Minutes of the Clarion Investment Committee held at 1pm on 15th October 2020 by video link.

Committee Members in attendance: –

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

|

|

Apologies from Ron Walker, Founding Director, Clarion.

Review of previous minutes and action points

Minutes from the previous meeting held on 17th September 2020 were agreed by the Committee as a true and accurate record.

Economic commentary and market outlook

Please click here to access the October Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

- As so often in 2020, discussions regarding the latest virus news takes centre stage. It is increasingly apparent that regions and nations are at very different points in their journey with COVID-19, supporting the view that worldwide or national lockdowns can no longer be justified at this juncture. Countries throughout Europe, including the UK, are currently tightening restrictions on a regional, risk-based basis.

- In the UK, Boris Johnson admitted that existing lockdown rules were too “complex” and introduced a new three-tier alert system with areas of England categorised as being on medium, high, or very high alert over Covid-19. The Liverpool city region was the first to go on very high alert, in which there is a “baseline” that most pubs must close, and no household mixing will be allowed, either indoors or outdoors. Manchester has now followed. Opposition leader Keir Starmer called on the government to “follow the science” and impose a national “circuit breaker” lockdown of at least two weeks, as the death toll from Covid-19 rose to a four-month high.

- UK Chancellor Sunak unveiled new wage support plans which would see the government cover two thirds of wages in locked-down areas. In both economic and political terms, the UK cannot afford a further nationwide lockdown, so we should expect to see more of this kind of regional support in the coming weeks and months.

- Indeed, the UK economy continues to suffer more than most, given its bias towards the service sector. High-frequency economic data shows that the momentum behind renewed economic activity is faltering again and regional lockdowns are clearly influencing this picture. Around 30 million people in the UK are now living with additional restrictions beyond the basic national guidance.

- UK job losses rose at a record rate in the three months to August, even as more furloughed employees returned to work and some companies began hiring. The Office for National Statistics (ONS) said the number of redundancies increased by 114,000 in the third quarter, while the number of people claiming out-of-work benefits rose to 2.7m; more than double the level in March, before the coronavirus lockdown. The unemployment rate rose to 4.5%, up from 4.1% in the previous quarter and 3.9% a year earlier.

- As economies start to re-emerge from the pandemic, we are seeing an increasing divergence between countries in the east (i.e. China) vs the west (Europe and the US). Imports into China increased at their fastest rate this year in September in a sign that the country’s recovery is fuelling higher demand for overseas goods. Imports rose 13.2% in dollar terms last month compared with a year earlier. Economists had forecast a rise of just 0.4%.

- The IMF recently released its World Economic Outlook which stated the coronavirus crisis will wreak “lasting damage” on people’s living standards across the world, leaving significant scars on the global economy in the form of job losses and bankruptcies. The fund’s chief economist, Gita Gopinath, described the road ahead as “long, uneven and uncertain”. She went on to say that governments will need to increase taxes on the rich, as well as making it harder for corporations to avoid taxation.

- Joe Biden’s lead of roughly 10 points in the polls over President Trump, just a few days out from the elections, has helped to calm market nerves over the potential for a contested result. Expectations were also growing for an expanded stimulus programme under a Biden presidency, enabled by a so-called “blue wave” where the Democrats also take control of the US Senate and House of Representatives.

- Meanwhile, Brexit negotiations rumble on. Boris Johnson has openly stated that he is giving up on negotiations with the European Union over a new trade deal, although agreement must be reached by January 1st or the UK will trade with its biggest trading partners on the minimal terms dictated by the World Trade Organisation. This may or may not be hard ball tactics by the British Government but either way, as with previous Eurozone negotiations, reaching agreement on a trade deal is likely to “go to the wire”.

Strategy

Bonds continue to offer poor value for investors, with central banks seeking to flatten the yield curve in order to facilitate cheaper long‐term government borrowing. This is only likely to increase in western economies, with fiscal stimulus expected from the US in the wake of the election and other countries likely to follow this example. Our bond positioning at the short‐dated end of corporate debt offers above inflation yield with acceptable levels of duration and credit risk. With the sheer scale of additional money injected into markets and the high level of household savings ratios, which will surely be spent when confidence improves, inflationary pressure could emerge in time, evaporating the return of overpriced long‐dated bonds.

