Category: Financial Planning, Investment management

Minutes of the Clarion Investment Committee held at 1pm on February 13, 2020 at Overbank, 52 London Road, Alderley Edge, Cheshire.

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

| Adam Wareing (AW) | Director of Operations (Clarion Wealth Planning) |

| Jacob Hartley (JH) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on January 16, 2020 were agreed by the Committee as a true and accurate record.

The possible impact on business & consumer confidence and economic growth caused by the Coronavirus was one of the main discussions at the meeting.

It is difficult to write about this event without thinking about the human tragedies that are unfolding around the Coronavirus and at this stage no one has insight into the severity and duration of the epidemic but like everyone else we hope that the distress and suffering the virus has already caused will soon dissipate.

The virus has the potential to cause severe economic and market dislocation. Post the Investment Committee meeting, the situation worsened in the final few days of the month with the Virus spreading to other parts of the world. Further outbreaks and deaths caused a panic in stock markets with widespread falls in all markets.

Of course, given the extreme uncertainty over exactly how much economic damage the effort to contain the Virus will eventually cause, a panic by short term investors, short sellers and traders was inevitable.

Looking at the situation dispassionately however, it is a fact that during unsettling times such as this, which can be disconcerting for all investors, history shows that investors who hold their nerve by ignoring inevitable stock market volatility, and even treating weakness as a buying opportunity, are well rewarded and compensated for the risk taken.

Clarion follow the statistics of new Coronavirus cases and deaths via https://www.worldometers.inf/coronavirus/coronairus-cases / The spike in new cases in the middle of February was quite alarming but this was largely due to the change in the way China records new cases to speed up detection. We continue to monitor the situation closely.

Other points discussed were as follows:

Please click here to access our February Commentary summarising the Investment Committee’s current thoughts on other issues and themes.

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

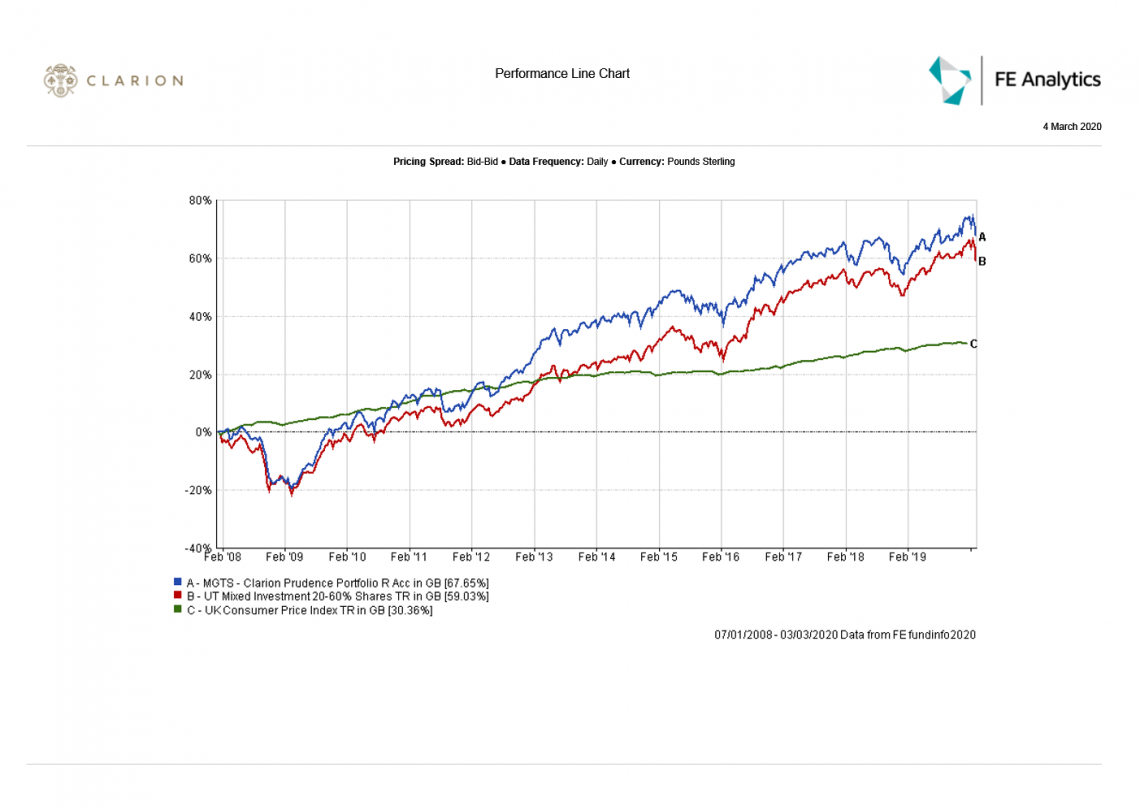

Prudence has benefited from a positive asset allocation effect, driven by the fund’s overweight exposure to equities and an underweight allocation to bonds. Selection effect was slightly negative over 12 months, due to short-dated bond funds being the core exposure to fixed income, given that longer dated bonds have outperformed.

