Category: Financial Planning, Investment management

Minutes of the Clarion Investment Committee held on 16th October at Overbank, 52 London Road, Alderley Edge, Cheshire, SK9 7DZ at 13:00.

| Keith Thompson (KT) | Chair/Director |

| Ron Walker (RW) | Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

| Adam Wareing (AW) | Paraplanner (Clarion Wealth Planning) |

| Jacob Hartley (JH) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 16th September 2019 were agreed by the Committee as a true and accurate record.

For the October Stock Market and Economic Commentary……An Autumn Chill but more Treats than Tricks, please click here.

The key points discussed by the Committee were as follows:

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

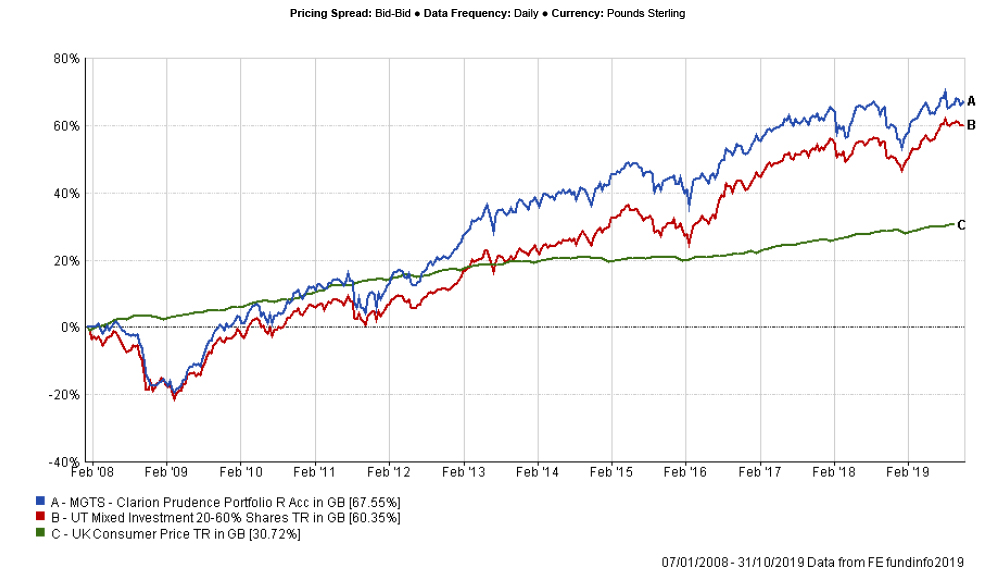

The fund was again slightly behind the IA Mixed Investment 20-60% Shares sector over 3 months, but its performance has improved in September and October, following a market rotation from growth stocks to value.

The strategy has benefited from a positive asset allocation and improving fund selection effect. The active decision to overweight short-dated bonds was the biggest detractor over 12 weeks, as longer-dated issues outperformed following a reduction in bond yields. The active overweight allocation to global equities was the biggest contributor over 12 months, but underlying UK holdings outperformed over 12 weeks, following an appreciation of Sterling.

Amongst underlying global funds, the Fundsmith Equity strategy was the weakest performer over 12 weeks, but remains the best performing holding over 12 months.

In the UK, all underlying funds outperformed their respective sectors over 12 weeks, with the Royal London UK Equity Income strategy being the strongest. The Committee have noted improvements in the performance of the Man GLG UK Income strategy which looked weaker in September.

In bonds, all underlying short-duration strategies have underperformed over 12 weeks, but their performance improved over the shorter-term periods.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Meridian also lagged the IA Mixed Investment 40-85% Shares sector over 12 weeks. Similar to the Prudence strategy, the fund performed better in September and October.

Over 12 weeks the portfolio’s asset allocation and fund selection effect were neutral. Short-dated bonds were the biggest detractor over 12 months, followed by an underweight allocation to the US. The effect of this positioning reversed more recently as long-dated bonds and US equities have underperformed.

Over 12 weeks half of the fund’s underlying holdings outperformed their respective benchmarks, but over 4 weeks all but 2 funds have outperformed. The Committee were pleased with the performance of the recently added Artemis Income strategy, which was the second-best performing fund over 12 weeks.

Concerns were expressed over the concentration and size of the Liontrust Special Situations fund. The strategy is c.£5bn in size and Liontrust have no plans to soft close it. TR believes that the fund could suffer liquidity issues if faced with significant outflows. The Committee agreed with TR and considered several alternative strategies including the Jupiter UK Special Situations, Blackrock UK Special Situations and Investec UK Special Situations funds. The Investec strategy was the most value-oriented fund compared to others and has performed exceptionally well over the short-term, following a rotation to value. The Committee believe that the Investec fund carries the most potential upside and agreed to purchase it as a replacement for the Liontrust fund.

