Category: Financial Planning, Investment management

| Ron Walker (RW) | Director |

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Matthew Jealous (MJ) | Chief Operations Officer (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 21st November 2018 were agreed by the Committee as a true and accurate record.

| Action to be taken by | Action Point | Status |

| DK | To replace Kames Investment Grade Bond with BlackRock 1-10 Year Corporate Bond. | Complete |

| All | Discuss the BMO European Growth and Income fund. | Complete |

| All | Discuss the viability of adding Jupiter UK Special Situations in Meridian. | Complete |

| DK | Review BlackRock European Dynamic. | Complete |

| All | Discuss whether the hedged position in Japan should be sold. | Complete |

The Committee debated the current macroeconomic situation and recent market volatility, the main points of discussion being.

Stock Markets have experienced sharp corrections in December with the traditional year end, Santa Claus, rally being more akin to a blood bath than anything else.

Investors are clearly in risk off mode where fear becomes the dominant force and exuberance turns into irrational panic. This change in sentiment seems to have been caused by the fact that investors now think that a modest slowdown in world growth will become something more sinister and turn into a full-blown recession in 2019 or early 2020.

This narrative is difficult to justify as Corporate America, in particular, continues to perform well despite a backdrop of trade tensions with China, interest rate normalisation and the gradual reversal of quantitative easing.

The Committee expect that the Federal Reserve Bank of America (Fed) will help the economy to navigate these difficult waters by pausing and ultimately slowing its programme of interest rate cuts and quantitative tightening.

Unemployment in most major advanced economies is near historic lows, inflation is under control and companies continue to generate remarkably fat profit margins.

Many of the traditional early warning signs of recession are not flashing red, or anywhere near red at the moment. High yield credit spreads in the US remain close to historically narrow levels showing little signs of stress and certainly nowhere near recession levels. The yield curve has been flattening but this would be expected in an interest rate tightening cycle and is still upwards sloping. Furthermore, real interest rates are still negative. None of these factors is consistent with a looming recession.

The Committee remain cautiously optimistic that the current economic growth cycle will continue for the following reasons:

The Committee reviewed risk management, eligibility and investment & borrowing powers reports and confirmed that these were in order and no action was required.

MJ mentioned the new reporting system implemented by Margetts. MJ will review new reports with DK, who will present them to the Committee at the next IC meeting.

The Committee reviewed StatPro reports and confirmed that the relative VaR (Value at Risk) ratios for all three Clarion funds were below 100% and stress tests were in line with expectations.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

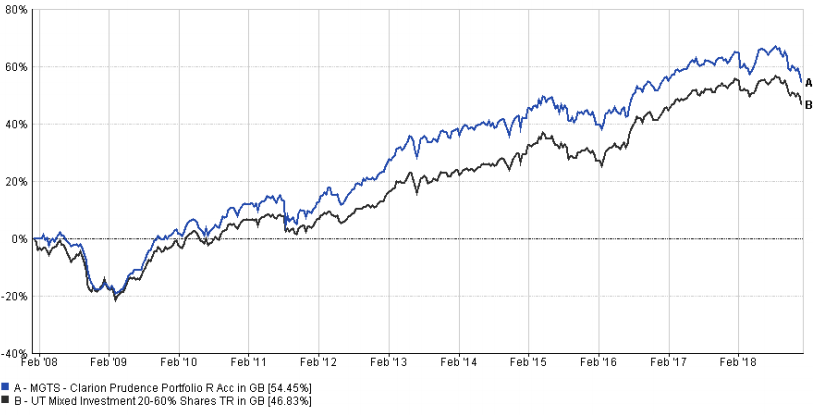

Over 3 months the Clarion Prudence portfolio was behind the IA Mixed Investment 20-60% shares sector by c.1.4 percentage points. This difference in performance has been primarily due to the over-weight to equity, the underweight allocation to the US in favour of the UK and the underweight allocation to long-dated Gilts in favour of short-dated corporate bonds, as US equities and Gilts outperformed over the period.

Long term performance of the Fund remains strong and is comfortably ahead of both the sector average and the benchmark.

