Category: Financial Planning, Investment management, Our team news

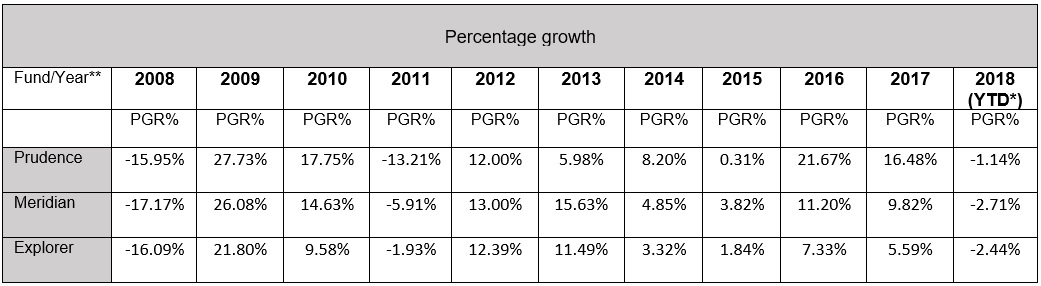

The anniversary marks a decade of strong performance and risk-adjusted returns for the three funds – Clarion Prudence, Clarion Meridian and Clarion Explorer with total assets in the three funds of more than £90 million.

Since inception on 10th January 2008, Clarion Explorer, has delivered annualised returns of 7% net of fees with a 100% increase in the unit price.

The investment return achieved by Clarion Meridian, the portfolio’s balanced fund aimed at more cautious investors, is not far behind with a total unit price increase of more than 90%.

The returns achieved by the lowest risk Fund, Clarion Prudence, are equally impressive on a risk/reward basis with a unit price increase of more than 60% over the same time frame.

The Portfolio Funds are diversified across a wide range of geographical areas and market sectors, giving clients and individual investors, most of whom are invested in a blend of all three funds, exposure to over forty different investment funds.

Ron Walker, founder of Clarion Wealth and its Portfolio Funds, said:

“Over the last ten years, our funds have proved to be robust and have continued to deliver a strong performance in relation to their risk profiles.

“We are especially pleased to see the unit price of our Explorer fund increase by around 100% since its launch, providing a solid return on investment for our clients who seek capital growth.”

Commenting on the fund anniversary, Chairman of Clarion Wealth’s Investment Committee, Keith Thompson said:

“This anniversary is a testament to our highly rigorous and disciplined investment approach.

“The unit price of our Explorer fund has almost doubled since inception in part due to the overweight exposure to Asia and Emerging Markets – both areas have continued to perform strongly and are the main driver behind the fund’s positive relative returns.

“Risk and reward go hand in hand – our Portfolio Funds are primarily designed around our clients and their risk profiles, whilst also being attractive to investors who enjoy controlled risk with an eye on opportunity. A robust and diligent selection process of the underlying holdings and fund managers has helped to deliver the impressive returns achieved by all the Clarion funds. Being invested in the best geographical area with the best fund manager for that area is paramount to achieving the best risk adjusted returns for our clients”

“We continually monitor the performance of the Funds to ensure that they support the lifetime cashflow strategies of our clients. We remain positive that the good investment returns in recent years should continue.”

Total Assets under management are more than £180 million split between the three Portfolio Funds referred to above and a range of segregated Model Portfolios which are managed on a discretionary basis.

Based in Cheshire, Clarion Wealth specialises in true lifelong financial planning for the serious business of life. The firm develops and implements bespoke long-term financial plans for successful individuals and their families, particularly business owners intending to exit or capitalise their business.

Clarion is keen to point out that the value of an investment can go down as well as up and investors may not get back the full amount invested, and that past performance is not a guide to future performance.

Emerging markets tend to be more volatile and illiquid then more mature markets and therefore your investment is at greater risk. Political risks and adverse economic circumstance are more likely to arise putting the value of your investment at risk.

Notes:

*YTD is the time period from 01/01/2018 to 21/02/2018

**The funds referred to within this data are R Acc funds

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.