The Investment Committee favour equities due to their yield (particularly in the UK) and potential for capital appreciation. UK equities have been undervalued since the Brexit vote in 2016, in part due to the value‐bias inherent in the major indices. The emergence of a Covid‐19 vaccine or a respectable resolution to a trade deal with the EU are plausible candidates for an upward re‐rating of UK equities. Our overweight allocation to Asia Pacific equities is largely due to the superior experience of Asian countries in suppressing the virus with targeted testing and lockdowns. China’s rapid rebound offers a route map of economic recovery for many of these economies. Our emerging markets holdings are focused away from countries that are still struggling with the initial wave of the virus, with minimal exposure to Latin America. US equities continue to be driven by top heavy indices and tech performance. Our long‐held concern that regulation will inevitably affect US megacaps has been borne out by the recent DoJ legal case brought against Alphabet, the owner of Google, accusing the company of violating competition laws.

Review risk management, eligibility and investment and borrowing powers

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion Funds; Prudence, Navigator, Meridian and Explorer

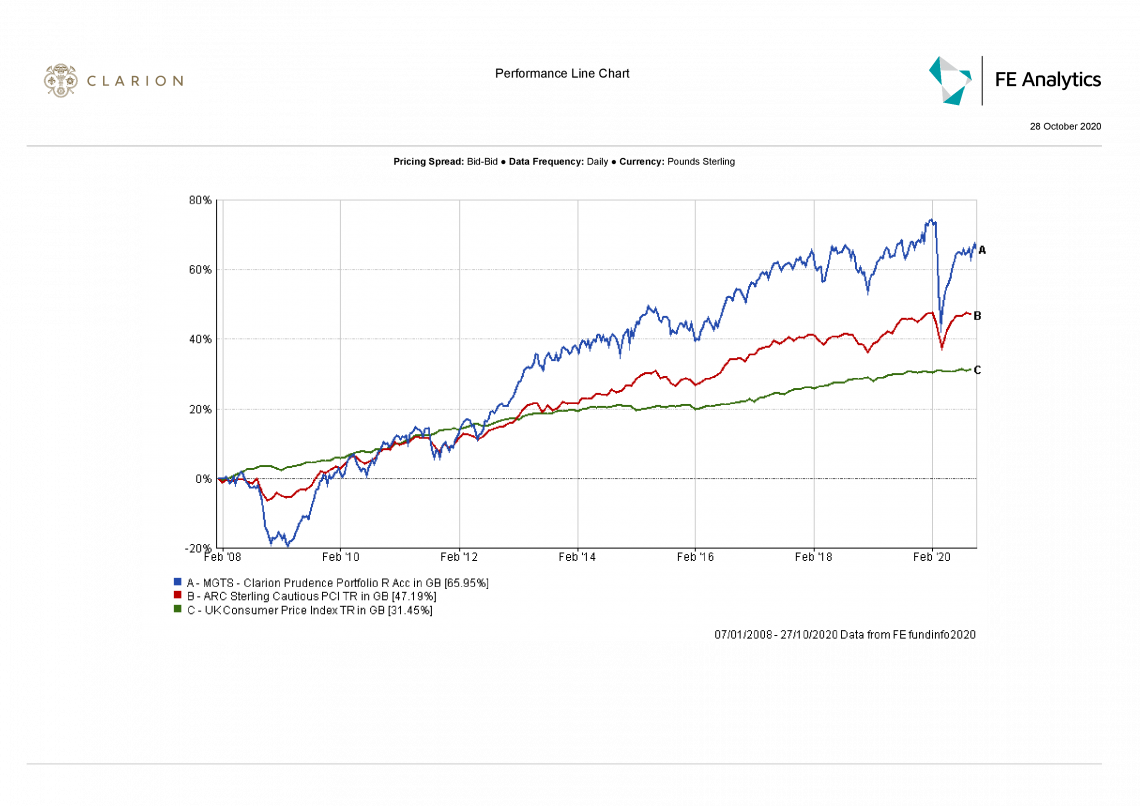

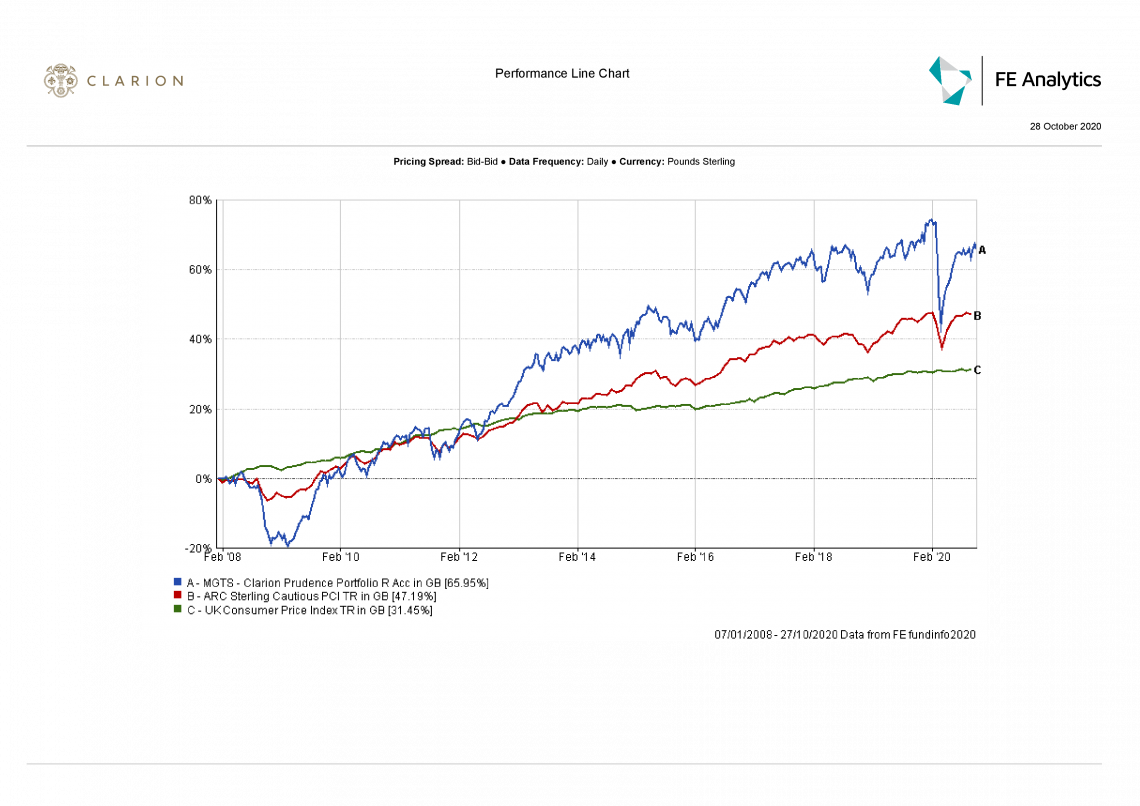

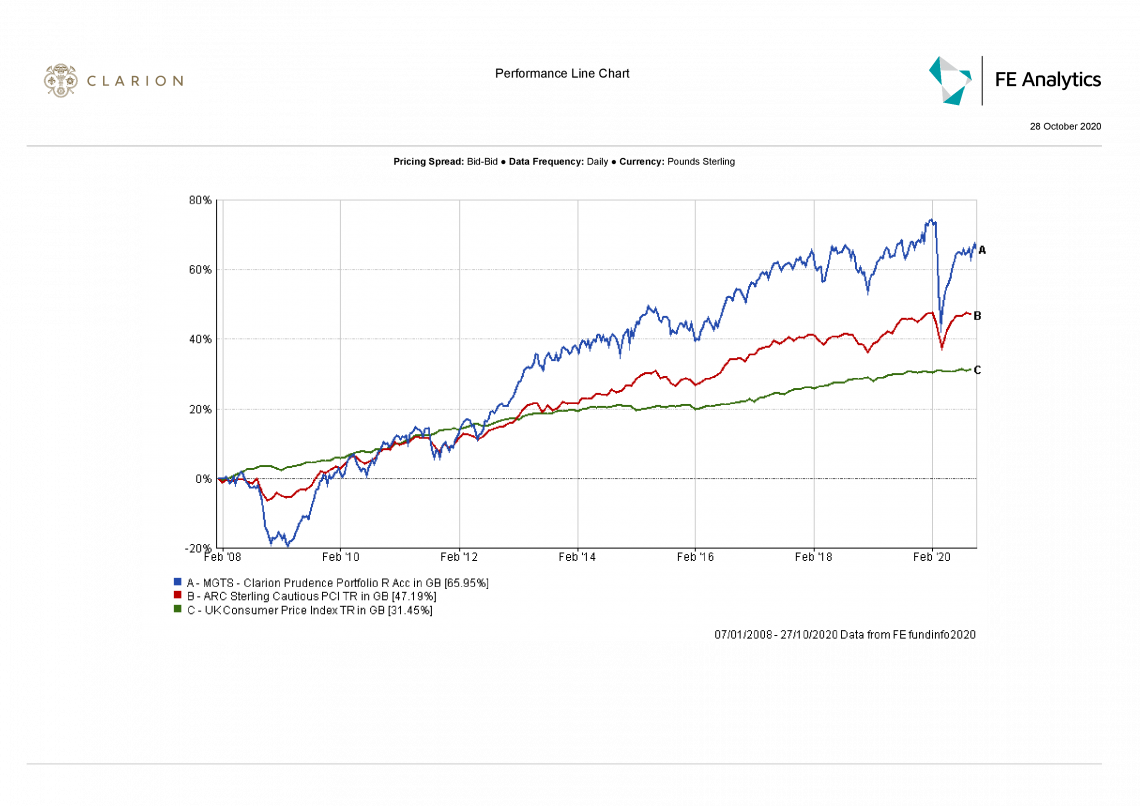

MGTS Clarion Prudence

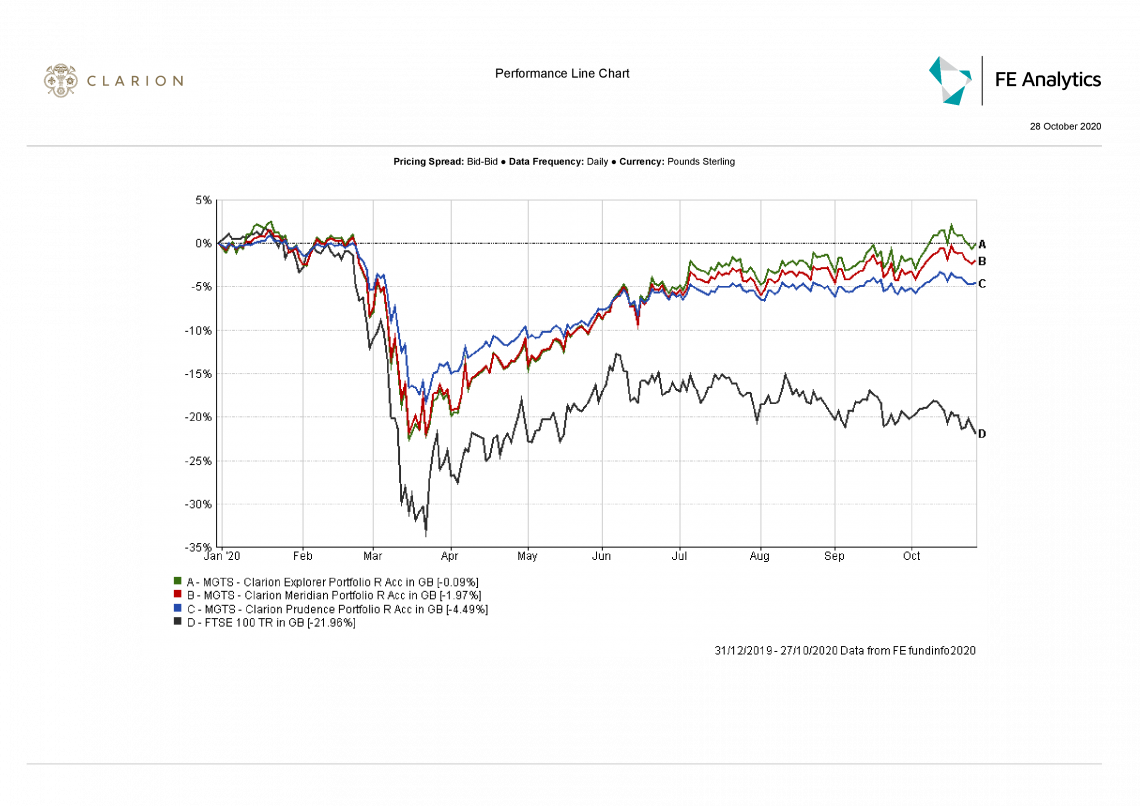

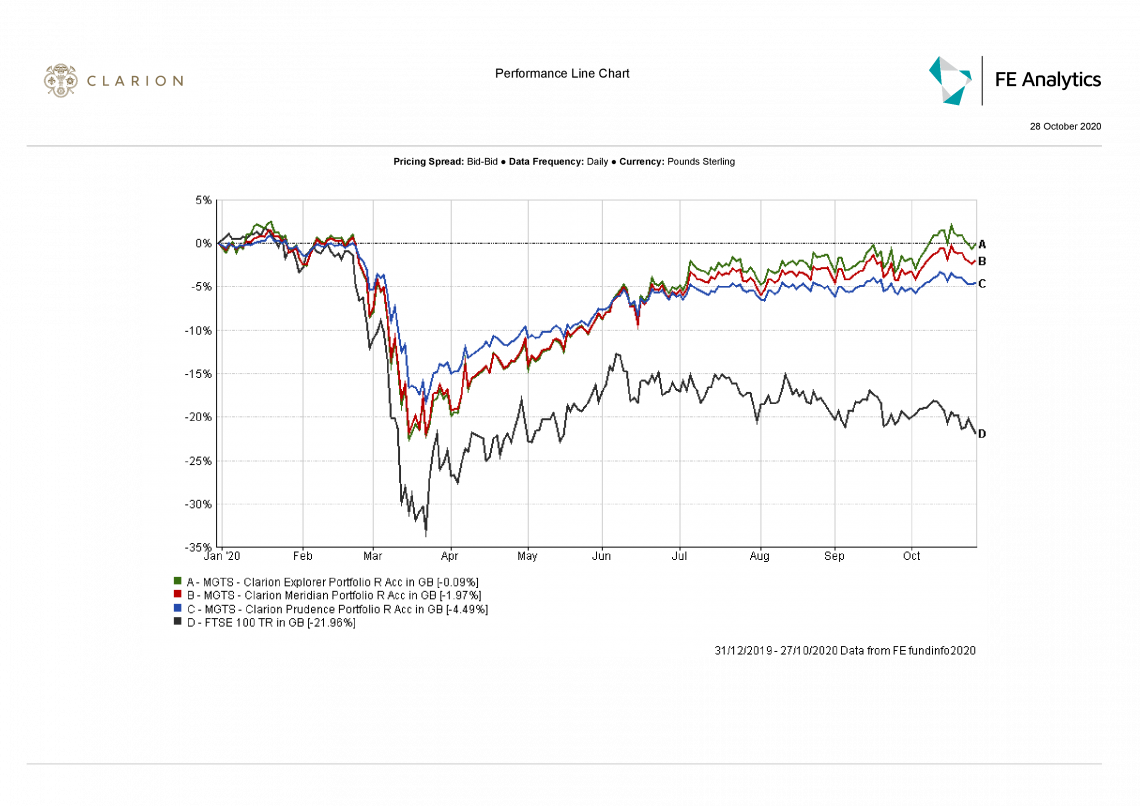

- Prudence performed slightly behind its sector over the last quarter by 0.50% whilst comfortably outperforming its DT strategic benchmark over the same time by 2.50%.

