Category: Financial Planning

The US election on 5 November is fast approaching, and many analysts are predicting it will be one of the closest presidential contests in American history.

Markets are typically averse to uncertainty, and short-term volatility is common in the build-up to elections as investors react to potential policy shifts.

However, once the outcome of the vote becomes clear, markets often stabilise as uncertainty diminishes, allowing investors to adjust to the new political and economic landscape.

Read on to discover how the upcoming US election might influence the market and your finances.

The noise and uncertainty implicit in the election cycle can lead to market volatility, but it is unlikely to have a lasting effect on performance.

As political candidates present varying economic policies, investors may react to perceived risks and opportunities, leading to increased trading activity. Market reactions can also be exaggerated during critical events, such as debates or major campaign announcements.

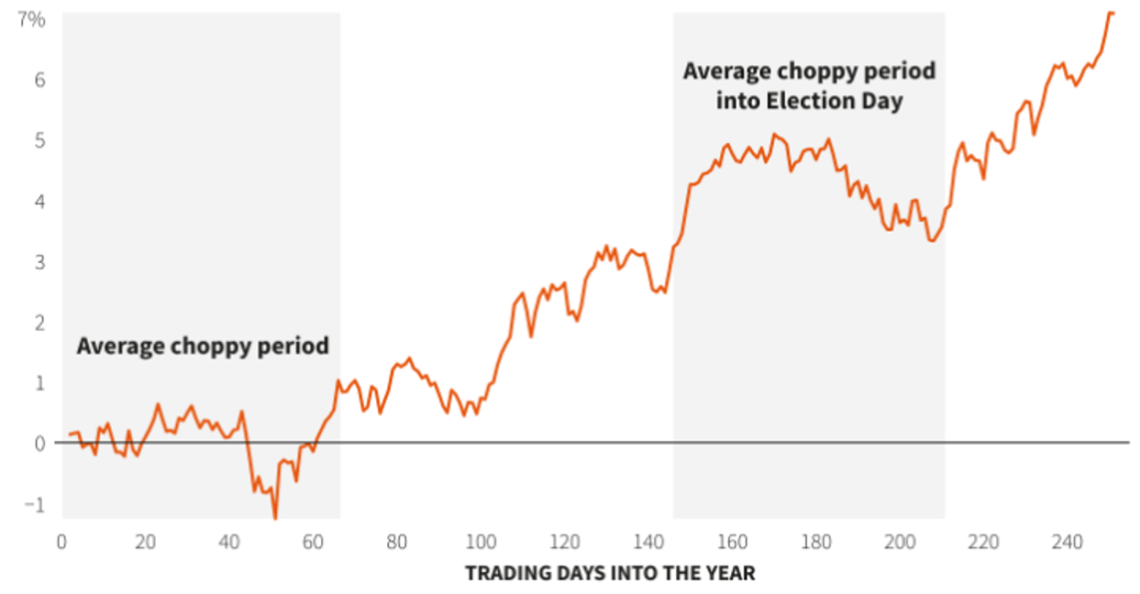

The graph below shows the average volatility or “choppiness” of the S&P 500 in US election years since 1950.

Source: Reuters

As you can see, volatility generally increases as the election day draws closer.

However, such fluctuations are unlikely to last much further beyond the election as it tends to be the uncertainty that drives the volatility rather than the predicted outcome.

For example, in 2016, as the contest between Donald Trump and Hilary Clinton heated up and the polls narrowed, global markets fluctuated amid the uncertainty.

Yet, on the day following the election, once Trump’s victory was determined, the Guardian reported that the Dow Jones, the S&P 500, and the Nasdaq all posted gains.

So, markets have typically been quick to steady once a clear electoral outcome replaces uncertainty.

Despite the volatility caused by electoral noise, markets typically trend toward growth and have often shown stronger performances in election years.

Forbes reports that the S&P 500 performed almost 1% better on average during a presidential election year compared to the year after. But with average respective gains of 11.57% and 10.67%, staying invested yielded double-digit returns in both cases.