TR is also concerned about the performance of the Buffettology fund and feels that it could have been driven by significant inflows this fund has received over the last 2 years. The Committee agreed to monitor flows into the Buffettology fund on a monthly basis and will consider selling out of this strategy if the flows turn negative.

Overall the Committee are happy with the performance of the Clarion Meridian fund and no other changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate

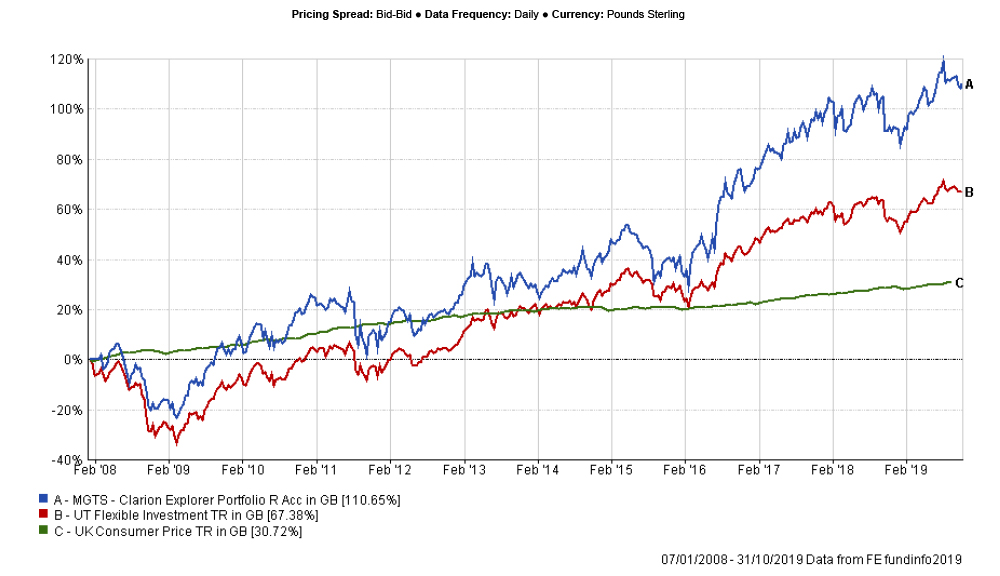

Explorer performed in line with the IA Flexible Investment sector over 3 months. The fund’s asset allocation effect has improved as US did not outperform other markets over the period. The underlying fund selection effect remains strong.

In Japan, with a recent depreciation of Yen, the hedged share class of the Lindsell Train Japanese Equity fund outperformed the unhedged Baillie Gifford Japanese fund. In Global, the Lindsell Train Global Equity fund has underperformed the IA Global sector over 12 weeks following a rotation from growth stocks to value.

Selection in Asia and Emerging Markets was mixed over 12 weeks but improved over the shorter term. The Schroder Institutional Pacific strategy and UBS Global Emerging Markets were the two weakest performers over the period. At the same time, the Stewart Investors Asia Pacific Leaders and JPM Emerging Markets Equity Income funds performed more defensively and outperformed respectively.

Given that the Committee expect a Brexit deal to be agreed sooner or later between the UK and the EU, DK proposed increasing the portfolio’s allocation to the UK and introducing a mid-cap index tracking fund. The Committee were positive about DK’s idea and decided to increase the allocation to the UK to 10% and introduce a mid-cap tracker at a 3% weighting. The Committee agreed to decrease the portfolio’s allocation to cash by 1% to the 3% weighting and decrease allocation to global funds by 1.5%.

The Committee are pleased with the overall performance of this strategy and no other changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model D

Model E

Model F

Model G

The Committee discussed the new strategic allocations proposed by DK and agreed that these were appropriate. DK and TR will work on the new wording of the updated investment process document. DK will create a tool to monitor the portfolios’ risk relative to DT’s parameters.

DK and TR will work on the FCA application for the new fund and aim to complete it by the end of October. Clarion will need to find a suitable name for the new fund.

| Action to be taken by | Action Point | Review Point |

| Clarion | To name the new fund | ASAP |

| DK and TR | To draft an application for the new fund | Next IC |

| DK and TR | To confirm new strategic allocations with the Margetts risk team | Next IC |

| DK and TR | To update the investment process document | Next IC |

| DK | To look and the M&G Global Dividend fund’s performance relative to other value funds in the IA Global sector | Next IC |

| All | To review the Time Ground Rent fund | Next IC |

| All | To review inflows into the Buffettology fund | Next IC |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.