Category: Financial Planning, Investment management

The Clarion Investment Committee met on the 19th October 2023. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Yields on US 10-year treasuries reached 5% for the first time since 2007 on expectations that the Federal Reserve would keep interest rates higher for longer.

High US mortgage rates are likely to slow down US home sales this year to the lowest level since 2011.

The US public sector deficit rose to $1.7 trillion, or 6.3% of GDP, in the 12 months to September, up from 5.4% of GDP a year earlier. A widening deficit fuelled market concern about rising levels of US public debt.

President of the asset manager Blackstone Jonathan Gray said that the higher government yields would hit consumers and slow down the US economy.

Wholesale prices of German goods fell at the fastest rate since 1949 on lower energy prices.

A sharp decline in German exports to the US and China, its two largest trading partners, increases the risks of a material contraction in German third quarter GDP.

UK consumer confidence fell by nine points in October to -21, the biggest monthly fall in more than three years, unwinding gains that have been seen earlier this year.

UK retail sales fell by 0.9% in September, more than economists expected, as consumers cut back on discretionary spending and unseasonably warm weather hit sales of autumnal clothes.

The Office for National Statistics delayed the publication of key UK labour market data, including the unemployment rate, due to low response rates affecting the accuracy of the statistics.

UK inflation held steady at 6.7% in September, slightly higher than forecasts, underscoring the persistence of price pressures.

UK average wage growth slowed slightly to 8.1% and vacancies edged lower the three months to August, suggesting a slight easing in a still-tight labour market.

UK public borrowing in the financial year to September was almost $20bn lower than forecast by the OBR, giving the UK chancellor some room to manoeuvre ahead of the Autumn Statement next month.

UK rents rose by 5.7% in September, the fastest pace on record. New rents are rising at an even faster rate.

The Chinese economy grew by 4.9% in the year to the third quarter, more than economists expected, as fiscal and monetary stimulus helped bolster the recovery. Commenting on the numbers China’s statistics office said that domestic demand remains inadequate.

Argentina borrowed $6.5bn from China in a bid to support its economy as its economic crisis deepens.

The price of gold increased to over $63 per gram as investors increased exposure to safe-haven assets.

Global wheat prices hovered at the lowest level in three years easing global food inflationary pressures as Russian production replaced Ukrainian supply following the end of the Black Sea Grain Initiative.

Bank of America’s CEO Brian Moynihan said that he expects the US economy to avoid a recession and manage a “soft landing”.

Euro area inflation fell to 4.3% in the 12 months to September, down from 5.2% in August. Core inflation also fell. The development increases the likelihood that the ECB will keep rates on hold when it meets at the end of the month.

German business confidence fell for a fifth consecutive month in September, pointing to a contraction in GDP in the third quarter.

The Office for National Statistics (ONS) revised its estimate of UK GDP upwards – it now thinks that in the second quarter of this year the UK economy was 1.8% larger than its pre-pandemic size in the final quarter of 2019.

Previously, the ONS had estimated that GDP in Q2 2023 was 0.2% below pre-pandemic levels. The development suggests the UK recovered faster than thought from the pandemic but doesn’t materially change the picture of slow growth over the last two years.

Weak consumer demand in China hit French beauty company L’Oréal’s revenues as it missed analysts’ expectations in the third quarter.

Streaming service Netflix increased its number of subscribers by 9m in the third quarter, 50% higher than expectations due in part to a clamp-down on password sharing and despite an increase in prices.

Tight labour markets pushed American Airlines into a loss of over $0.5bn in the third quarter as it made a one-time bonus payment to its pilots in an effort to avert strike action.

UK’s largest investment platform Hargreaves Lansdown reported a 13% increase in revenues in Q3 2023 as higher interest income offset the drop in share dealing.

Investment bank Goldman Sachs reported a 36% fall in profits in the third quarter due to the retreat from retail banking and real estate investment losses.

Phone manufacturer Nokia announced 14,000 job cuts as macroeconomic uncertainty and higher interest rates pushed the company to restructure and reduce costs.