- The outperformance against its benchmark was mainly due to our allocation attribution, mainly within the IA Global and IA UK Equity sectors.

- Our selection in Asia over the past month, has been strong, with First State Asia Focus returning +3.95%

- In similar vein, JPM Japan has been strong, returning an impressive +11.76% and +7.89% over the last quarter and month, respectively. Our tactical overlay within Japan has certainly paid off as of late.

- M&G Global Dividend has outperformed Fundsmith Equity over the last 12 and 24 weeks as a result of its rotation from growth to value. These two funds continue to work well alongside one another, given their trade-off between value and growth strategies; adding a good level of diversification for the Global element of the portfolio.

- Fidelity European has been disappointing over the last quarter, providing a loss of -1.21%. However, this performance is mainly down to the lag in equity markets we have seen of late across Europe as a whole, combined with its defensive investment approach. The fund remains over 1% up over 12 months versus its sector and the Investment Committee do not have any concerns of the ongoing suitability of this fund.

- Hermes Global Emerging Markets continues to look strong, particularly over 1 year where the fund has returned +13.82%. Looking more short term, this fund continues to hold its own with strong performance over 4, 12- and 24-week periods.

- The performance in short-dated bonds has been relatively flat over the last quarter. In contrast, the other bond holdings within the portfolio have had a positive quarter given the growing concerns of a second wave of Covid-19 and the impact this may have on the economy. Baillie Gifford High Yield has certainly been a winner as result of these concerns, returning 2.56% over the last quarter.

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £30.64m.

- Performance over 1 year is up at +0.66% compared to a fall in the UK Footsie 100 index of circa -14%

There were no proposed changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

MGTS Clarion Navigator

- The fund is now fully invested in line with the agreed assets/ allocation following several large inflows into the fund over the last month.

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £4.78m; an increase of circa £2.04m from the last committee meeting carried out in September.

- The unit price as at the 16th October 2020 was 103.27p; showing a 3.27% increase having been launched at 100p on the 11th May 2020.

The Committee proposed no changes to fund selection.

Due to the fact that the Navigator Fund has only been operating for a short period of time, we are unable to provide a useful performance graph of the fund versus its relevant benchmark.

The Committee approved the strategy and confirmed it is in line with the mandate.

