Category: Financial Planning

Millions of savers across the UK could be missing out on market gains by opting to play it safe and keep their money in cash accounts instead of making investments.

While there are clear benefits of cash savings accounts – namely guaranteed interest and security – they are typically less likely to keep pace with inflation, particularly over the long term. This means that your money can lose its purchasing power over time and may miss out on the long-term growth of the market.

A recent government report found that the UK has the lowest level of retail investing among the G7 countries, and a large portion of personal wealth remains in low-interest cash accounts.

While it was speculated that Rachel Reeves might address this issue in her recent Mansion House speech by making changes to Cash ISA allowances, she refrained from introducing any major reforms. However, Reeves did indicate that changes to ISA allowances would remain on the table.

Read on to find out how playing it safe and keeping cash savings could cost you in the long run.

In the 2025/26 tax year, you can save or invest up to £20,000 across your ISA accounts. There are several different types of ISAs, but the two most popular are Cash ISAs and Stocks and Shares ISAs.

As with regular savings accounts, Cash ISAs provide guaranteed interest and security, making them a good option for short-term targets such as building your emergency fund. Stocks and Shares ISAs, on the other hand, carry more risk but have historically offered higher returns over the long term, making them well-suited for longer-term goals.

A report by Paragon found that as of May 2025, there is £417 billion held in adult Cash ISAs, up from £378.7 billion in January. While some of these accounts may offer higher rates of interest, further data from the UK government report found that 29 million UK adults have cash in accounts offering around 1% interest.

The same report notes that stock market returns have averaged close to 9% over the past decade, highlighting just how much savers could be missing out on by playing it safe with cash accounts.

Indeed, research published by Money Age found that if you opened a Cash ISA when they were first launched in 1999 and maxed out your allowance each year, you may have lost out on more than £134,000 compared to if you had invested that money into FTSE 100 companies.

By keeping their money in cash accounts and opting for caution, millions of UK savers, with billions in total savings, may be missing out on the opportunity for far greater returns through long-term investing.

Cash savings can provide stability and are not susceptible to the same market fluctuations and volatility that investments are. While that certainty can be helpful for short-term needs, when it comes to protecting and growing your money over time, inflation can steadily chip away at your purchasing power.

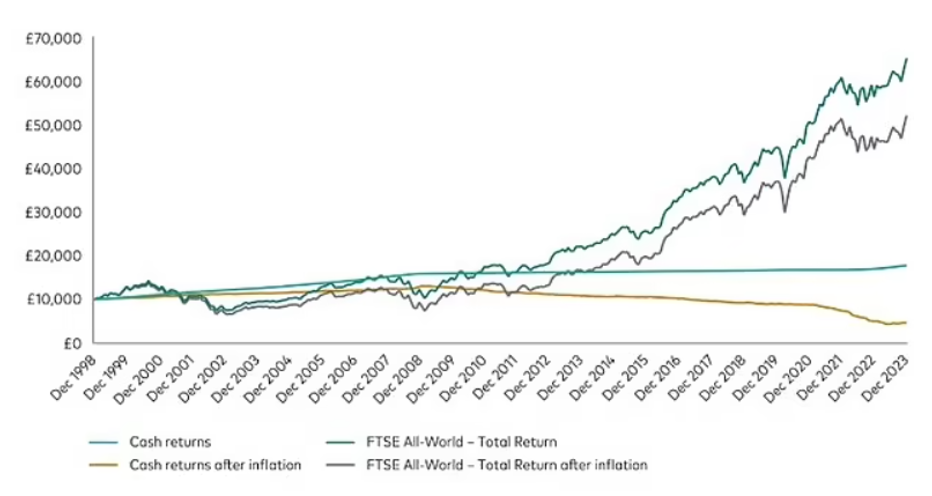

This is Money reports that if you put £10,000 into a cash savings account when ISAs were launched in 1999, it would have grown by 90% to just over £19,000, not accounting for inflation. Yet, that same £10,000 invested and globally diversified in the FTSE All-World Index would have grown by more than 650% to over £75,000.

After adjusting for inflation, the £19,000 generated from cash savings drops to less than £5,000 in real terms, while the £75,000 from investments retains much more of its value, equating to around £65,000. This highlights how, over time, inflation erodes the purchasing power of cash, whereas investments not only keep pace but can continue to grow in real terms.

You can see this example illustrated in the graph below.

Source: This is Money

So, while cash accounts offer stability and aren’t exposed to short-term market volatility, they’re far less likely to keep pace with inflation. Over the long term, investing gives your wealth a much greater chance of growing in real terms, whereas cash is more vulnerable to losing value.

Of course, cash savings can still play a useful role in helping you to reach your goals and remain financially stable. For instance, if you need easy access to liquid funds to cover emergency costs, it’s a good idea to have some saved in cash.

However, if you’ve already built up a sufficient cash safety net, it’s worth considering how the rest of your savings could be invested to support you over the long term.

Market investments or Stocks and Shares ISAs offer a way to grow your wealth more effectively over time. While returns aren’t guaranteed and you may experience volatility, you can tailor your investments to your risk tolerance to help manage fluctuations and keep you on track.

Striking the right balance between cash savings and investments can be challenging. Holding too much in cash can mean you risk losing purchasing power over time due to inflation, while keeping too little may leave you exposed in the event of unexpected expenses or emergencies.

A financial planner can help you clarify your goals, time horizon, and risk tolerance, then build a strategy that supports long-term growth while ensuring your immediate needs are also covered.

To speak to a financial planner, get in touch.

Email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.