Category: Financial Planning

American economist Harry Markowitz famously said, “Diversification is the only free lunch in investing.”

Portfolio diversification refers to the process of allocating your investments across a range of asset classes, regions, or sectors. The “free lunch” comes from the protection and growth potential offered by this approach.

Market performance is notoriously difficult to predict due to the sheer number of variables that influence it, including macroeconomic performance, geopolitical events, and investor sentiment.

These factors interact in complex and unpredictable ways, making it challenging even for experts to forecast market movements with certainty.

Portfolio diversification reduces your reliance on the performance of any single asset or market, helping you mitigate the risk of a downturn. In simple terms, it ensures you don’t put all your eggs in one basket.

But diversifying your portfolio isn’t just about managing risk – it also opens the door to growth opportunities in other markets and regions, allowing you to capitalise on potential gains you might otherwise miss.

Every month, JP Morgan releases a market review, charting the performance of different asset classes, global market indices, government bonds, and fixed income returns. The charts included in their review rank the performance of these metrics from the last decade until the year to date.

Read on to explore some of these performance charts and find out why they demonstrate that portfolio diversification is essential.

“Home bias” refers to the propensity for investors to invest in markets they are familiar with.

While sticking with what you know may feel safer and provide you with some comfort, having a home bias typically concentrates your portfolio, making you more exposed to the volatility of a regional market.

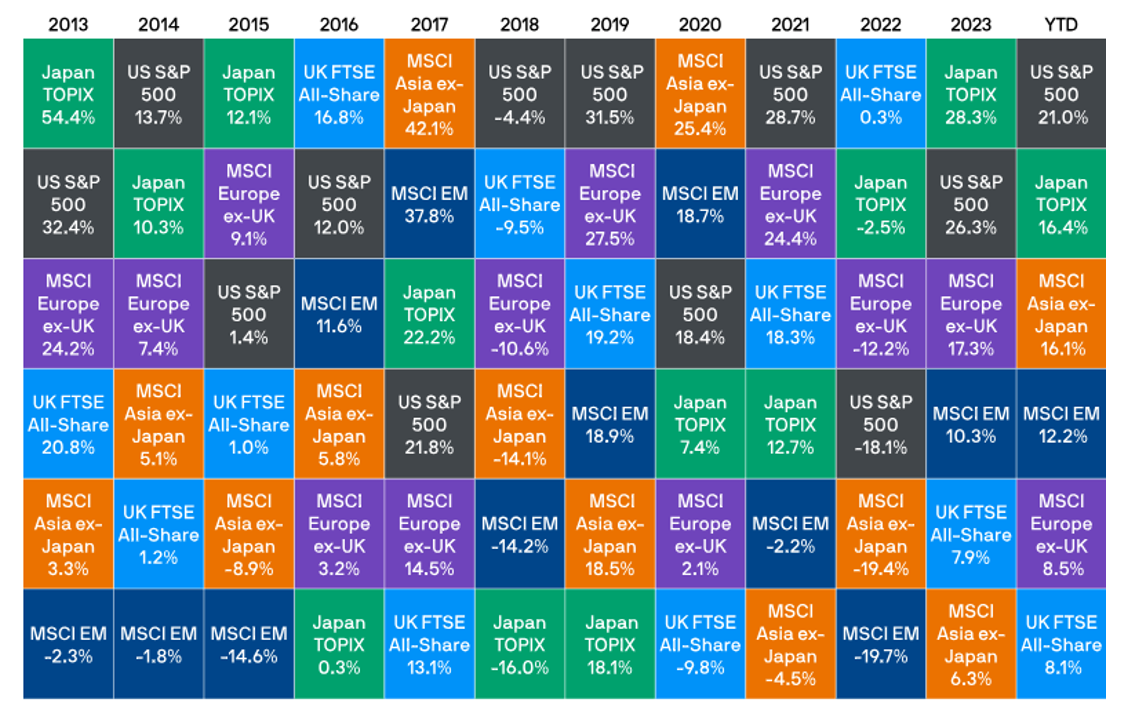

The chart below shows the ranked performance of major global indices from 2013 until October 2024. The index at the top delivered the highest average returns in the year, and the one at the bottom delivered the lowest.

Source: JP Morgan

As you can see, past performance does not necessarily indicate future results, and predicting which indices will perform well based on the previous year’s ranking is all but impossible.

For instance, the UK FTSE All-Share has fluctuated considerably over the last decade, ranking as the best-performing index in some years and the worst in others. It even slipped from the top of the table to the bottom between 2016 and 2017.

So, if you had a home bias and concentrated your investments in UK FTSE companies, you could have faced significant volatility and missed out on opportunities in stronger-performing markets elsewhere.

