Minutes of the Clarion Investment Committee held at 10am on 17th September 2020 by video link.

Committee members in attendance: –

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Matt Jealous (MJ) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

| Ron Walker (RW) |

Founding Director, Clarion. |

Apologies from Toby Ricketts (TR), Fund Manager (Margetts Fund Management).

Review of previous minutes and action points

Minutes from the previous meeting held on 20th August 2020 were agreed by the committee as a true and accurate record.

Economic commentary and market outlook

Please click here to access the September Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

- The adage of September being the worst month for stock markets (the S&P 500, for example, has dropped by 1% on average in September going all the way back to 1950) is proving to be true in 2020, with market volatility picking up over recent weeks.

- Most US, UK and European indices are down in the low single digits for the month to date.

- It is worth bearing in mind however, that for some regions – the US in particular – the recent fall in stock markets doesn’t meaningfully dent the extremely strong rally that has taken place since the lows in March 2020. The S&P 500 index for example, is up almost 40% since its bottom in March and, despite the poorer performance in recent weeks, remains in positive territory for the year.

- It is difficult to try and ascribe any one reason for market moves but we could take our pick of reasons from the ‘wall of worry’ facing markets as we approach the last quarter of the year:

- Rising coronavirus cases and the potential reversion to lockdown in regions such as Europe and the UK.

- Elevated unemployment levels.

- Concerns about job support schemes rolling over as we approach the end of the year and governments’ ability to provide further fiscal support.

- Tepid outlook for major economies, highlighted recently by key central banks.

- Uncertainty surrounding the results of a hotly contested US presidential election and its effect on markets.

- Brexit.

- The Federal Reserve and Bank of England kept policy rates unchanged, as expected.

- However, the continued accommodative stance taken by the banks – whilst generally positive for markets – has raised some concerns about the health of underlying economies as central bank policy makers in both the US and the UK highlighted the ‘highly uncertain’ outlook for their respective economies.

- Here in the UK, the Bank of England is being watched closely after the minutes of the latest rate-setting meeting appeared to raise the spectre of negative interest rates. Concerns about sub-zero rates are driven by their impact on banks, making them less profitable so less likely to lend money into the real economy. There is also the theory that below a certain point, lower borrowing costs stop having the stimulative effect as the negative message they relay about growth prospects ultimately ends up constraining spending and investment decisions. Whilst the governor seemed to back away from negative rates at a recent conference it remains a closely watched matter.

- The number of new Covid-19 cases in the UK and Europe continues to climb, although it is worth noting that daily deaths, fortunately, remain low, implying that new cases are being seen in younger, healthier parts of the population and that the rollout of early testing practices is having some impact.

- Rising cases, however, have once again raised the possibility of lockdown restrictions being re-introduced. Here in the UK, PM Boris Johnson announced a series of new restrictions and refused to rule out a second lockdown to contain the spread of the virus.

Strategy

We retain an underweight position in the US, due to concerns that the US market has become overvalued, and therefore is more likely to lag other markets on a relative basis in the future. We remain overweight to developed Asia, where we feel Covid‐19 has been effectively handled. These economies are likely to follow China in V-shaped economic indicators and sentiment. UK equities are attractively priced for quality assets and would be likely to rally hard on positive Brexit news and we remain positioned according.

Bond yields are well below the rate of expected inflation and therefore investors are almost certain to lose money in real terms if they hold UK government bonds to maturity. We continue to favour short duration bonds, which are less sensitive to interest rate risk.

We increased our exposure to Gold, Gold Miners & Precious Metals in the Prudence Portfolio from 3% to 4% to reflect our belief that Gold offers a better alternative to cash and long duration bonds and will continue to act as a safe haven in the event of market turmoil and financial stress.

