Tags: Explorer, funds, investment, Meridian, Prudence

Category:

Financial Planning,

Investment management

Minutes of the Clarion Investment Committee held at 2pm on 23rd April 2020 by video link.

Committee members in attendance: –

| Sam Petts (SP) | IC Chairman and Financial Planner (Clarion Wealth Planning) |

| Keith Thompson (KT) | Chair/Director |

| Ronald Walker (RW) | Founding Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 26th March 2020 were agreed by the committee as a true and accurate record.

Please click here to access the April Economic and Stock Market Commentary written by our Chairman, Keith Thompson

The Investment Committee continue to focus on our responsibilities to our investors. We are working within the limits of what we know in what is a highly uncertain time for everyone. Clarion remains ‘open for business’ if not quite ‘business as usual’. All employees are working from home and regular conference calls are taking place between colleagues.

Members of the investment committee hold regular conference calls via Zoom with the team at Margetts Fund Management to keep up with events, discuss investment strategy and to review the Portfolios Funds.

The path and eventual control of the Covid19 pandemic remains critical to both the economy and financial markets. Governments are taking extraordinary steps to protect their national health systems and to save lives. Together with central banks they have also embarked on mind boggling quantities of monetary and fiscal support to try to minimise the financial hit to individuals and companies both large and small. These measures are providing life support to economies and should enable them to recover once the crisis has passed. Further stimulus is likely to follow to keep the economy safe and to turbo charge the recovery.

In the midst of the high level of uncertainty there have been encouraging signs of a recovery in stock markets in recent weeks. Markets are however likely to remain volatile for some time to come until there is more visibility about a gradual exit from lockdown. Volatility, while uncomfortable and disconcerting for investors should, however, be seem as an opportunity. It allows our active fund managers to exploit mispricing of quality, strong companies which will survive the crisis and prosper in the future.

The committee firmly believe it is best to ride out short term volatility, stay calm, remain invested and focus on the future recovery which will emerge at some point . The committee prefer to resist making any major changes to the portfolios at times such as this other than to rebalance in favour of equity funds. Indeed, anything other than minor tweaks are not considered necessary although after a full discussion we have made some minor adjustments to the Prudence and Meridian Funds with corresponding adjustments to the model portfolios.

Whether we have seen the bottom of this cycle remains to be seen and much depends on how quickly the current severe lockdown is lifted. Any easing will be welcome and will contribute to a recovery in economic activity. We believe the Clarion Portfolio funds and model portfolios are well positioned to benefit fully from the rebound in markets when that occurs.

The committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

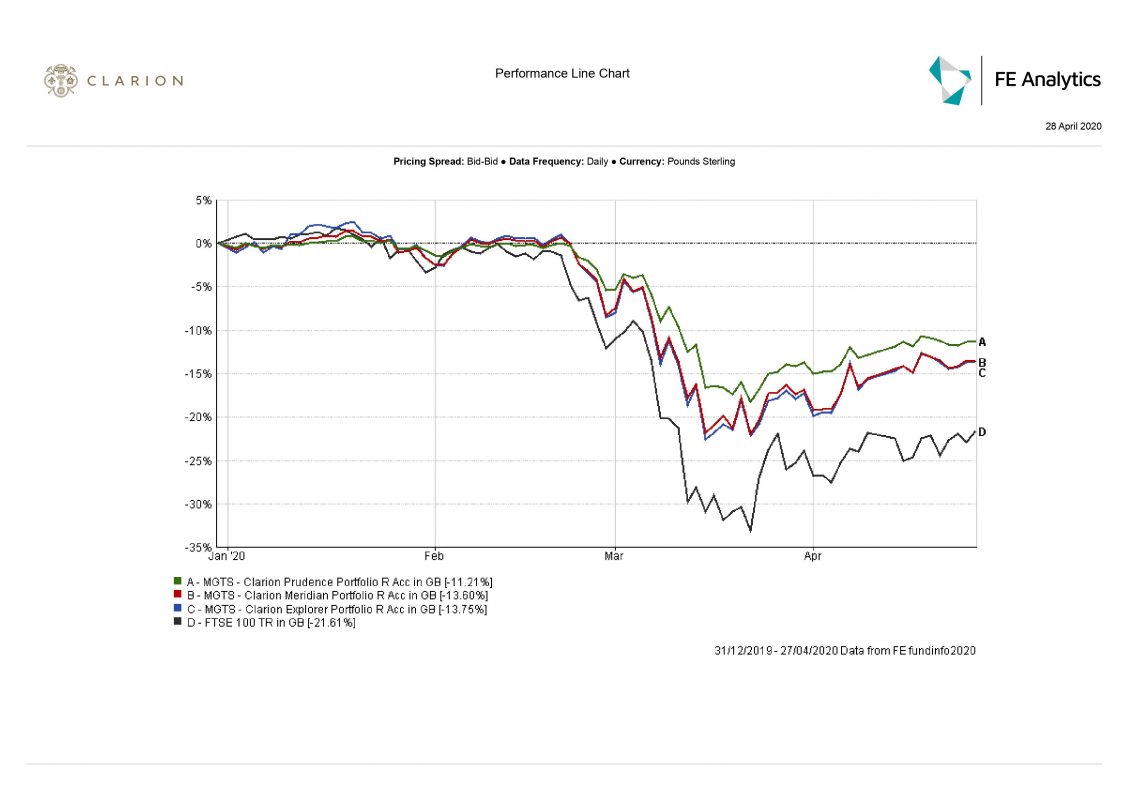

We remain confident in our overall fund selection process. The Clarion Portfolio funds are performing well relative to peers. Our weighting towards Asia has worked in our favour as Asian Markets have fallen less than Western Markets. We are pleased with the way in which the funds held up in the dramatic falls of a few weeks ago and also with the way they have recovered on the market bounce back. We are firmly focused on maximising the opportunity ahead.

The majority of the underlying funds in Prudence, Meridian, and Explorer have outperformed their respective benchmarks over 12 weeks. All underlying holdings are highly liquid with no exposure to open ended property funds where redemptions have been blocked for some weeks causing problems for other fund of fund strategies.

The committee discussed the possibility introducing a small exposure in Prudence & Meridian to Gold to provide diversification to the fixed interest holdings. With bond yields so low, even negative in some cases, the opportunity cost of holding gold is zero. In a world of continuing fiscal and monetary stimulus, central banks are not concerned about protecting the value of plain money and gold acts as a currency of last resort. Unfortunately, the price of gold, and gold miners in particular, is volatile and as such may not be a suitable holding for the Prudence & Meridian portfolio funds. It was decided therefore to conduct further research to find a suitable gold fund.

The committee also discussed the opportunity presented by the recent widening of credit spreads between medium to long dated investment grade corporate bonds and government bonds. We decided to take advantage of the higher yields available by replacing the Royal London Short Dated Credit Fund in Prudence with the Royal London Sterling Credit Fund which has a longer duration and higher yield with minimal increased risk in the current environment.

In the Meridian Portfolio Fund, it was also decided to sell down the Royal London Short Dated Credit Fund and the BlackRock Corporate Bond Fund and to invest the proceeds in the Royal London Sterling Credit Fund and also slightly increasing the weighting to the Legal & General Short Dated Bond Fund.

These changes to the fixed interest allocations in Prudence & Meridian will slightly extend the duration weighting and increase the yield without materially affecting the risk profile of the Funds.

The committee also noted that the Lead Manager, Alistair Mundy, of the Investec UK Special Situations Fund, a holding in the Meridian Portfolio Fund has resigned due to non-coronavirus related health reasons. Alistair has been at the helm for more than two decades and this resignation combined with the relative underperformance of the Investec fund caused the committee some concern. It was decided therefore to replace the Investec Fund with the BlackRock UK Equity fund, a top quartile rated fund over the last five years. The BlackRock fund follows a similar style of “value investing” to the Investec Fund and this combined with the solid medium to long term performance of the BlackRock Fund was sufficient to persuade the committee that it was an ideal replacement.

The Clarion Portfolio funds and model portfolios are well positioned to benefit from a return to growth in the economy and remain slightly overweight equities.

We remain in regular contact with our fund managers who are taking full advantage of the current situation to invest in solid growth companies with strong balance sheets at bargain basement prices.

The committee approved the strategy of all the funds and confirmed it is in line with the mandate.

Appropriate adjustments were made to the model portfolios to reflect the changes to the Prudence & Meridian Funds mentioned above.

None of note. Next Investment Committee Meeting is 21st May although in the interim period the committee intend to have hourly conference calls on a twice weekly basis.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.