Category: Financial Planning, Investment management

The Committee discussed the current economic and market outlook and the following is a brief summary of the key points however, please refer to the Half Yearly Market and Economic Commentary published alongside these minutes for more detailed information.

The potential investment opportunities identified are;

The Committee reviewed risk management, eligibility and investment, borrowing powers reports and confirmed that these were in order and no action was required.

The committee reviewed risk data for the Clarion funds and agreed that the VaR ratios and stress tests for Clarion Meridian and Explorer were in line with expectations and within internal thresholds.

The Committee continue to monitor the relative VaR ratio for the Clarion Prudence fund, which is currently above the internal threshold of 120. The Committee reviewed this breach of the internal limit and agreed that the fund’s risk profile was in line with the mandate and no immediate actions were required. Compared to the benchmark, the fund currently holds an overweight allocation to equities, and includes a c.20% exposure to global equity funds, which are not represented in the benchmark. These allocation differences are the main cause of VaR ratio differences between the fund and the benchmark. The Committee will continue to monitor this ratio; however, no concerns have been raised at this stage.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

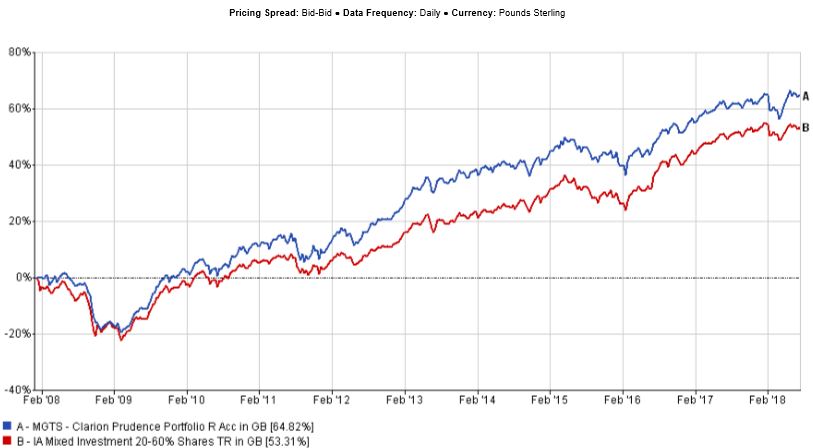

Over 3 months the fund has outperformed the sector by c.1.6% and benefited from the overweight equity and short dated bond allocations. Over the same period the fund has marginally lagged the benchmark, which can be explained by its active allocation to global equity funds, which have underperformed the UK equity market.

Long term performance of the Fund is strong and comfortably ahead of the sector average since inception.

The Committee are pleased with the strong relative performance of the underlying bond holdings as all funds outperformed their respective sectors over 3 months. The recently added Fidelity Short Dated Corporate Bond fund was the strongest performing bond fund over the period.

The fund selection in the UK was strong, and all but one fund outperformed the IA UK Equity Income sector over 12 weeks. The Premier Income fund was the only underperforming holding over the period. The Committee looked at this fund’s recent and longer term performance, which was relatively close to the sector, and whilst the recent weaker relative returns were marginal, the fund did not consistently outperform the sector over 3 years. It was noted that the Premier fund’s allocations have changed recently. The Committee agreed that a more in depth review of the fund’s performance was needed, and it was agreed to obtain more detailed information about the main drivers of the fund’s recent performance and review further at the next IC meeting.

The Committee reviewed the performance of both the Henderson Global Equity Income and Invesco Perpetual Global Equity Income funds. Performance of both funds looked weak relative to the IA Global Equity sector over 3 months however, they were more in line with the IA Global Equity Income sector. Due to their income bias, both funds hold c.40% exposure to Europe. It was noted that over 12 months the Invesco Perpetual fund performed strongly and the Committee were comfortable with its risk and return profile. The Henderson strategy was more average and performed in line with the Global Equity Income sector. The Committee agreed to monitor the fund’s performance going forward and obtain further information about the main factors affecting its returns and review again at the next IC Meeting.