Review risk management, eligibility and investment and borrowing powers

The committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion Funds; Prudence, Navigator, Meridian and Explorer

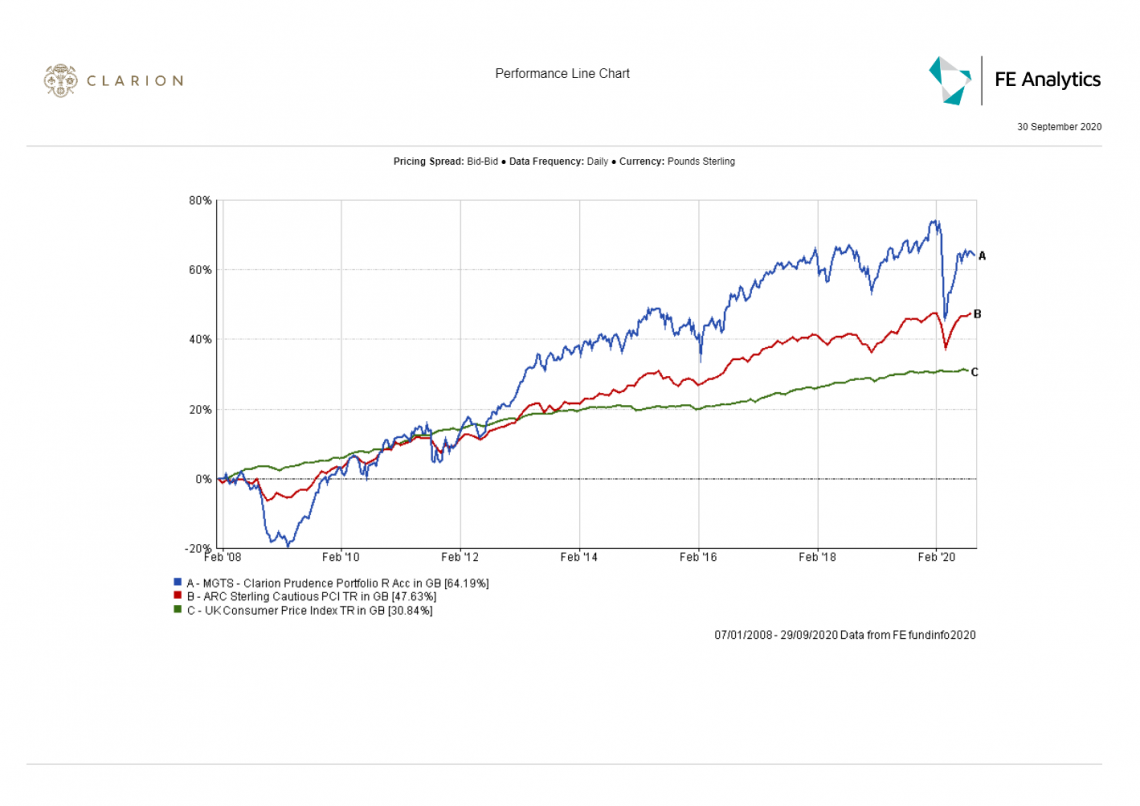

MGTS Clarion Prudence