Chinese property developer Country Garden missed a $15m bond payment in September adding to liquidity concerns in the Chinese property market.

Tighter US rules on advanced computer chips from China caused shares in semiconductor companies to fall, highlighting the sector’s exposure to rising geopolitical risk.

Tesla announced it would cut the price of its entry-level model sold in the UK by £3,000 following a 44% fall in annual global net income in September.

Fund manager M&G announced it would close its £565m property fund after it suffered major outflows by UK retail investors, in further signs of the impact of higher interest rates and tighter regulation on the sector.

Chat-GPT owner OpenAI was reported to be selling shares taking the valuation of the company to roughly $86bn, three times what it was worth six months ago as investors have a growing appetite for AI businesses.

Jaguar Land Rover announced plans to offer battery-powered versions of all its models by 2030, despite the UK government scrapping the ban on new fossil fuel-powered cars.

The Economist reported that Chinese banks may be “loaded up with hidden bad debts” after uncovering that 50% of Jinzhou Bank’s personal-business loans were non-performing.

Nissan’s CEO Makoto Uchida said that “the world needs to move on from internal combustion engines” as the company announced it would only sell electric vehicles in Europe by the end of the decade.

Discount supermarket Aldi announced it would increase investment in the UK to more than £1.4bn over the next two years and open another 500 stores.

The US Federal Trade Commission accused Amazon of using “a set of interlocking anti-competitive and unfair strategies” to maintain monopoly power.

US president Joe Biden urged Congress to approve a $100bn military aid package for Israel and Ukraine and said he is still committed to a “two-state solution”.

King Abdullah of Jordan called for humanitarian assistance to Gaza and warned that “the whole region is on the brink of falling into the abyss” following the outbreak of the Israel-Palestine war.

Retired hedge-fund founder Ray Dalio warned that the Israel-Palestine conflict, following the outbreak of the Ukraine war, increases the chances of an “uncontained hot world war”.

The US Federal Reserve warned that geopolitical tensions pose a threat to the global financial system at a time of slower growth and high inflation.

The UK Labour Party won two by-elections in Mid-Bedfordshire and Tamworth, overturning substantial Conservative Party majorities, and pointing to landslide victory at the next UK General election to be held in 2024.

Russia exempted bunker fuel, gas oils and middle distillates from its indefinite export ban which has increased diesel prices in the last few weeks.

US Senate leaders struck a “temporary” deal to avoid a government shutdown and provide funding for Ukraine’s war effort as well as disaster relief for US states hit by wildfires and floods.

Please click here to access the October Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Inflation rates globally are approaching or past their terminal levels, hinting at a reduced likelihood of further interest rate hikes. The Bank of England is proceeding with caution, mindful of the stimulative impact rate increases can have initially, particularly for depositors and debtors. Around 40% of mortgages within the UK are expected to bear higher rates by the end of this year which can have a knock-on effect to GDP as disposable incomes shrink.

The United States may delay rate cuts in comparison to Europe and the UK due to the prevalence of long-term fixed-rate mortgages. 30-year mortgages are commonplace in the US meaning that any rate hike is unlikely to have an intrinsic impact on consumers in the short run. Furthermore, there is a growing consensus regarding the inflationary effects of on/near-shoring, which seems to have gained bi-partisan support. While localising the production of goods creates more reliable supply chains, there is also a likelihood of increased costs.

The paralysis within the US Congress continued with the latest Republican contender, an ex-Wrestling Coach, being rejected. This is not helping the Treasury market, although deeper trends are playing out. As always, there are plenty of reasons why an event has happened, but it boils down to investors adjusting to a higher real yield world, hence the steepening of government bond curves. Why is this happening? The US debt mountain, massive capital investment needed to support climate action and carbon reduction, more Asian money being kept at home to build domestic infrastructure, less Chinese recycling of dollars into Treasuries, a more general theme of de-dollarisation in a fragmenting world. These trends seem structural but give little insight into timing or a clearing level.