KT asked whether the Committee should consider adding some long-duration bond funds to the portfolio as a safety measure. TR felt that bond yields are too low now as investors took a flight to safety following the outbreak of the coronavirus. The timing for buying into long-duration bonds could be wrong and it might be worth waiting for virus fears to recede. The Committee agreed to explore the opportunity of adding long-duration exposure to the portfolio and will discuss some specific options at the next IC meeting. Overall, the Committee feel that bond yields are currently very low but will potentially be looking to increase the portfolio’s overall duration if bond yields go up.

Overall, the portfolio is well balanced and has performed in line with the sector over 1, 2 and 12 weeks. The pairing of the two global funds with different investment styles worked well, as both have complemented each other. The Committee were pleased with the strong performance of the only Asian fund in the portfolio and commented on a well-balanced selection of funds in the UK.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

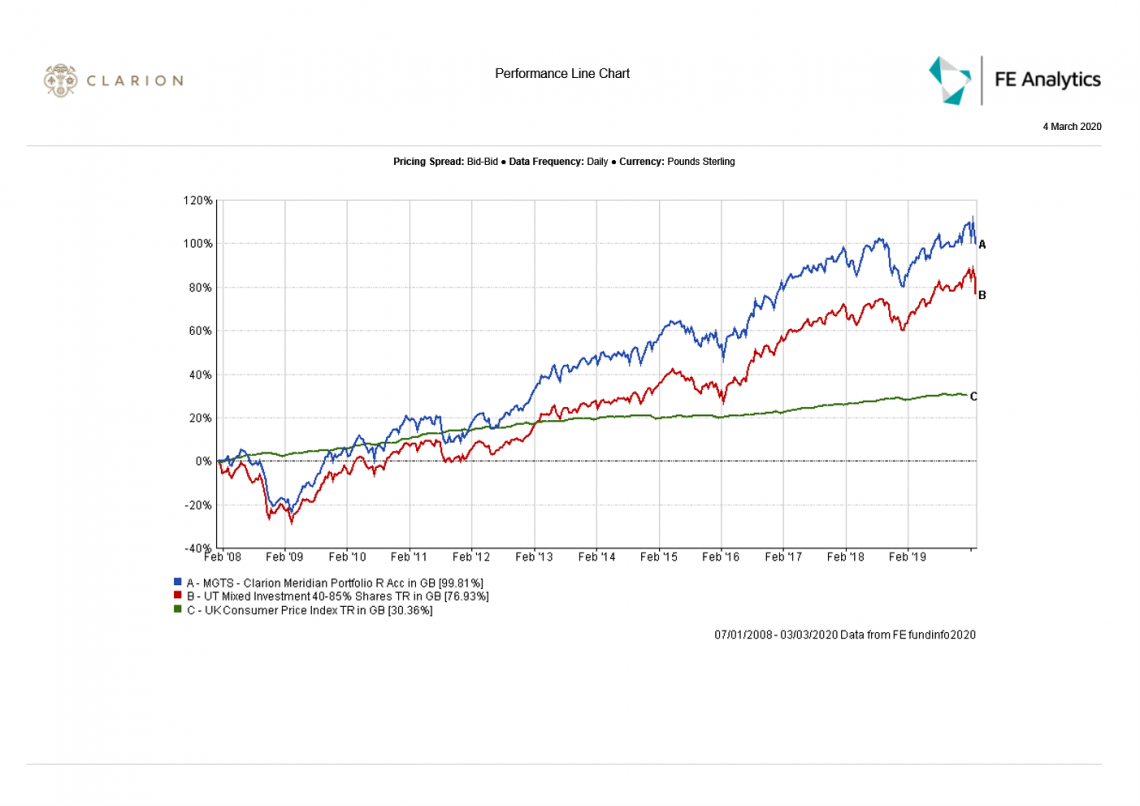

There was a neutral allocation effect in Meridian, with the underweight allocation to the US being the biggest detractor and the overweight allocation to Global funds being the main positive contributor. Fund selection effect was also mixed, with the selection of short-dated bonds being the biggest detractor and selection of European and US funds making a positive contribution.

KT asked if the Committee should consider increasing the portfolio’s allocation to the US, bringing it in line with the sector. TR and DK argued that together with the allocation to global equity funds, the Meridian strategy’s allocation to the US is very close to that of the IA Mixed Investment 40-85% Shares sector.

The Committee discussed the fund’s allocation to Japan, which was at c.3%. Given that Japan is one of the most undervalued markets, as indicated by the relative valuation metrics, the Committee discussed whether the allocation to Japan needs to be increased to a meaningful position of 5%. Was agreed that 1% will be re-allocated to Japan from Asia and 1% from Emerging Markets, thus increasing the allocation to Japan to 5%, reducing the allocation to Asia to 14% and allocation to Emerging Markets to 12%.

Otherwise, the Committee felt that the Meridian portfolio is well balanced and in a good position to perform well over coming months. Meridian has outperformed the IA Mixed Investment 40-85% Shares sector over 1 and 2 weeks and was in line over 12 weeks.