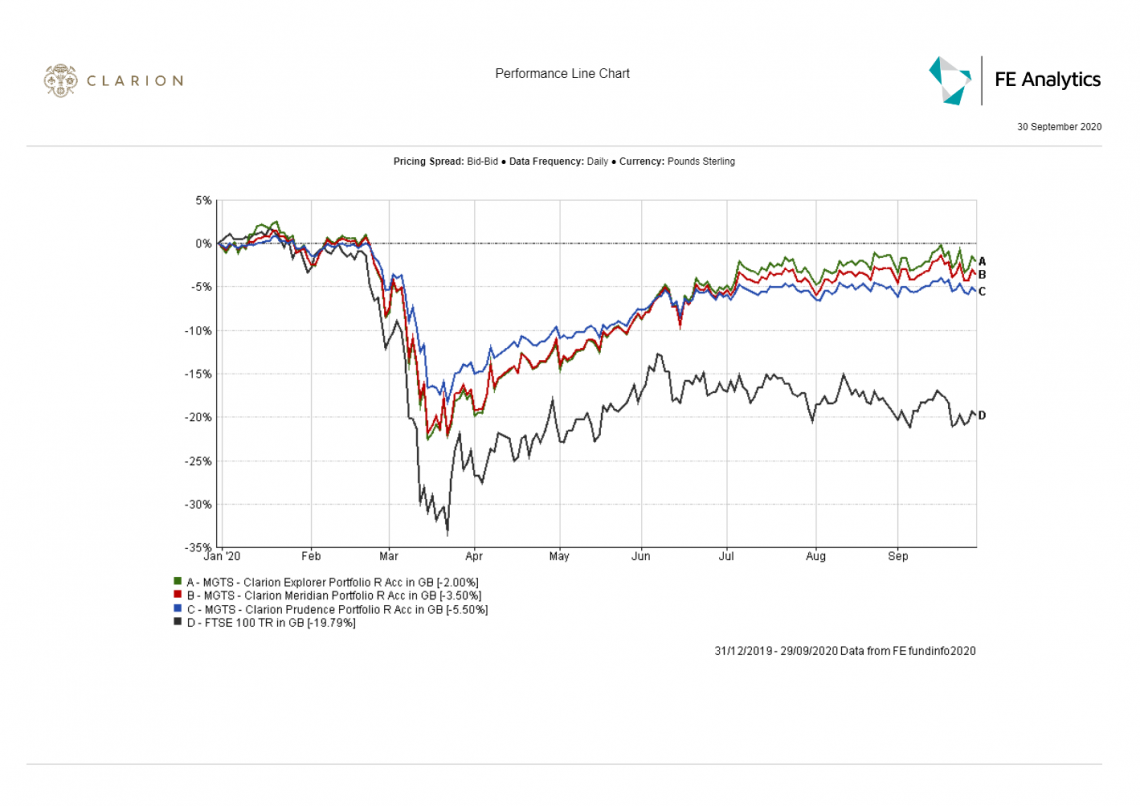

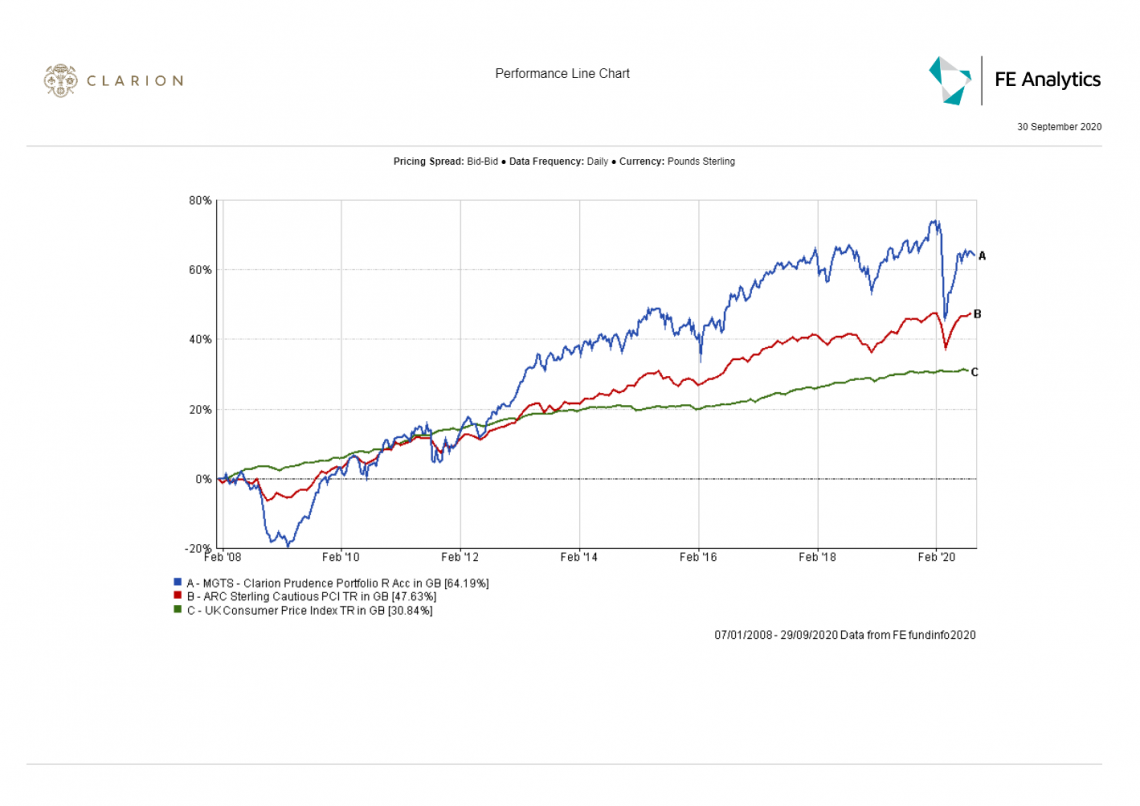

- Performance of the Prudence fund lagged its sector over the last quarter by -1.20% whilst outperforming the DT strategic benchmark by +1.60% over the same time.