The Israel-Palestine conflict appears to be maintaining a relatively regional stance, and markets have normalised after an initial severe reaction. However, there could still be some fallbacks in international relations, especially with the middle east and oil producing nations, as the conflict continues.

The UK’s public finances surprised last week – with the borrowing level being less than expected. This has given rise to speculation that tax cuts could be back on the agenda, with Stamp duty being put in the spotlight. This is a bad tax – certainly the level applicable to housing transactions. It discourages transactions and mobility but does raise considerable money, over £15bn from all sources. Some shift to a tax system less based on transactions would be economically desirable but the political will is lacking to redraw the rules to tax property values more. Further tinkering with support for first time buyer is also mooted – another bad concept. If the Prime Minister believes in planning for the long term this should be kicked into the long grass. The economic illiteracy of boosting prices at the bottom of the housing ladder is staggering.

Gilt yields ignored the better deficit data, with rates mirroring the global trend. The latest inflation data was a tad disappointing, with CPI coming in at 6.7% and service inflation at 6.9%. Not enough for the Bank of England to change course, but focusing greater attention on next month’s release where a big drop is forecast. Bad news on that would lead to investors questioning the peak rate consensus.

One significant concern revolves around debt. High-yield investments are currently unappealing, primarily due to the financial limitations of poor-performing businesses justifying their position in the high-yield sector. These enterprises may be unable to sustain the double-digit interest rates they would be required to pay.

The Investment Committee have kept the bond holdings unchanged in recent weeks and maintain a balanced mix of short and long-duration bond strategies to align with the average duration of the corporate bond market. The Committee are comfortable with their current market exposure but will keep an eye on changes in bond yields. If bond yields increase further, they may consider adding more long-term bonds to their portfolio.

The Committee hold an underweight exposure to US stocks compared to their peers in the relevant IA sectors on a valuation basis. Many of the large US companies hold valuations that may not accurately reflect the long-term value of these businesses. Instead, the Committee see valuation opportunities in smaller-cap US companies that are already pricing in recessionary factors not yet evident in the US.

Conversely, the Committee hold a marginally overweight allocation to UK equities due to attractive valuations. UK equities are currently trading well below their long-term average due to issues such as Brexit and persistent inflation, which have impacted their performance. However, the Committee believe the UK has the potential to return to historical averages. Inflation in the UK is decreasing, and the labour market is easing, making UK equities seem promising for long-term outperformance compared to some other regions.

In Asian and Emerging Markets, the focus is on regions that can benefit from macroeconomic differences when compared to developed markets. China and Latin America are seen as promising in this regard. Latin American countries have dealt with inflation by raising interest rates aggressively and well ahead of the western countries, putting them ahead of the curve compared to developed markets. This may open the possibility of earlier economic stimulus, which could benefit equities in these countries.

China, on the other hand, has not faced the same inflationary issues as Western countries, which also creates an opportunity for economic stimulus. Additionally, the region is trading below long-term averages after a period of underperformance when compared to developed markets.

The key themes can be summarised below as:

In the Committee’s view central banks are likely to shift from the previous inflation target of 2% to a higher figure or a floating range, which will most likely be around 3-4%. The amount of economic destruction required to bring inflation back to a 2% target would be too great to be justifiable. Coupled with multiple developed economies (US and Europe) trying to ease the reliance on supply chains from China, inflation is likely to be stickier, although much lower than current levels, than initially thought.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

October 2023

Creating better lives now and in the future for our clients, their families and those who are important to them.