Similarly, Japan’s TOPIX index was the top performer in 2015, delivering 12.1% growth, but fell to the bottom in 2016 with a mere 0.3% return. Interestingly, in 2016, the UK FTSE All-Share recorded a much stronger growth of 16.8%, outperforming TOPIX’s high the year before, which shows that the drop-offs aren’t always felt across regions.

Indeed, the range of performance between the regions can be considerable.

For instance, in 2020, the first year of the pandemic, the MSCI Asia ex-Japan index delivered impressive growth of 25.4%, while the UK FTSE All-Share suffered a decline of -9.8%.

So again, home bias would have left your portfolio overly exposed to the struggles of the UK while missing out on potentially significant gains in Asian markets.

This volatility illustrates the risks of concentrating your investments in a single region or market. Such an approach leaves you vulnerable to market fluctuations and regional economic downturns.

Conversely, spreading your holdings across regions can help protect you from market dips and enable you to capture wider gains.

The volatility of performance isn’t just restricted to regional indices.

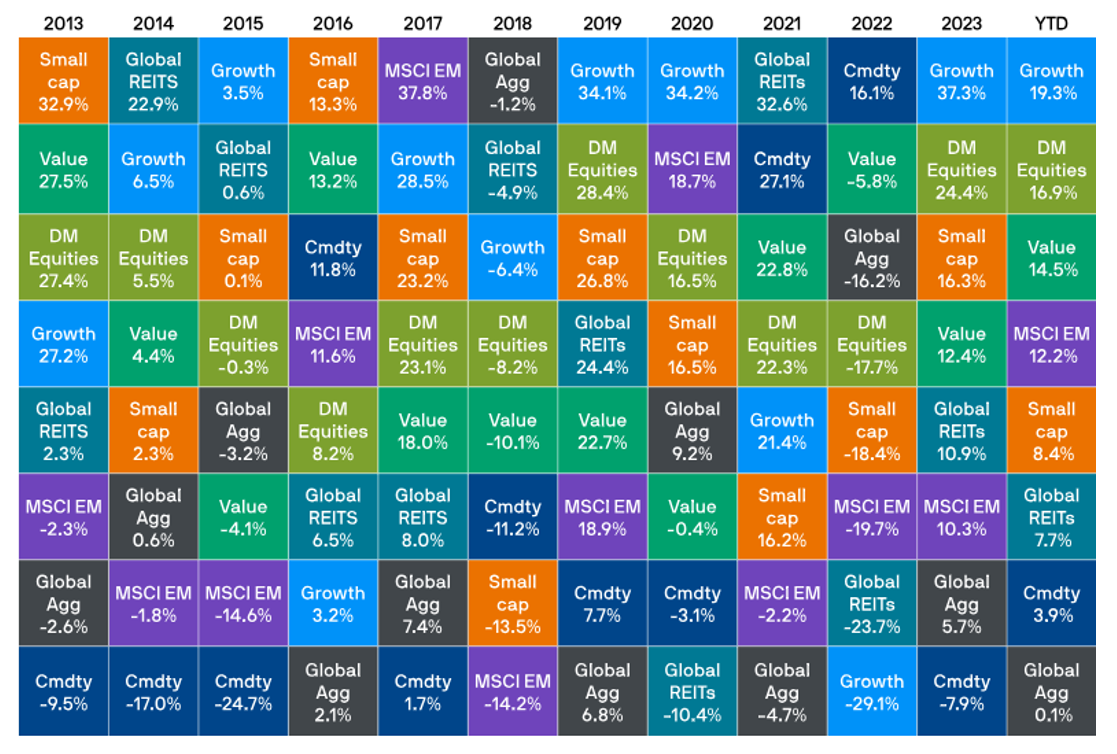

The chart below shows the ranked performance of different asset classes over the same period. Again, the asset at the top delivered the highest average returns in the year, and the one at the bottom delivered the lowest.

Source: JP Morgan

Like global indices, the performance of asset classes is difficult to predict and can vary widely from year to year.

For instance, in 2022, commodity assets led the pack with a 16.1% gain, while growth assets performed the worst, posting a loss of -29.1%.

The following year, they exchanged places on the performance board as growth assets were the best performer in 2023, delivering 37.3% gains, while commodity assets were at the bottom with a -7.9% return.

Again, this volatility highlights the risk of concentrating your investments in a single asset class, as by doing so, you expose yourself to the unpredictable swings of that class.

A financial planner can help you create a balanced portfolio, based on your risk tolerance, time horizons, and long-term goals.

By tailoring a strategy that incorporates diversification, they can help to ensure your portfolio is equipped to weather market fluctuations while also capitalising on opportunities for growth.

With a diversified portfolio, you can stay on track to achieve your financial goals with confidence, stability, and peace of mind.

To speak to a financial planner, get in touch.

Email [email protected] or call us on 01625 466360.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.