- The portfolio has performed ahead of its benchmark mostly due to the asset allocation of the portfolio, despite the lag in selection which was held back due to the fixed interest and UK Equity Income holdings.

- The introduction of ‘Merian Gold and Silver Fund’ has so far been a great addition to the portfolio, returning 4.11% over the past four weeks.

- With the committee’s continuing concerns regarding future inflationary pressures as a result of the fiscal stimulus provided by governments worldwide, it was agreed to allocate a further 1% to ‘Merian Gold and Silver Fund’. This additional allocation would be provided by reducing the cash within the portfolio.

- ‘Man GLG UK Income Professional Fund’ is the only fund within the portfolio that is raising concerns with the committee at this time following negative performance over a one and three-month period. It appears that following the falls earlier this year, the fund is yet to gather momentum in the recovery process. However, it was highlighted that this fund has a negative correlation to the other UK Equity Income holdings within the portfolio due to the asset allocation and the mid-cap/ value holdings within. It was agreed that we would monitor performance of this fund over the next month and in the meantime look at alternative funds that offer similar levels of diversification.

- The portfolio remains in good shape and therefore no changes are required at this stage other than the increased allocation to gold.

- Fund size is currently £33.90m.

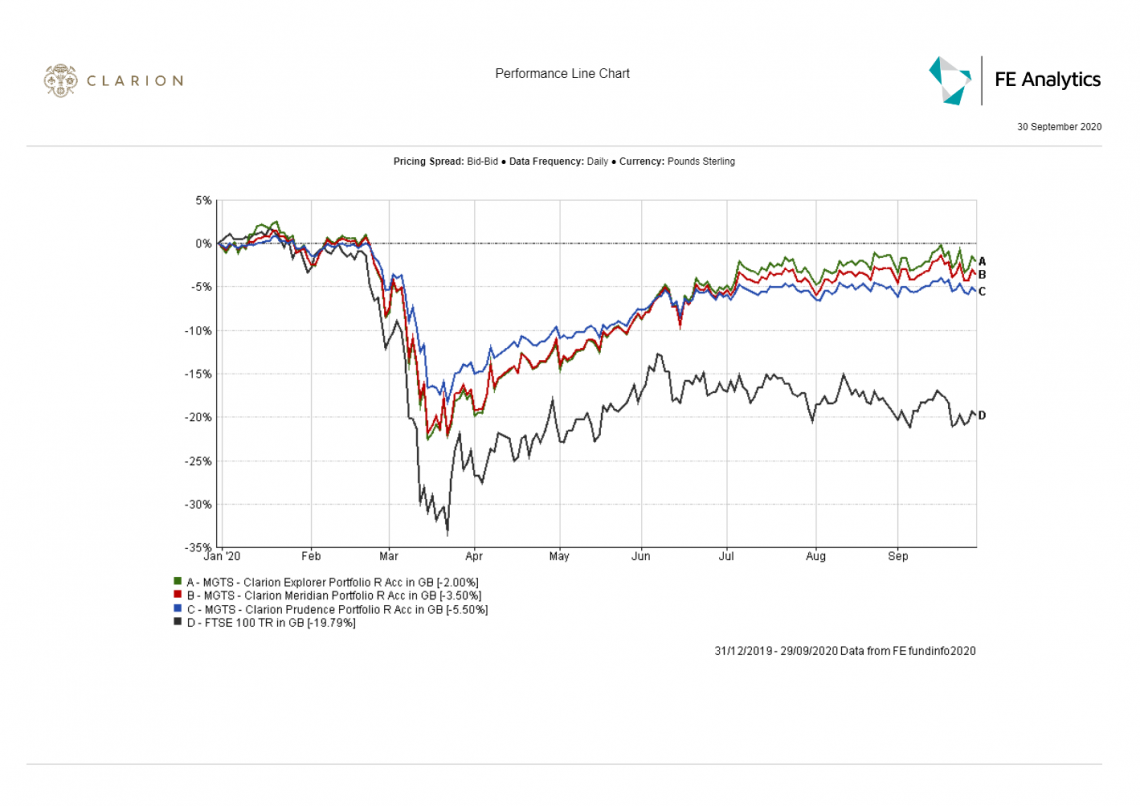

- Performance over 1 year is marginally down at -0.75% compared to a fall in the UK Footsie 100 index of circa -15%.