The Committee proposed no changes to fund selection at this time and made no further comments.

The Committee approved the strategy and confirmed it is in line with the mandate.

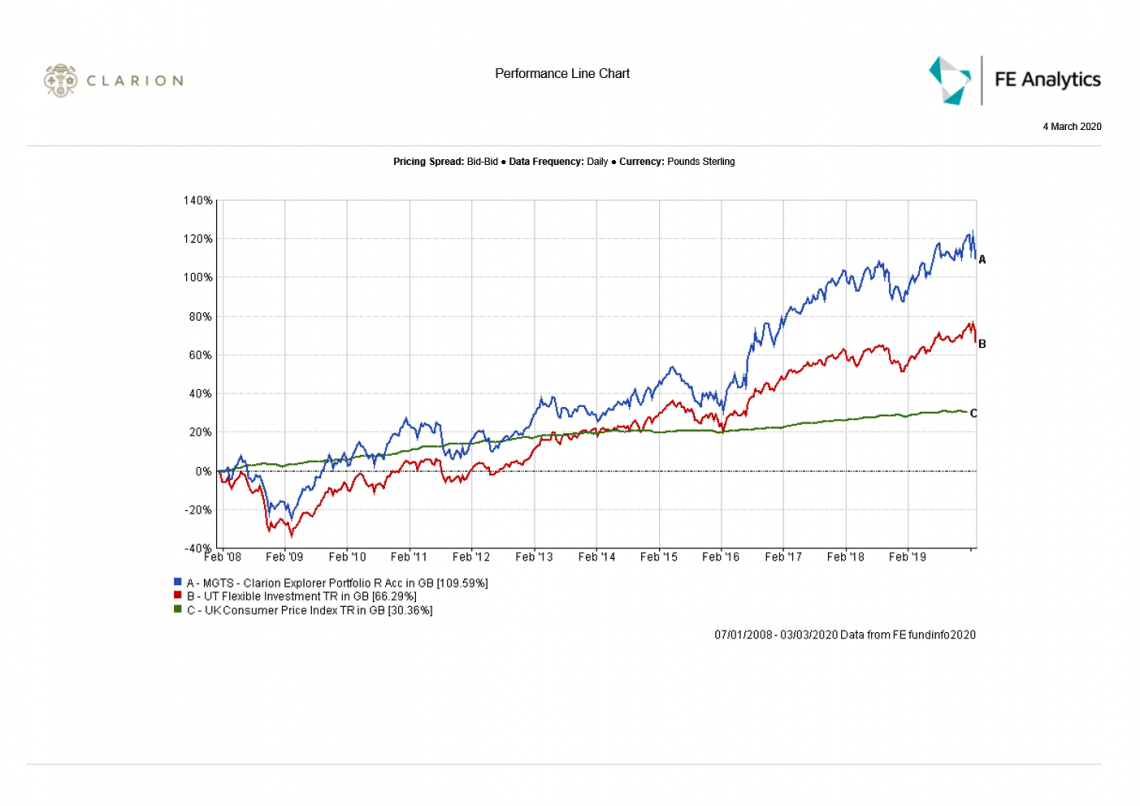

Explorer has benefited from a positive fund selection effect over 12 months, while the asset allocation effect was neutral.

The Committee were generally happy with the performance of most underlying holdings and had no immediate concerns. The recent spell of weaker performance of the JPM Emerging Markets Income fund was noted and discussed. This fund has underperformed the IA Global Emerging Markets sector over various periods ranging from 1 week to 12 months. The Committee looked at the performance profile of the JPM fund in more detail and agreed that it was strong long-term, and the recent underperformance was marginal given the relatively high volatility of Emerging Markets funds following the outbreak of the coronavirus.

The Committee discussed increasing the fund’s allocation to Japan at the expense of the Asian weighting and as in the case of Meridian it was agreed that the allocation to the IA Asia Pacific ex Japan sector will be reduced by 1% and the proceeds reinvested in Japan.

The Committee are pleased with the overall performance of this strategy and no other changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model E:

Model D:

The Committee looked at the way Distribution Technology rates the Clarion funds and identified that the Explorer portfolio was on the edge of its target risk rating, Meridian was showing above its target risk rating and Prudence was above its suggested portfolio, but within the target risk range. The Committee agreed that these ratings will need to be monitored closely going forward. SP will look at all three portfolios and will aim to identify the biggest contributors to the risk ratings and investigate whether there are any lower risk alternatives which might be more appropriate.

| Action to be taken by | Action Point | Review Point |

| DK | Update strategic targets on attribution analysis, Tec sheets and targets | Next IC |

| SP | To check how risk profiles of Clarion funds can be brought in line with those suggested by DT. | Next IC |

| DK | Research note for the Blue Whale Growth fund as recommended by KT | Next IC |

| All | To consider adding a long-dated bond fund to the portfolios and increasing the US exposure. | Next IC |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.