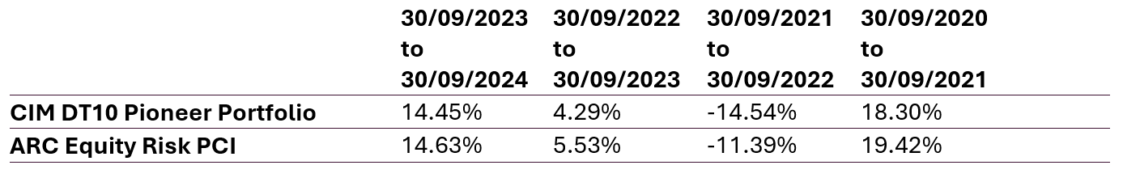

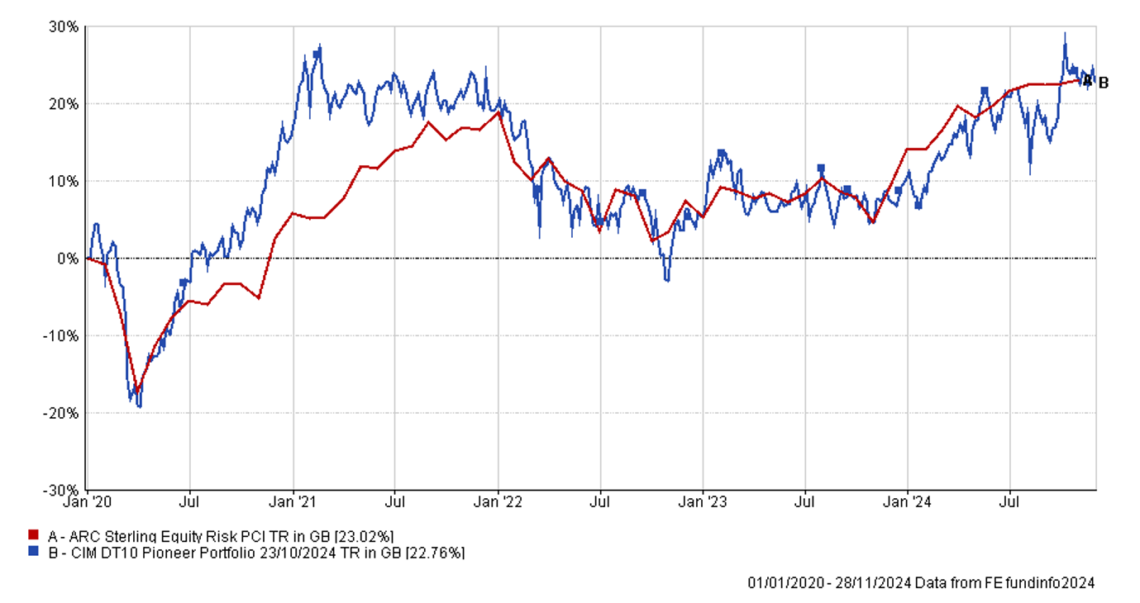

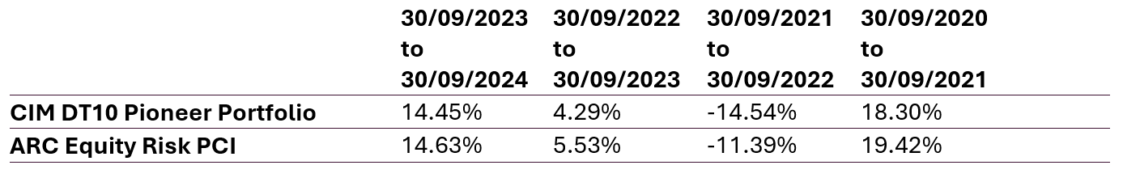

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Pioneer Portfolio

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

November 2024

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.