Category: Financial Planning, Investment management

The main discussion points were as follows:

The Committee reviewed risk management, eligibility and investment & borrowing powers reports and confirmed that these were in order and no actions were required.

Upon reviewing the risk data for the Clarion funds, the Committee noted that the relative Value at Risk (VaR) ratios for all three Clarion funds remain green, low risk, and are below 100% VaR relative to the benchmarks. For the stress tests, Clarion Prudence is closest to but comfortably below the warning level whilst Clarion Meridian and Explorer are well below the warning levels.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

The fund outperformed the sector by c.0.2 percentage points over 3 months and outperformed the strategic benchmark by c.0.7 percentage points. The fund’s short duration bond exposure outperformed the corporate bond sector over the period, and the portfolio’s value/income bias has also helped relative performance. The active allocation to global equity funds was a major contributor to the fund’s strong performance, as Sterling weakened over the period, so these funds outperformed the UK equity income holdings.

On average the underlying global funds returned c.6% over 12 weeks, with the M&G Global Dividend strategy being the strongest, with c.8.6% returns. The Invesco Perpetual Global Equity Income fund was the weakest global equity strategy over the period, which was mainly due to its overweight allocation to Europe and a general tilt to ‘Value’.

The Majedie UK Income fund remains on the watchlist and will continue to be reviewed at future meetings. It was noted that the fund continues to perform well but the committee are still concerned that the forthcoming change of manager and investment style, although still a few months away,may eventually affect performance so the fund will remain under review.

Performance of all the other holdings in this portfolio are in-line with expectations.

A proposal was put forward to take some profits from the strong performance of the global funds created partly by the good returns from the US stock market and a weaker Sterling over recent months. After strong debate it was agreed to reduce global equities from 20.5% to 17.5% in favour of increasing UK equities from 35.5% to 38.5%. It was agreed to sell 1% from each of the global equity funds and invest 3% into the Vanguard FTSE UK Equity Income Index fund. This would increase exposure to the UK at a time of weakness and was seen as a two-way bet on Brexit and possible UK political uncertainty. It will also marginally reduce the ongoing fund charge of the Prudence Portfolio Fund.

There were no other changes proposed to the fund and the Committee are pleased with the overall performance of this strategy.

The Committee approved the strategy and confirmed it is in line with the mandate.

Over 12 weeks the strategy’s performance was c.0.6 percentage points ahead of the sector. Compared to the sector, the fund’s overweight allocation to equities was the main contributor to stronger relative returns. The US was the strongest equity market over the period, with both US index tracking funds delivering over c.11% returns in absolute terms. The allocation to a global equity fund was the second strongest contributor, as the M&G Global Dividend fund returned c.8.6% over the period.

The Committee were pleased to note that the First State Asia Focus fund has outperformed the sector over 3 months, by c.3.4 percentage points. This fund was retained in the portfolio following previously weaker periods and it was pleasing to note that this decision had been vindicated. The Fidelity South East Asia fund has performed slightly weaker over recent weeks due to its higher China weighting, however the Committee were happy that these funds work well together.

The bond allocation has been average, and the F&C European Growth & Income fund has had a weaker few weeks relative to the sector, but it has underperformed by only c.1.0 percentage point, and the Committee have no concerns.

In general, international equities performed more strongly than the UK over the period. This performance differential between international and domestic equities can be linked to the recent c.10% depreciation of sterling against the dollar. The overall fund selection has been good and only 1 underlying fund was below the 2nd quartile over 12 months.

The Committee noted that the M&G Global Dividend exhibited strong relative performance over 3 months, and that the Rathbone Income fund has outperformed after a weaker period several months ago.

As with Clarion Prudence, it was agreed to take profits from the stronger performing global funds created partly due to a very strong US stock market and a weaker Sterling over recent months It was agreed to reduce the Global and North American equity exposure by 1% and 2% respectively. This would be achieved by selling 1% from each of M&G Global Dividend, Vanguard US Equity Index and Fidelity Index US funds. The amount raised would be invested equally in the UK equity funds to take advantage of recent weakness in the UK market.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no further changes.

The Committee approved the strategy and confirmed it is in line with the mandate.

The fund has performed strongly and was ahead of the sector by c.0.9 percentage points, but behind the benchmark by c.1.2 percentage points over 3 months. The allocation to the US and the fund selection in Europe, Global and Japanese allocations were the major drivers of the fund’s performance over the period. The fund selection was generally strong across the portfolio, with only two underlying holdings falling below the 2nd quartile over 12 months.