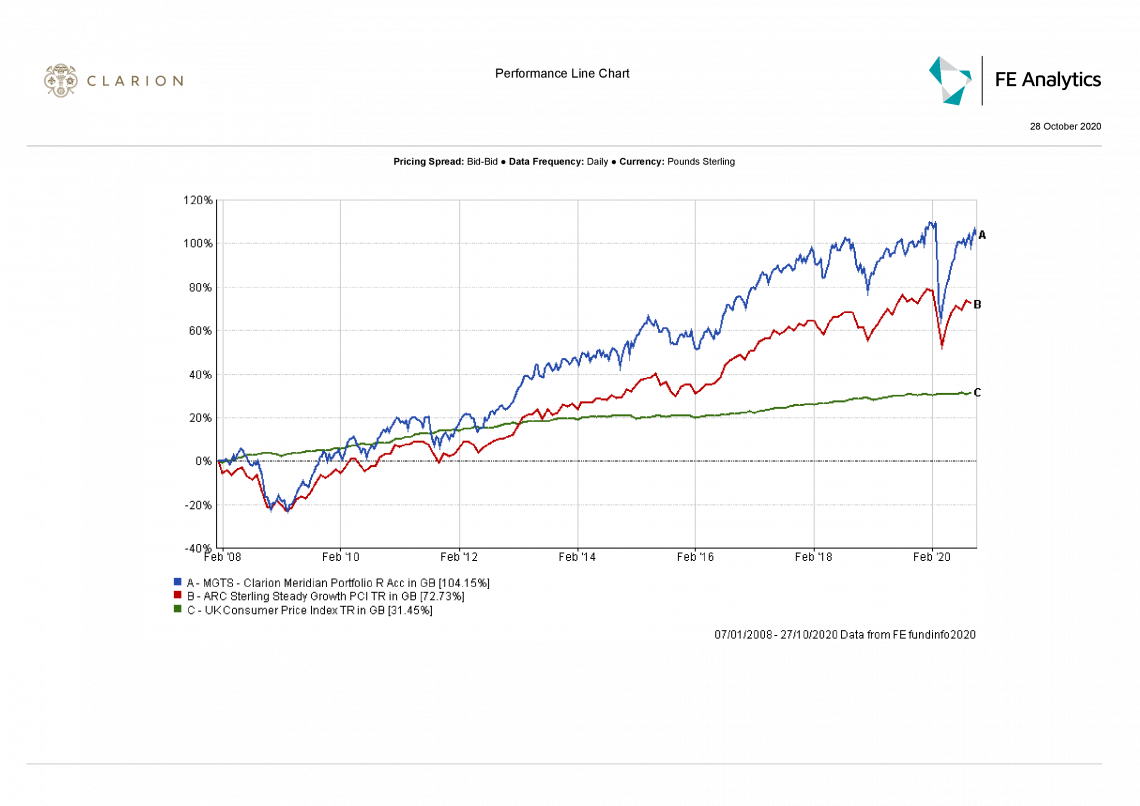

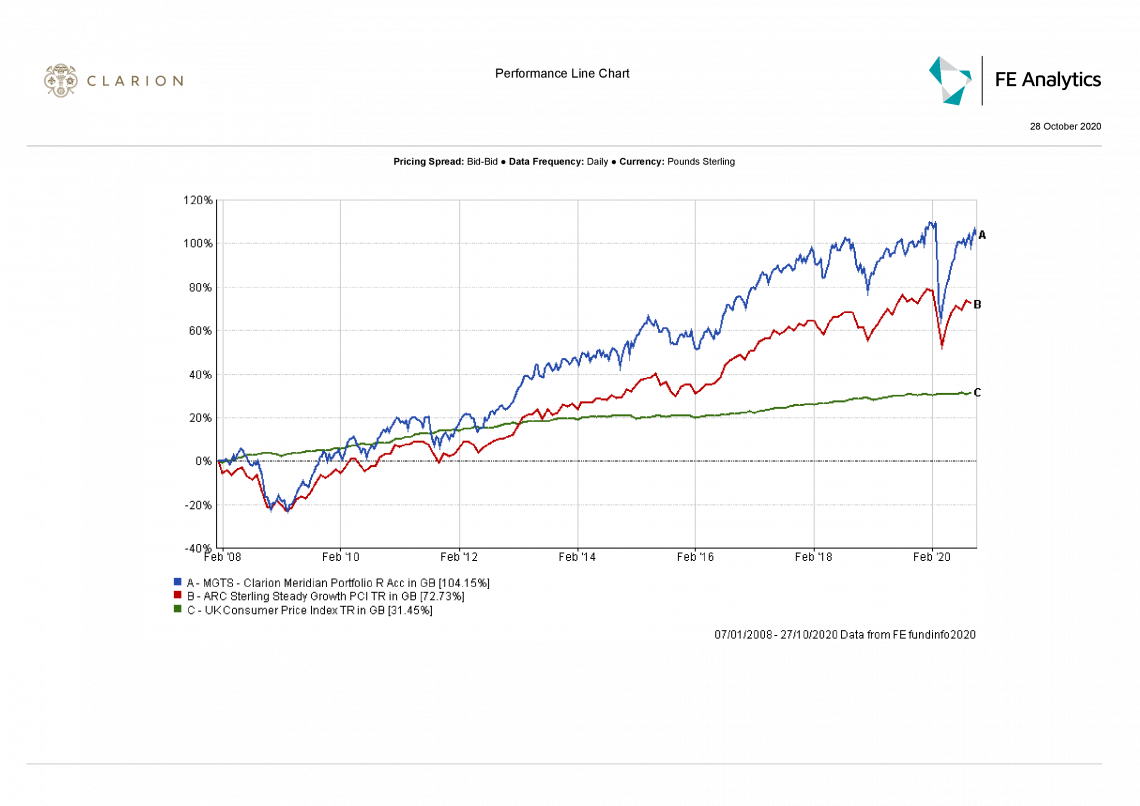

MGTS Clarion Meridian

- Meridian has had a positive quarter, returning +3.30%. This is ahead of both its sector and DT strategic benchmark with outperformance of +0.10% and +1.40% respectively.

- Again, the outperformance against its benchmark is predominately a result of our allocation attribution within the IA Global and IA UK Equity sectors. Selection has been relatively flat.

- The Hermes and SLI Global Emerging Market funds have proved to be a good match as they continue to work well together side by side. The SLI fund has a bias towards growth stocks and in contrast, the Hermes fund has a bias towards value. This provides a level of diversity and downside protection when a swing in performance between growth and value occurs. The value strategy of Hermes has seen the fund return +13.82% and +6.81% over the last 12 and 3 months, respectively.

- Artemis Global Select and Fundsmith Equity have both struggled of late within the Global element of the portfolio, with them both marginally lagging their sector over a 4-week period.

- ‘Man GLG UK Income’ was previously brought to the attention of the committee following a period of poor performance and it was agreed that the fund would be kept under review with the potential to remove it from across the Clarion managed funds. One of the driving factors to the underperformance was believed to be down to the value investment approach; an approach which has become favourable as of late. Over the last 2 weeks, this fund has delivered a +5.97% return and has outperformed its sector by +1.25% as result of its investment approach and has proved to be the strongest performing fund over this timeframe. Whilst the fund will remain on the radar of the committee, it was agreed that we would keep our allocation within this fund for the time being.

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £56.52m.

- Performance over 1 year is positive, returning +3.71% compared to a fall in the UK Footsie 100 index of circa -14%