The Committee are pleased to note the stronger performance of the Threadneedle UK Equity Income fund which was the best performing fund in the portfolio over 12 weeks, with an absolute return of c.12.5%. This fund had struggled at the beginning of 2018; however, the Committee made a decision to keep this fund in the portfolio based on the manager’s positive long term track record and the fund’s allocations to some more liquid parts of the UK equity market.

There were no changes proposed to the fund and the Committee are pleased with the overall performance of this strategy as well as most of its underlying holdings.

The committee approved the strategy and confirmed it is in line with the mandate.

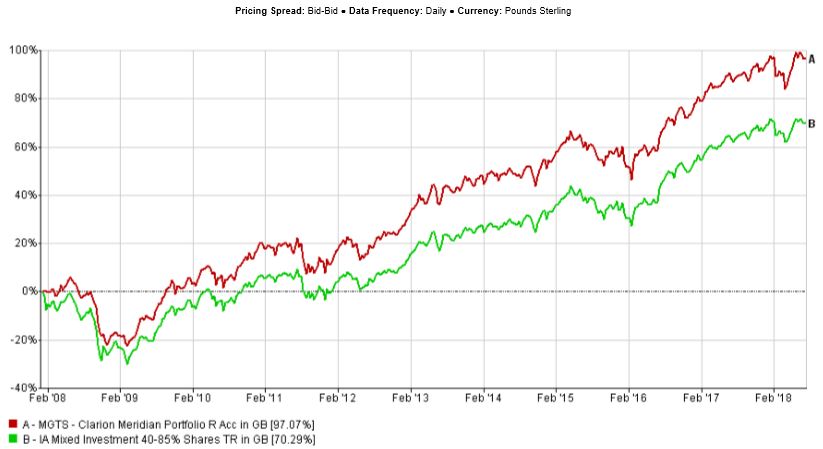

The fund was ahead of the sector by c.0.7% over 12 weeks. Overweight allocations to the UK and short dated bonds were the main contributors to the fund’s strong relative performance. Long term performance is strong and is comfortably ahead of the sector average since inception.

Both of the underlying Asian funds performed well over 3 months and outperformed the IA Asia Pacific ex Japan sector by c.1.5% and c.2% over the period. Both funds are relatively more conservative compared to many other funds in the sector, which had a positive effect given that Asian markets have experienced some falls over the last few weeks.

In bonds, the Committee raised some concerns about the M&G Optimal Income fund as it has recently underperformed the sector. The Committee feel that the M&G fund has become too large, with a current size of approximately £24billion. It was agreed to look for potential alternatives to replace this fund with and review them at the next IC meeting.

In the UK, the Committee are pleased with the performance of the JPM UK Dynamic fund, which was the most recent addition to the portfolio. The JPM fund was the best performing holding in the portfolio over 12 weeks. The Committee have also noted the continuation of strong performance from the SVM UK Growth strategy, which was the best performing fund over 12 months.

The Standard Life UK Equity Income Unconstrained strategy has recently underperformed the sector. This fund is very active and the manager often displays strong views which are translated into significant overweight and underweight positions relative to the sector. Historically, this strategy has been relatively volatile and its performance can typically range within the first or the fourth quartiles of the distribution of fund returns within the IA UK Equity Income sector but long term performance remains strong.

With regard to the US allocations, the Committee discussed the possibility of adding a US Smaller Companies fund to provide diversification to the current low cost US index tracking exposure. US Large Cap stocks represented by the Dow Index look fully valued whereas small cap stocks appear to offer good value as demonstrated by the recent outperformance of the Russel 2000 index. Smaller Cap stocks generally outperform at this stage of the economic cycle. It is also the Committee’s view, that under the current market environment, some strategies which track indices with market cap weighting structures can create market distortion by misallocating capital to companies on the basis of their size rather than fundamentals. The Committee discussed the Artemis US Smaller Companies fund as a potential purchase; however, no decision has been made at this time and further information will be obtained about the IA North America Smaller Companies and suitable Smaller Cap Funds with a further review at the next IC meeting.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no changes at this time

The committee approved the strategy and confirmed it is in line with the mandate.

