Category: Financial Planning, Investment management

Minutes of the Clarion Investment Committee held 1pm on 16th January 2020 at Overbank, 52 London Road, Alderley Edge, Cheshire.

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

| Adam Wareing (AW) | Director of Operations (Clarion Wealth Planning) |

| Jacob Hartley (JH) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 11th December 2019 were agreed by the Committee as a true and accurate record.

Bearing in mind that this meeting was held the day before the UK General Election, the key elements discussed were as follows:

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

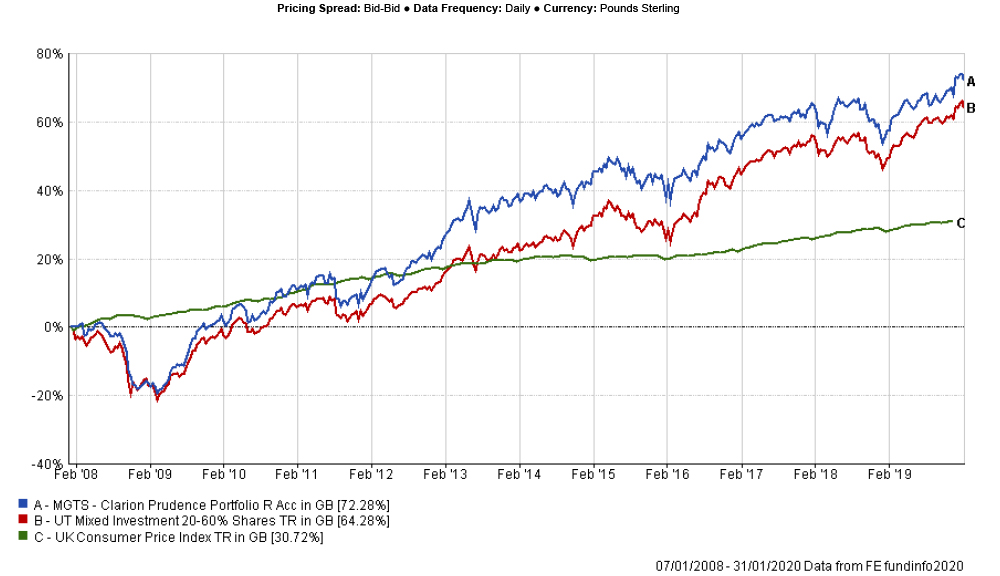

Prudence has benefited from an active allocation to global equity funds and a strong selection of UK strategies. Although short-dated bond funds detracted from the portfolio’s return over 12 months as long-dated bonds outperformed, Prudence outperformed the IA Mixed Investment 20-60% Shares sector by c.1.7 percentage points and ended 2019 in the second quartile.

There has been a swing in the relative performance profiles of the Fundsmith Equity and M&G Global Dividends strategies over 12 weeks. While the more growth biased Fundsmith strategy outperformed over 12 months, the more value-oriented M&G fund was ahead over 12 weeks, highlighting the short-term rotation from growth stocks to value.

The Committee were pleased with the underlying selection of UK funds, as 4 out of 6 were ahead of the IA UK Equity Income sector over 12 weeks. The Man GLG UK Income strategy was the best performing fund over 12 weeks, due to its mid-cap bias, which has benefited from the appreciation of Sterling.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Meridian has benefited from an overweight allocation to the UK, Asia Pacific and Global funds. The preference for short-dated bonds rather than long term, detracted from performance over 12 months. Overall the fund has outperformed the IA Mixed Investment 40-85% Shares sector by c.0.6 percentage points over 12 weeks.

The CFP SDL UK Buffettology fund was the best performing underlying holding over 12 weeks with c.10.5% return in absolute terms. This was followed closely by the SVM UK Growth strategy with c.8.5% return over the same period.

The Committee noted the weaker performance profiles of the Artemis Income and Rathbone Income strategies, which have underperformed the IA UK Equity Income sector over 12 weeks but outperformed over 1 and 2 weeks.

The Committee were pleased with fund selection in Asia and Europe, where all funds outperformed their respective sectors over 12 weeks. The underlying selection of all funds looked strong over 12 months but weakened slightly towards the end of the year.

Overall the Committee are happy with the performance of the Clarion Meridian fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

The underlying fund selection in Explorer was the major contributor to the fund’s outperformance over both one year and 12 weeks. The underweight allocation to the US was the biggest detractor from relative returns over one year. Overall the fund was c.2.3 percentage points ahead of the IA Flexible Investment sector over 12 months and c.1.1 percentage points ahead over 12 weeks.

The Committee commented on the exceptional selection of the underlying Emerging Markets, Japanese and European funds, as all outperformed their respective sectors over 12 weeks. The UBS Global Emerging Markets Equity fund was the strongest performer over the period with c.10.7% return in absolute terms.

While positive in absolute terms, 3 out of 5 underlying Asia Pacific funds slightly underperformed the IA Asia Pacific ex Japan sector over 12 weeks. This was mainly due to underweight allocations to China within these portfolios, which has outperformed over the last three months.

The Committee are pleased with the overall performance of this strategy and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

No changes.

The Committee discussed and agreed new asset allocations for Clarion funds and Clarion models which will be implemented in the new year. AW and DK will work on the implementation of new strategies in January.

The Committee discussed a potential new fee structure. Clarion would like to bring the cost of the Clarion Portfolio funds in line with the cost of holding Clarion models on platforms. AW will send a breakdown of platform costs to Margetts and TR will consider a proposal which will be discussed at the next meeting.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.