The Committee are pleased with the Henderson Emerging Market Opportunities and JPM Emerging Markets Income funds, which have outperformed the IA sector over 3 months. The SLI Global Emerging Markets Income fund looks slightly behind the IA sector but it was recognised that this may be due to a valuation timing issue which makes it difficult to compared to most other funds. The Jupiter European and BlackRock European Dynamic funds have displayed strong outperformance against the IA sector over 3 months, with Jupiter outperforming by c.7.2 percentage points.

It was noted that the two Japanese holdings complement each other, as the Schroder Tokyo fund is unhedged and Lindsell Train Japanese fund is the GBP hedged share class.

It was agreed that there was less of a case to reduce US exposure in the Explorer portfolio, especially as there are no UK holdings in which to invest the proceeds. The portfolio looks well placed and has performed well despite the underperformance of Chinese equities in recent months.

There were no changes proposed to the portfolio and the Committee are pleased with the overall performance of this strategy.

The Committee approved the strategy and confirmed it is in line with the mandate.

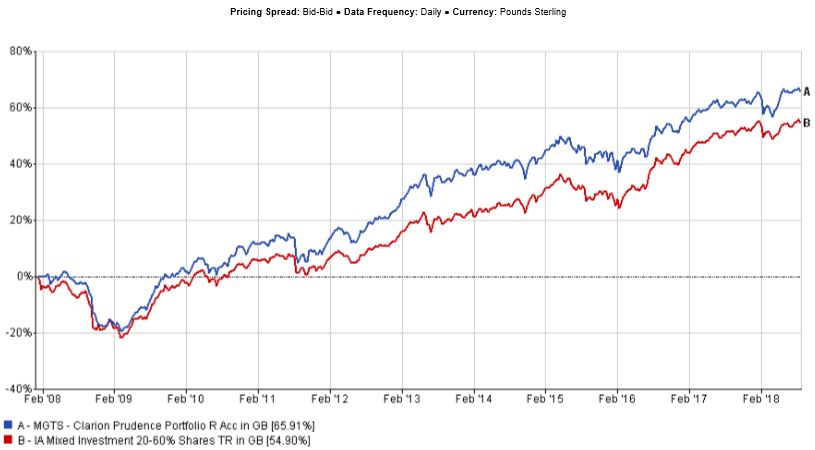

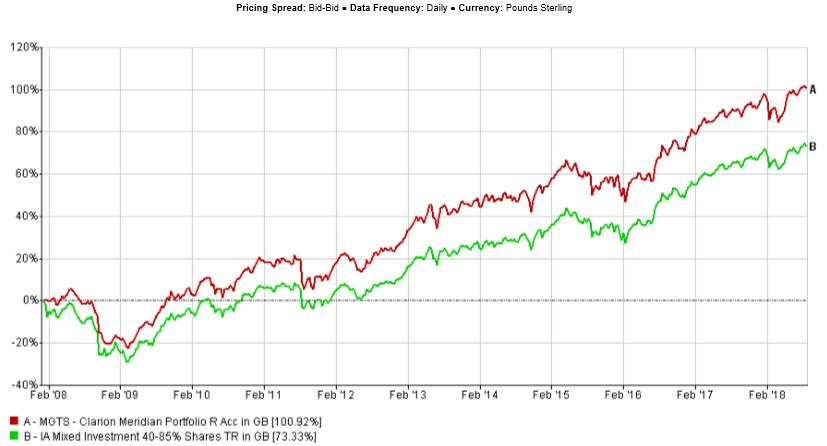

Long term performance of the Clarion Portfolio funds remains strong and is comfortably ahead of the relative sector average and benchmark as demonstrated by the supporting graphs which also add support to the argument that it is “time in the market” rather than “timing the market” which produces the best investment returns.

The Clarion fund asset allocations used for the model blends were updated.

In Clarion Prudence, the Global equities allocation was reduced by 3.5%, and the UK equity income allocation increased by 3.5%.

In Clarion Meridian, the Global equities allocation was reduced by 3%, and the UK equity income and UK All Companies allocations were increased by 1.5% each.

No changes were made to Clarion Explorer.

These changes result in the following changes to the model portfolios.

Model A

Model B

Model C

Model D

Model E

Model F

Model G

Disclaimer:

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.