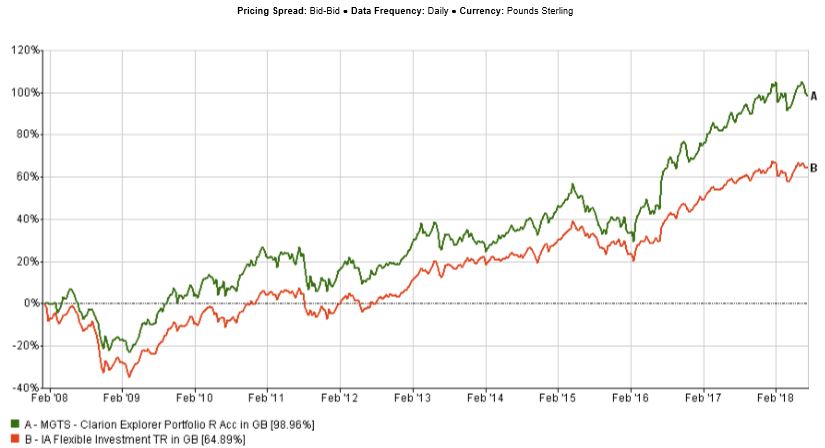

The fund has slightly underperformed the sector over 3 months, due to the overweight allocation to Asia and Emerging Markets, which have underperformed developed market equities over the period. Long term performance remains strong and the Fund has comfortably outperformed the sector average since inception.

After the recent weakening of the Chinese equity market, some more defensive Asian and Emerging Markets holdings have outperformed their respective sectors. The Stewart Investors Asia Pacific Leaders strategy was the best performing underlying Asian holding over 12 weeks and the JPM Emerging Markets Income strategy was the best performing emerging markets holding over the period.

The Committee also noted the improving performance of the Henderson Emerging Markets Opportunities fund. Earlier this year the Committee made a decision to keep this fund in the portfolio due to its underweight exposure to China. This positioning detracted from the fund’s returns in 2017 and the beginning of 2018 when the Chinese market was rising, however the fund has contributed positively during the most recent market falls in the Chinese equity market.

The Committee debated reducing the fund’s exposure to Asia and Emerging Markets due to concerns that these markets could be negatively affected if the trade war with the US worsens and the US dollar strengthens due to a “flight to safety”. While the Committee firmly believe in the long term fundamentals of Asia and Emerging Markets, the rising interest rate environment in the US could also negatively impact these markets and the Committee are generally in favour of taking profits and temporarily reducing the risk of the portfolio.

The Committee initially debated the idea of reducing the allocation to Asia and Emerging Markets by a total of 4% and introducing a US smaller companies fund for the reasons debated above under the Meridian Fund. A counter proposal was put forward to raise 2% from Asia and Emerging Markets in favour of cash so that this would be available for potential future reinvestment on market falls. The Committee agreed that the market effect of trade wars can go both ways and there was a significant risk of missing the upside in Asia and Emerging Markets if Trump’s trade war rhetoric is watered down.

A further proposal was to raise 4% from Asia and Emerging Markets and reinvest 2% of the proceeds in Japan and leave 2% in cash available for future reinvestment. The Committee were more in favour of this proposal and supported the idea of increasing the allocation to Japan on the basis that in the event of an escalation of the trade war rhetoric there could be a flight to safety which would benefit the Japanese Yen as well as the US Dollar. The Committee also expect the growth of the Japanese economy to continue with a knock on effect of a strengthening of the Yen. The fund’s exposure to Japan will also benefit from an indirect exposure to other countries in Asia and Emerging Markets thus offering a hedge if these markets strengthen. The Committee decided to increase the Schroder Tokyo fund unhedged share class by 2%, given that this fund is expected to benefit from a stronger Yen. The cash component will be increased by 2% to help to reduce risk slightly as volatility is expected to continue throughout the summer months and to allow for possible reinvestment opportunities at lower levels.

The Committee had no other immediate concerns regarding the Explorer fund and proposed no other changes.

The committee approved the strategy and confirmed it is in line with the mandate.

Model E

Model F

Model G

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.