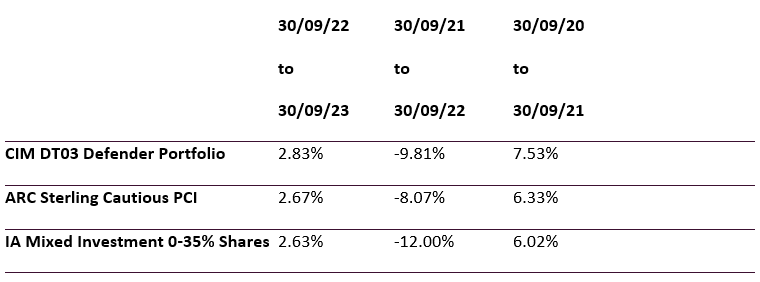

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

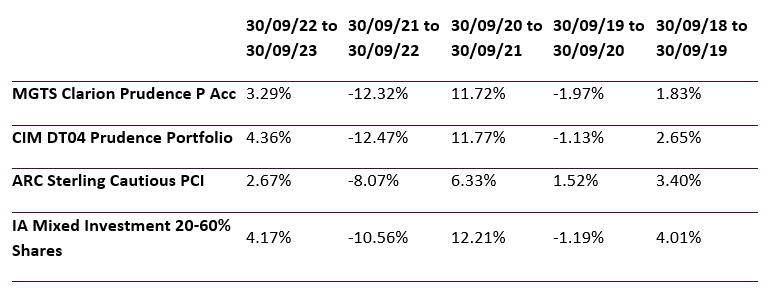

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

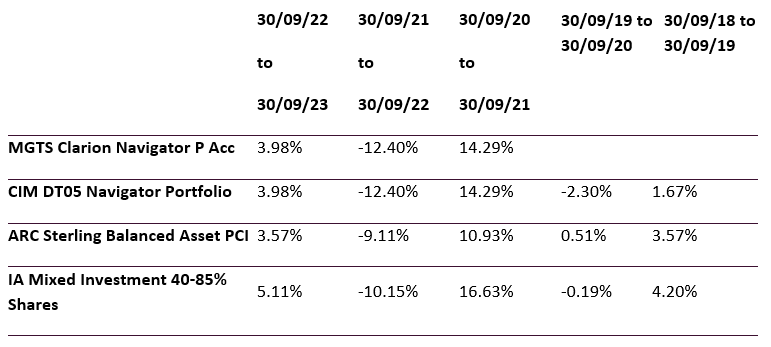

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Navigator Fund & Portfolio

There were no changes made to the Navigator portfolio in October 2023

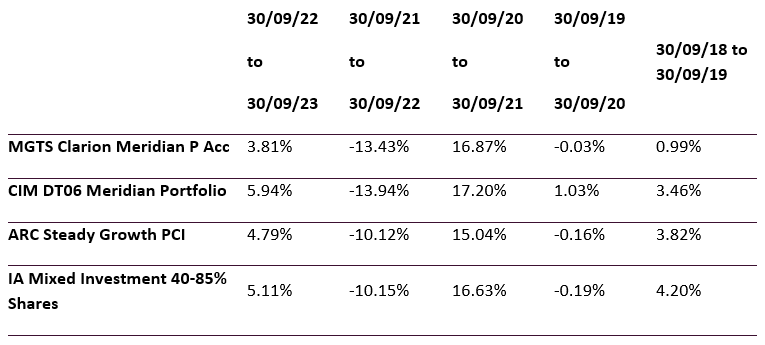

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Meridian Fund & Portfolio

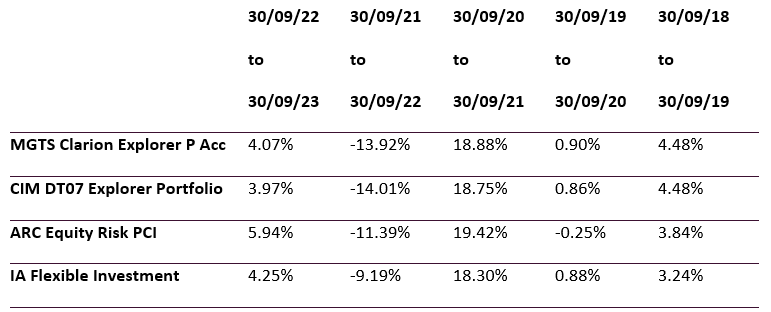