The Committee are generally happy with the selection of funds in Prudence, as all but four underlying holdings outperformed their respective sectors over 12 weeks and most funds were 1st or 2nd quartile over 12 months.

The Committee agreed that the AXA Sterling Credit Short Duration fund should be sold and the proceeds invested equally among the other short duration bond funds. This move was primarily due to cost reduction as the AXA fund is currently the most expensive short dated holding included in the Clarion Prudence portfolio.

In Equities, the Henderson Global Equity Income fund was the best performing holding in absolute terms, while the L&G UK Index fund was the best performing strategy relative to its sector. Invesco Perpetual Global Equity Income and Threadneedle UK Equity Income were the two weakest funds relative to their sectors. The Committee raised no immediate concern about the Threadneedle fund, but the performance of the Invesco Perpetual fund was questioned.

The Invesco fund is now in the 4th quartile over 12 months and its performance shows no improvement over the short term, while a similar strategy, Henderson Global Equity Income, has outperformed the sector over short-term periods of up to 12 weeks. The Committee discussed whether this fund should be replaced with a different strategy. The Committee debated two funds as potential replacements, the Overstone Global Equity Income fund and the Lindsell Train Global Equity fund. The Committee looked at the performance profiles and portfolio compositions of both options. The Lindsell Train fund has a more concentrated portfolio with a tilt towards large cap multinational companies, while the Overstone fund has a value bias, with a marginally lower concentration.

The Committee recognise however that selling out of the Invesco fund after a period of underperformance during the recent period of higher volatility in equity markets could be costly and after much debate The Committee agreed not to take definitive action at this stage. The performance of the Invesco fund will be reviewed again at the next meeting and the Analyst will research and prepare a list of potential replacements.

In the meantime, the Committee decided to reduce the fund’s exposure to Global funds, which are dominated by US stocks and reinvest the proceeds with a tilt towards UK equities. The Committee feel that UK stocks provide better value as their valuations have been depressed by political uncertainty which can often fade quite quickly. UK large-cap stocks pay a good level of income, which can contribute to total return during periods of flat markets and help protect investors during periods of capital depreciation. The Committee agreed to reduce the allocation to global equity funds by c.3% and reinvest the proceeds in UK Equity Income funds.

Overall the Committee are happy with the performance of the Prudence fund and no other changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

The fund’s performance was c.2.8 percentage points behind the IA Mixed Investment 40-85% Shares sector over 3 months. Compared to the sector, the portfolio is overweight to equities which have underperformed cash and bonds over the period. The Fund is also overweight UK equities relative to the US and given that the latter have outperformed, this positioning detracted from the fund’s relative returns.

Despite this recent period of short term under performance, long term performance remains strong and is comfortably ahead of the sector average.

The Committee are happy with the fund selection in the Bonds, Asia, and Global allocations, as all of the funds within these areas have outperformed their sectors over 12 weeks. The fund selection among the UK All Companies funds was relatively weaker, with both active funds underperforming the IA sector.

The SVM UK Growth fund was the weakest underlying holding over 12 weeks both in absolute and relative terms. This strategy has a tilt to small and mid-cap stocks with a UK bias and tends to outperform when the outlook for the UK economy is favourable but has a tendency to under-perform during weaker periods. Currently, the SVM fund’s performance is experiencing some significant headwinds from the Brexit uncertainty. The Committee are aware of the nature of the fund’s underlying strategy and agree that the recent period of weaker performance is in line with long-term expectations.

The Committee reviewed the performance profile of the BMO Select European Equity fund (ex F&C European Growth and Income). The Fund Analyst has completed a detailed review of this strategy and concluded that while BMO insist the fund’s underlying strategy hasn’t changed, its portfolio is significantly different to what it looked like when the fund was initially purchased. This strategy used to have a balance of growth and value assets and was expected to perform relatively well during both positive and negative markets. However, since the manager change in 2017, the portfolio became more concentrated and the asset allocation style drifted from a mix of growth and value towards more growth-oriented stocks. Further to this change, the portfolio has underperformed the sector during the recent period of weaker markets, which could suggest a change in its performance profile. The Committee agree with the findings but decided not to replace the fund at this stage due to increased market volatility. The Committee decided to keep the BMO fund in the portfolio for now, however it will be reviewed further at the next IC meeting when the Analyst will present a list of potential substitutes.

