Category: Financial Planning, Investment management

| Ron Walker (RW) | Director |

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 21st January 2019 were agreed by the Committee as a true and accurate record.

| Action to be taken by | Action Point | Status |

| MJ | To create an additional report showing the frequency of compliance checks at Margetts and the amount of breaches in between IC meetings. | Complete |

| DK | To review BlackRock European Dynamic. | Complete |

| DK | To check whether historic OCF data was available. | Complete |

| All | Review the SLI UK Equity Income Unconstrained fund. | Complete |

| DK | To Implement changes agreed at the IC meeting. | Complete |

The Committee discussed the current economic and political environment and the implication for financial markets and the following is a brief summary. The key elements were as follows:

DK presented a template of a new risk report developed by Margetts. The report will show net and gross leverage levels for each of the Clarion funds, the frequency of compliance checks conducted by the Margetts risk team (expected to be daily), indicate whether compliance checks have been delayed on any particular day and list all soft and hard limit breaches registered over the period. The new report will replace the old eligibility and investment and borrowing powers reports and the Committee are unanimously approved its use going forward.

DK explained that due to system migration, investment limit reports are currently unavailable, but Margetts are working on their development in the new system. There will be no StatPro reports going forward and all risk data will be generated in-house by Margetts.

In principle, the Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

The fund’s performance improved further in February and it is now in line with the IA Mixed Investment 20-60% Shares sector over 12 weeks. The portfolio’s overweight equity position was the major contributor to stronger relative returns as markets turned positive in 2019.

Fund selection was generally stronger among equity funds and weaker among bond strategies. Most of the portfolio’s underlying bond funds have a short-duration bias and have underperformed their respective sectors as bond yields slipped lower. The Committee have no concern regarding this positioning and expect monetary conditions to become tighter over the longer-term causing short dated bonds to perform better than long dated bonds.

Most of the underlying UK equity funds outperformed the IA UK Equity Income sector over 12 weeks, with only two strategies, the Aviva Investors UK Equity Income and Royal London UK Equity Income funds, being weaker over the period. Both funds are strong long-term performers and the Committee did not raise any significant concern over the relatively short-term period of underperformance.

It was noted, however, that the Aviva UK Equity Income strategy is one of the more expensive funds in the portfolio. The Committee agreed to review this position at the next IC meeting and will consider a list of potential replacements.

Among global equity funds, the Henderson Global Equity Income strategy looked relatively weak. The Committee discussed the rationale behind the purchase of this fund. It was agreed that due to an income mandate the Henderson strategy has a higher allocation to Europe, whereas the IA Global sector has a much higher exposure to North America. European equities have lagged the US for some time which has been the main drag on the fund’s performance. The Committee agreed to keep this fund in the portfolio at this stage as it provides additional diversification alongside the M&G Global Dividend strategy which holds much higher exposure to the US.

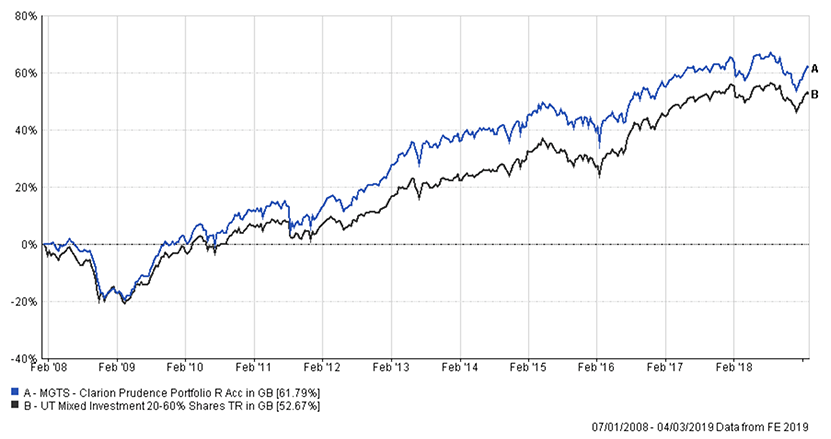

Overall, the Committee are happy with the performance of the Prudence fund with long term performance remaining strong as demonstrated by the graph below. No other changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

The short term performance of the Meridian fund has improved and long term performance remains strong. The stronger relative short term performance was due to the themes which have also been experienced in the Prudence fund. The overweight equity position has contributed to relative returns, while short-duration bias in bonds had a negative effect.

The Committee discussed the BMO Select European fund, which has recovered some of its previous underperformance but failed to significantly outperform the newly added Fidelity European strategy. It was agreed that the remaining BMO holding will now be sold and the proceeds will be reinvested in the Fidelity European strategy.

The Committee noted an improvement in the performance of the Fidelity Institutional South East Asia strategy and weaker relative returns of the First State Asia Focus fund. The Fidelity strategy has a higher exposure to more cyclical Chinese companies and tends to outperform during market rises, while the First State fund tends to invest more in less cyclical businesses, hence it usually outperforms during periods of market falls. The Committee has no concerns about either of these holdings as both performed in line with expectations and compliment each other.

Performance profiles of the SLI UK Equity Income Unconstrained and SVM UK Growth funds were discussed in more detail. Both funds have underperformed their respective sectors over 12 weeks. DK explained that both strategies have a tilt towards more domestically focused mid and small-cap companies, which are highly sensitive to the progress of Brexit negotiations.

It was agreed that the performance of the SVM Fund is likely to recover strongly if Brexit negotiations are concluded with a deal, however the Committee were concerned about the SLI strategy. It was also felt that after the merger with Aberdeen, some Standard Life funds have been under pressure and that the management structure of the group is not very stable. The Committee agreed to look at potential replacements for the SLI fund and will discuss available options at the next IC meeting.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no other changes at this stage.

The Committee approved the strategy and confirmed it is in line with the mandate.

The fund’s performance remained strong relative to the IA Flexible Investment sector over both the long term and the short term. The portfolio continues to benefit from the revaluation of equities and an uplift in Asia and Emerging Markets in particular, areas to which the fund is overweight. The underlying fund selection continues to be strong, with most funds outperforming their respective benchmarks over 12 weeks.

Out of 9 underlying holdings in Asia and Emerging Markets, 6 outperformed their respective sectors over 12 weeks. All of the three funds with weaker relative returns are more defensive and while their relative performance was weaker during market rises in January and February 2019, they outperformed during market falls in the second half of 2018.

The Committee are pleased with the improving performance of the BlackRock European Dynamic strategy. This fund currently holds overweight positions in the Industrials and Technology sectors, hence the performance is more cyclical. The fund has lagged the IA Europe ex UK sector in 2018, but has outperformed in 2019 as equity markets recovered.

The Committee noted the weaker relative performance of the Jupiter European fund, which is now behind the sector over periods of 2 weeks and 6 months. However the fund’s performance is very strong over 12 months with a positive return of c.5.4% over the period.

The Committee looked at the performance of the two Japanese fund which have lagged the IA Japan sector over 12 weeks. While the weaker relative performance of the Lindsell Train Japanese Equity strategy was mainly due to the currency hedging, the Schroder Tokyo fund remains unhedged. The historic performance chart indicates that over 12 months the Schroder Tokyo strategy performed in line with expectations, outperformed during negative markets and underperformed during positive markets. It was noted that the manager of the Schroder Tokyo fund will change in the summer and DK will write a review on this fund shortly.

The Committee are pleased with the overall performance of the Explorer strategy and proposed no other changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model A

Model B

Model C

Model D

Model E

Model F

DK provided a review of the Fidelity Short-Duration Bond fund. The key points are noted below.

No other business.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.