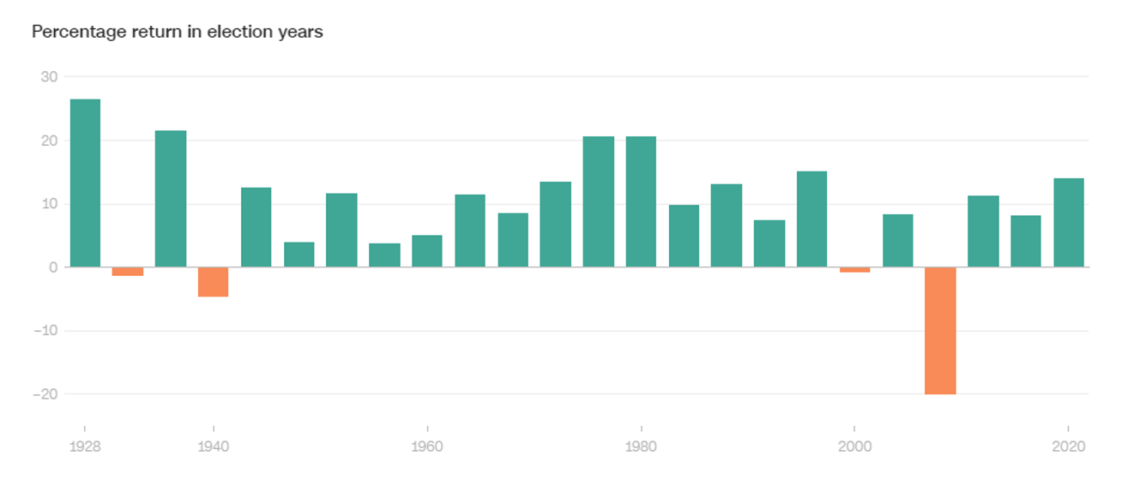

Moreover, a report by CNN found that in 20 of the 24 US election years between 1928 and 2020, a portfolio with 60% stocks and 40% bonds would have yielded positive returns, as you can see in the graph below.

Source: CNN

The four instances of negative returns occurred during major historical events – the Great Depression, the second world war, the dot-com bubble burst, and the 2008 financial crisis. These broader macroeconomic events had a far greater impact on the market than any election is likely to have.

So, the overall strong performance of the market in election years suggests that any volatility caused by the uncertainty of the outcome has generally had minimal long-term effects.

Market performance is shaped by multiple factors, including macroeconomic conditions, technological advancements, and geopolitical events, with the election cycle being just one variable that can cause fluctuations.

Experienced investors know that market swings are inevitable and that tuning out the short-term noise surrounding elections is often wise.

Sticking to a well-crafted financial plan requires a long-term perspective and the discipline to stay focused, even amid significant volatility.

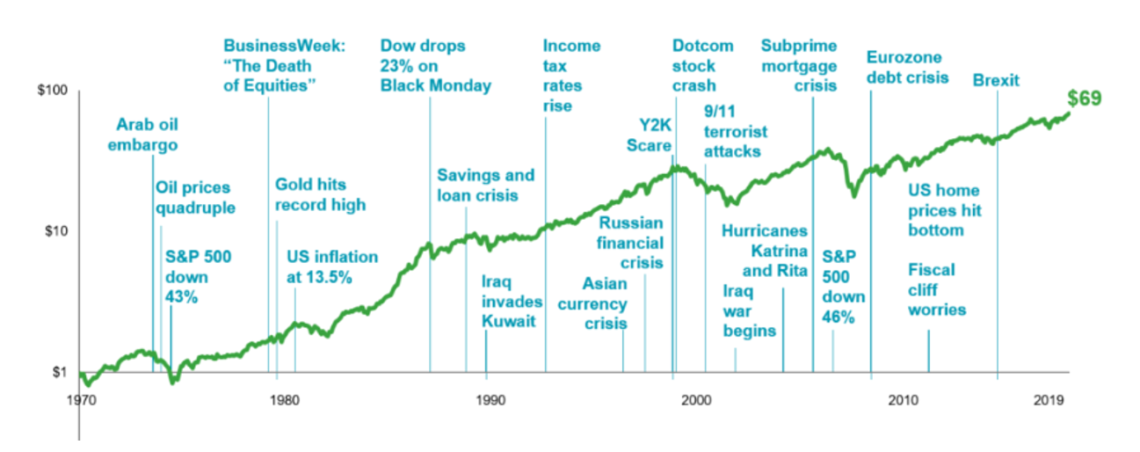

The graph below illustrates how $1 invested in the global equity market from 1970 to 2019 would have grown, despite several significant historical events that caused dips and volatility along the way.

Source: harvest

As you can see, history suggests that maintaining your investments during market downturns tends to be a good strategy for long-term growth.

Moreover, attempting to time the market based on a predicted reaction to an election is highly risky, as outcomes are never guaranteed.

A clear example is the Brexit referendum, where most polls predicted a “remain” victory. When the unexpected “leave” vote won, markets in the UK, US, Europe, and the rest of the world, experienced sharp losses the following day.

Although the markets eventually recovered, many investors who attempted to time their trades around the vote endured significant losses, highlighting the dangers of reacting to short-term events.

The historical data suggests that maintaining investments during volatile periods and consistently following a financial plan is a sound strategy for long-term success, as global markets typically trend toward growth.

A financial planner can help you create a plan based on your long-term personal goals, enabling you to navigate short-term volatility – whether related to elections or other events – while optimising your potential returns.

They can also work with you to develop other strategies to help weather fluctuations, such as portfolio diversification. Diversifying your portfolio can help you to mitigate risk and reduce the potential impact of short-term market volatility, as well as opening your portfolio to wider opportunities.

To speak to a financial planner, please get in touch.

Email [email protected] or call us on 01625 466360.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.