There were no proposed changes to fund selection.

The committee approved the strategy and confirmed it is in line with the mandate.

MGTS Clarion Navigator

- The portfolio remains in good shape and therefore no changes are required at this stage.

- The fund is very close to being fully invested in line with the agreed assets/allocation. The only outstanding fund is the ‘Merian Gold and Silver Fund’ which is due to be purchased imminently on receipt of new cash inflows.

- A close eye is to be kept on the Man GLG fund over the next month whilst alternatives are to be researched in the meantime should a change be necessary.

- Fund size is currently £2.74m; an increase of circa £850k from the last committee meeting carried out in August.

- The unit price as at the 18th September 2020 was 101.76p; a 1.76% increase having been launched at 100p on the 11th May 2020.

The committee proposed no changes to fund selection.

The committee approved the strategy and confirmed it is in line with the mandate.

Due to the fact that the Navigator Fund is not fully invested and has only been operating for a short period of time, we are unable to provide a useful performance graph of the fund versus its relevant benchmark. However for information, the unit price as at the 26th August 2020 was 100.57p; a 0.57% increase having been launched at 100p on the 11th May 2020.

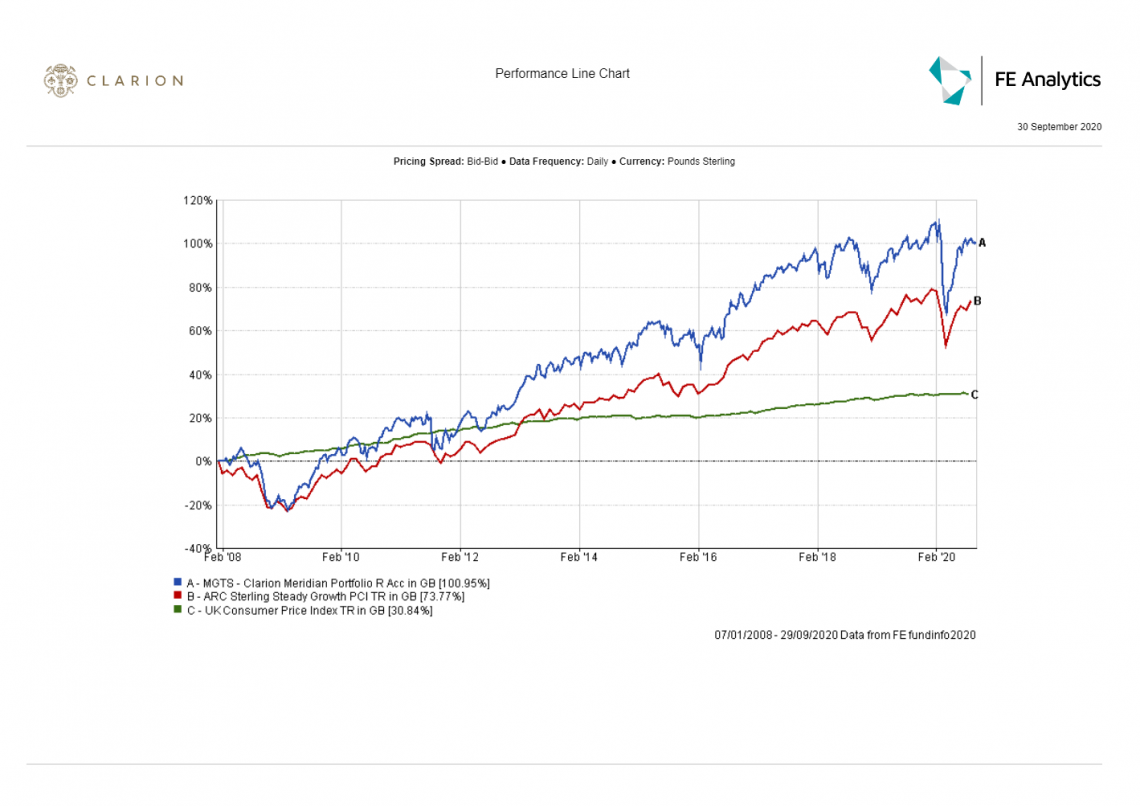

MGTS Clarion Meridian

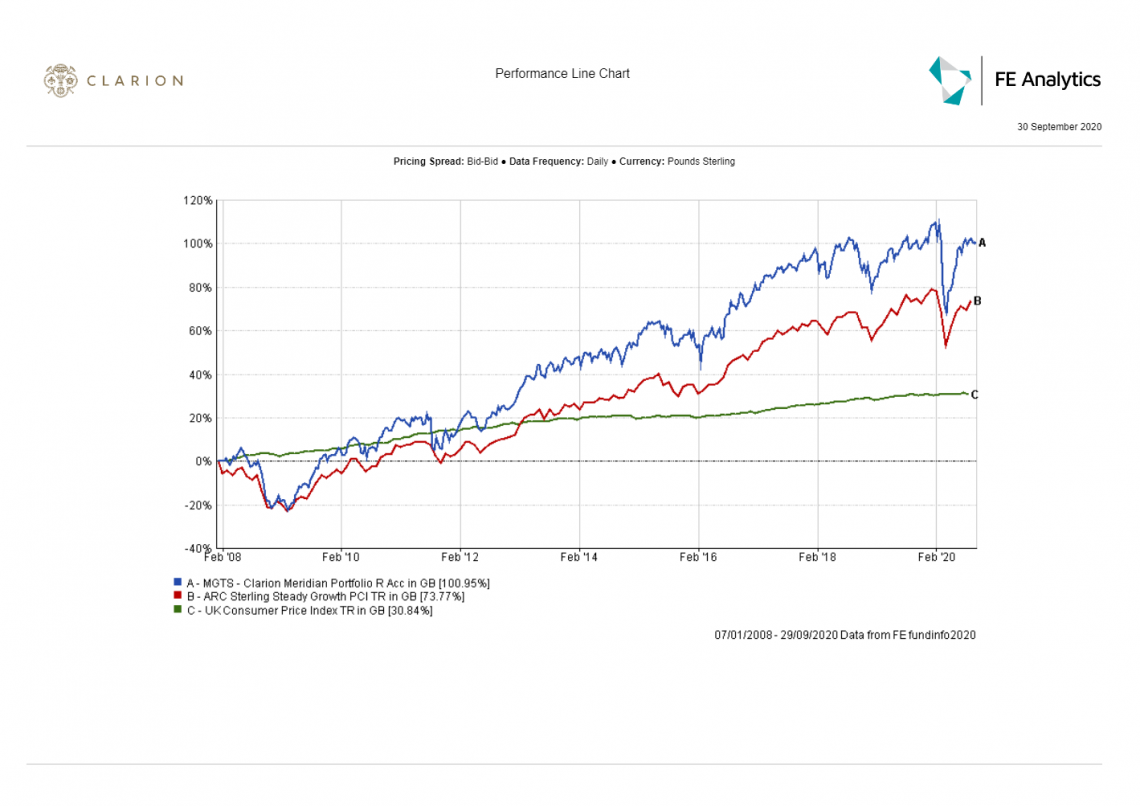

- Over the last quarter, the Meridian fund has continued to perform well, outperforming both its sector and DT strategic benchmark by +0.30% and +0.40% respectively.

- The attribution to the portfolio outperformance has mainly come through the portfolio allocation within the UK Equity Income and Global Equity elements of the portfolio. The portfolio was marginally down on selection, but overall, the cumulative performance of the portfolio compared its sector has been positive over the past 12 months.

- The Hermes and SLI funds held within the emerging markets element of the portfolio continue to work well alongside one another as their negative correlation continues to add diversification.

- ‘CFP SDL UK Buffettology Fund’ and ‘BlackRock UK Equity’ have both performed well within the UK Equities sector. Over the past 12 weeks, Buffettology has returned 44% whilst BlackRock has returned 1.93%. The 12-month figures are even more impressive with the funds returning 12.66% and 4.73% respectively.