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Explorer Fund & Portfolio

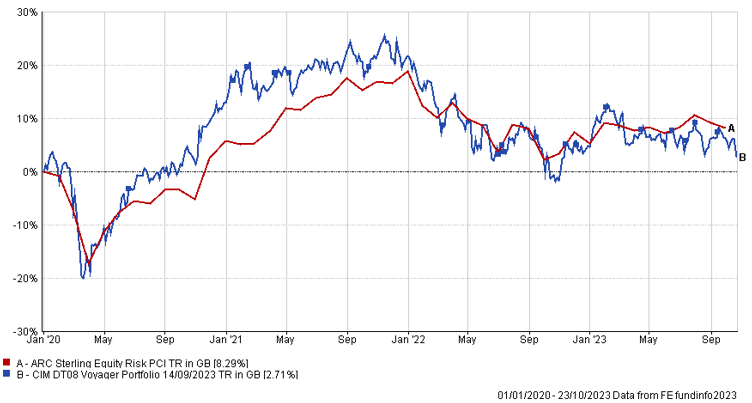

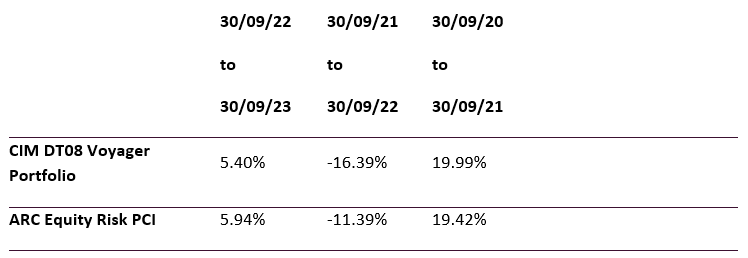

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Voyager Portfolio

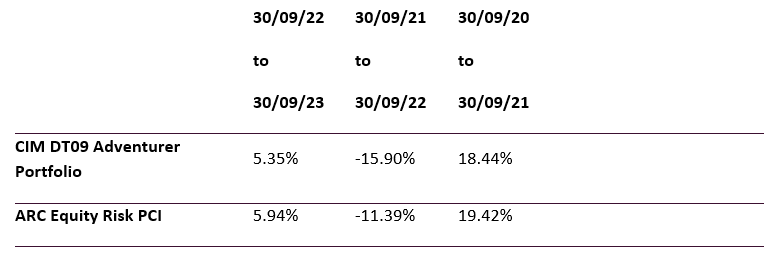

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Adventurer Portfolio

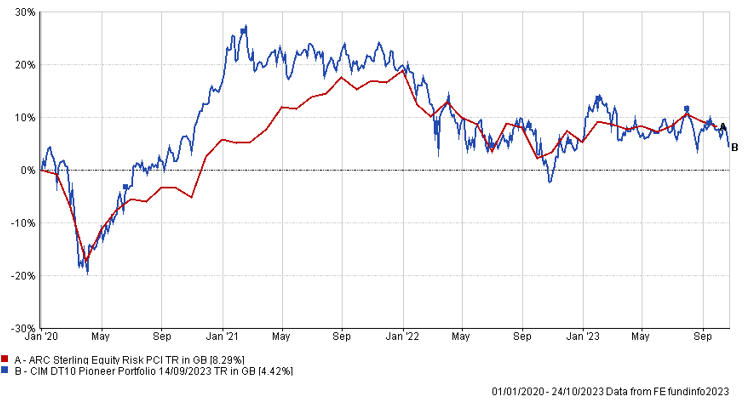

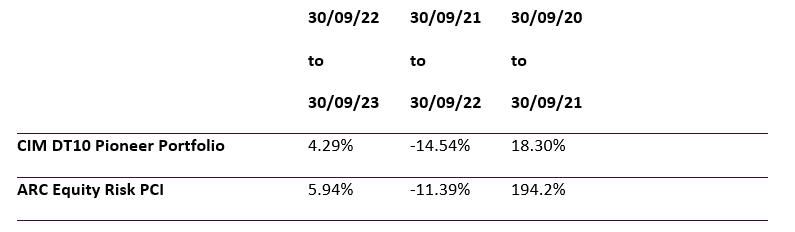

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Pioneer Portfolio

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.