There were no proposed changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

MGTS Clarion Explorer

- Over the last quarter, Explorer has outperformed its sector and benchmark by +1.30% and +1.20% respectively, whilst returning +5.10% overall.

- Both Stewart Investors Asian Pacific Leaders and Fidelity Asia have returned in excess of +8% in the last quarter whilst outperforming their sector by over +2%. The growth style of these funds has led to such outperformance.

- Lindsell Train Japanese has had a disappointing month, with a loss of -0.93%. Whilst this is disappointing, the performance of JPM Japan has balanced this out with a monthly return of +7.84%, making the net position of our holdings in Japan positive.

- At present, the overall balance of the portfolio’s equity holdings sways towards value whilst Prudence and Meridian have a good balance between value and growth. It was felt that a better balance is needed within Explorer, given the ongoing uncertainty of stock markets with the likelihood of further lockdown restrictions and Brexit looming. To achieve this balance, it was agreed that Man GLG, a value orientated fund, would be removed from the portfolio and be replaced by ‘BlackRock UK Equity’, a fund steered more towards growth. Overall, this will balance out the portfolio and put us in a greater position to ride out any short-term volatility that may arise over the upcoming weeks and months.

- Apart from the replacement of Man GLG, the portfolio remains in good shape and no further changes are required at this stage.

- Fund size is currently £20.70m.

- Performance over 1 year is up at +5.01% compared to a fall in the UK Footsie 100 index of circa -14%

The Committee proposed no changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model Portfolios

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds in particular the introduction of the Blackrock UK Equity Fund in place of the Man GLG UK Equity Fund.

Next Investment Committee Meeting is 19th November although in the interim period the Committee intend to conduct slightly shorter conference calls on a two-weekly basis.