- The committee discussed increasing the allocation to gold, as per the Prudence fund. However, the Meridian portfolio is currently in really good shape and with cash already at 2% (target), it was felt that a forced sale of assets would be required to fund this change. Therefore, it was agreed this increase would not take place at this current time.

- A close eye is to be kept on the Man GLG fund over the next month whilst alternatives are to be researched in the meantime should a change be necessary.

- As mentioned above, the portfolio remains in good shape and therefore no changes are required at this stage.

- Fund size is currently £51.30m.

- Performance over 1 year is marginally down at -0.27% compared to a fall in the UK Footsie 100 index of circa -15%

There were no proposed changes to fund selection.

The committee approved the strategy and confirmed it is in line with the mandate.

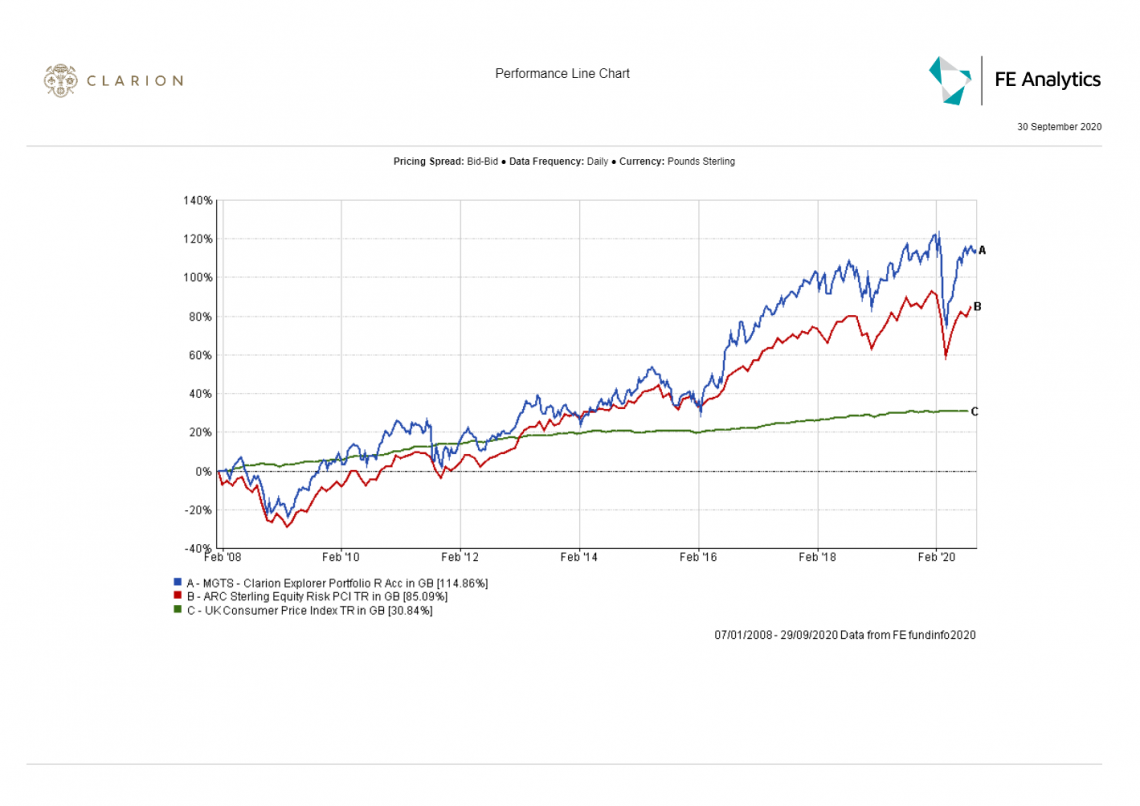

MGTS Clarion Explorer

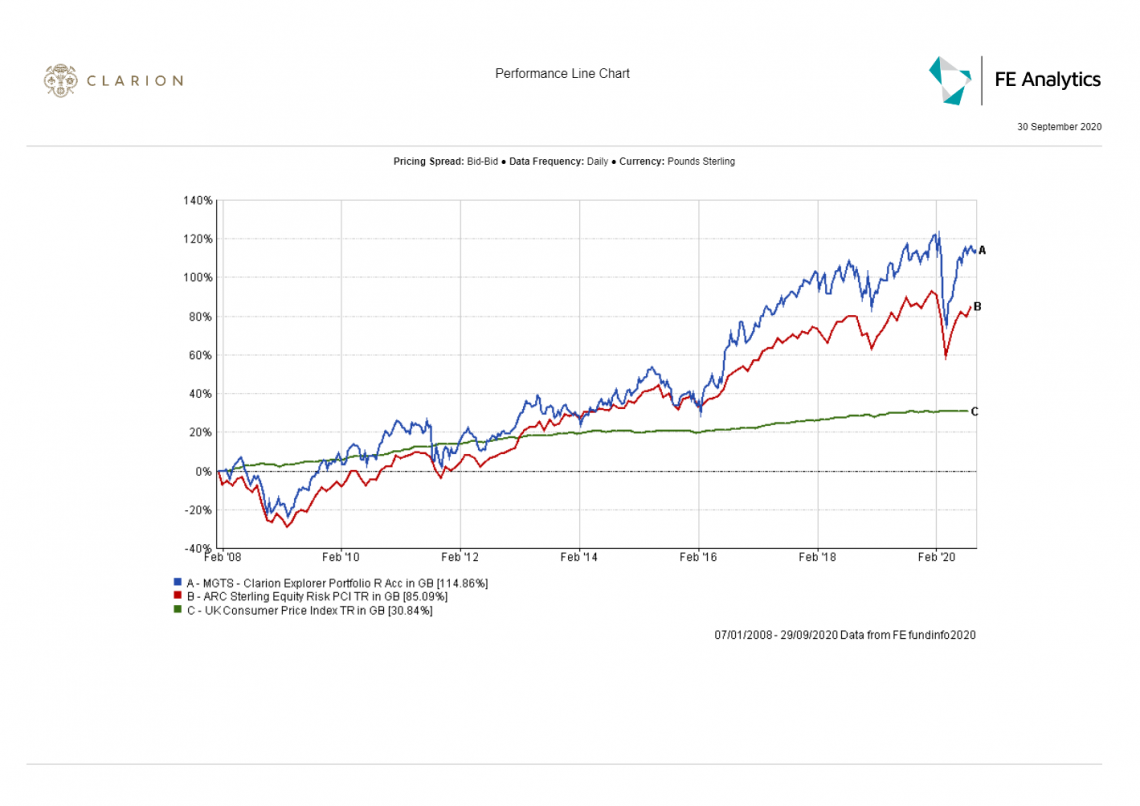

- The Explorer fund outperformed its sector over the last quarter by +1.40% whilst underperforming the DT strategic benchmark by -0.70% over the same time period.

- Performance was impacted slightly mainly as a result of our underweight allocation to North American Equities whilst the selection attribution has been relatively neutral.

- Overall, the committee have been pleased with the performance of the fund over the last quarter. A factor contributing to this performance is due to the Growth vs Value trade-off that has been evident within the underlying equity holdings within the portfolio.

- ‘Artemis Global Select’ has impressed over the last two weeks with a net return of +1.41%. This fund’s performance has now surpassed the performance of ‘Fundsmith Equity’ over a 12, four and two-week period.

- The performance of ‘Lindsell Train Japanese Equity Sterling Hedged’ has been disappointing over the last month, with a loss of -2.20%. One of the main reasons behind this is due to sterling depreciating against the yen by circa 3% which has consequently fed through to the ‘hedged’ version of this fund. Whilst this performance has been disappointing, it has only been relatively short term and therefore the committee are not alarmed at this current time. We will, of course, keep this under review.

- The portfolio remains in good shape and therefore no changes are required at this stage.

- Fund size is currently £22.58m.

- Performance over 1 year is down at -1.41% compared to a fall in the UK Footsie 100 index of circa -15%

The committee proposed no changes to fund selection.

The committee approved the strategy and confirmed it is in line with the mandate.

Model Portfolios

We increased the exposure to Gold, Gold Mining shares and Precious Metals through the Merian Gold and Silver Fund to reflect the changes to the Prudence Portfolio.

Next Investment Committee Meeting is 15th October although in the interim period the committee intend to conduct slightly shorter conference calls on a two-weekly basis.