The Committee discussed the weaker performance of the SLI UK Equity Income Unconstrained strategy, which is now in the 4th quartile over 12 months. The Fund Analyst explained that this fund historically was either in the 1st or 4th quartile. After looking at the past performance chart, the Committee argued that despite its performance profile being relatively volatile, over the longer term it did not outperform the sector by a significant margin. It was noted that historically this fund swings from periods of significant outperformance and to periods of underperformance and it was agreed that selling this fund could be better aligned with a period of stronger relative performance and sell at the height of its performance cycle. The Committee made no decision at this stage; however, the holding will be monitored going forward.

The Committee debated the possibility of adding the Jupiter UK Special Situations fund to the portfolio. This strategy has a value bias and while it tracked the market on the upside, during the more recent weaker markets, it has outperformed. The Committee felt the Jupiter Fund would add a layer of diversification to the overall strategy and the fund would complement the other underlying UK funds, while trimming all of the existing positions to equal weightings. The Committee debated current market volatility and agreed that significant changes should be avoided during the current period of higher market volatility and that it was better to wait until markets normalise. The Committee agreed to invest in the Jupiter fund in principle, however they will look to time this purchase better.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no changes.

The Committee approved the strategy and confirmed it is in line with the mandate.

The fund was ahead of the sector over 3 months, despite the recent falls in equity markets. The portfolio’s overweight positions in Asia and Emerging Markets have contributed positively to returns over the period. Fund selection also was strong across the portfolio as only 2 underlying active funds have underperformed their respective sectors.

Long term performance of the Explorer Fund remains strong and is comfortably ahead of both the sector average and benchmark since inception.

In Europe, the performance of the BlackRock European Dynamic fund has improved over the short term. The Committee continue to monitor this fund as it remains in the 4th quartile over 12 months. The Committee looked at the BlackRock fund in more detail and found that the overweight allocation to Industrials was the main cause of its underperformance. The Committee agreed to retain this holding in the portfolio but will continue monitoring its performance.

The fund selection in Asia and Emerging Markets was exceptionally good as all underlying holdings outperformed their respective sectors over 12 weeks. More value-oriented funds continued to deliver higher relative returns, while growth stocks generally underperformed over the period.

Both US index tracking strategies have underperformed the underlying Asia and Emerging Markets funds, which could indicate a shift in investors’ perceptions of risk and future growth expectations. On average, US funds fell by c.6% over 12 weeks, while Asian and Emerging Markets funds on average experienced more modest falls of c.2%.

The Committee discussed removing the hedged Sterling share class in the fund’s allocation to Japan, however they decided to keep the 50/50 split between the hedged and unhedged share classes given that the Brexit outcome remains highly uncertain. The Committee feel that Sterling is currently trading in the middle of both the soft-Brexit and hard-Brexit outcomes, hence the mixed exposure has been left in place.

The Committee decided to reduce the cash position by 2% and reinvest it in the M&G Global Dividend fund. The cash position was increased earlier this year, after a period of strong growth in 2017. The Committee feel that now is the time to reinvest it back in the market, after the recent falls in equity prices. The M&G Global Dividend fund has been chosen as it provides a good mix of regional exposures and has a value tilt.

The Committee are pleased with the overall performance of this strategy and proposed no other changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model A

Model B

Model C

Model D

Model E

Model E

Model F

DK provided a review of the Jupiter UK Special Situations fund. The key points are noted below.

No other business.

| Action to be taken by | Action Point | Review Point | |

| MJ and DK | To review Clarion risk reporting. | Next IC | |

| All | Consider replacements for the IP Global Equity Income fund. | Next IC | |

| All | Consider replacements for the BMO Select European Equity fund. | Next IC | |

| All | Review the SLI UK Equity Income Unconstrained fund. | Next IC | |

| DK | To finalise attribution analysis for Clarion funds | Next IC | |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.