Category: Financial Planning

When he wasn’t busy developing theories and proofs that undergird humankind’s understanding of physical reality, Albert Einstein took time to appreciate more comprehensible matters, such as compounding returns.

The great scientist is said to have proclaimed, “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it”.

Compounding is the process of earning returns on previous returns as well as on your initial investment.

This powerful effect can boost your wealth growth with no extra effort, bringing you closer to your financial goals. And, if you adopt a long-term perspective, you may eventually reach the “compound investment tipping point”, where your total returns surpass the amount you’ve invested.

Read on to learn about the power of compounding and how, over long time horizons, you could reach the compound investment tipping point.

Whether you’re saving or investing, positive returns on your initial investment will benefit from compounding.

For example, if you invest £10,000 with an average of 5% returns each year, your investment would grow to £10,500 after one year. Then, if your investment generated a further 5% the next year, this would be on both the initial £10,000 and the additional £500. So, you would have £11,025.

Though this may not sound like a lot, the effect accumulates over time, exponentially growing your wealth.

Indeed, a £10,000 passive investment with an average annual return of 5% would take just over 13 years to double in value – that is, your returns would match your initial investment, and you would have reached the compound investment tipping point.

Compounding works effectively with lump-sum investments (as in the example you just read), but it can also yield similar results over longer time horizons with smaller, regular contributions.

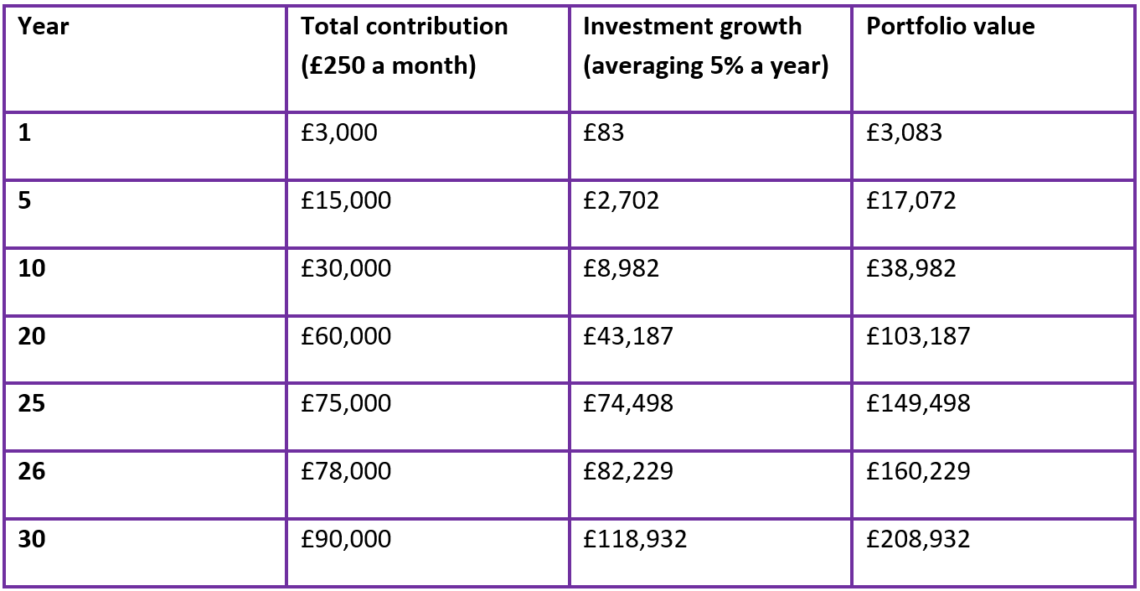

For example, if you invested £250 a month with an average annual return of 5%, your £3,000 contributions during the first year would return £83, representing less than 3% of the total pot.

However, after 10 years of contributing a total of £30,000, your investment returns of £8,982 would account for nearly 25% of the pot.

After 25 years, you would have invested £75,000 and you would be nearing the 100% tipping point as the returns would be worth £74,498.

And, by year 26, your £78,000 in contributions would generate an additional £82,229, representing over 100% returns on your investment.

So, sometime between years 25 and 26 marks the tipping point where your returns exceed your total contributions.

The table below shows the effects of compounding in this example.

Source: Nutmeg

As you can see, small but regular contributions over long time horizons can have a significant effect on your wealth. This can be particularly valuable when considering long-term savings goals such as contributing to your pension to fund your retirement.

While investment returns are never guaranteed, a financial planner can work with you to optimise your portfolio and boost your chances of reaching the compound investment tipping point by taking the following steps.

When aiming for the compound investment tipping point, portfolio diversification is important for balancing risk, maximising potential returns, and ensuring steady, consistent progress.

A financial planner can help you diversify your portfolio across a range of sectors, regions, and asset classes to help mitigate the risk of any single stock hurting your overall performance. This can also increase your potential to capture returns from a wider range of opportunities.

Risk is an inherent part of investing, and managing your risk exposure is key to creating a sound financial plan.

When investing for long-term goals, such as reaching the compound investment tipping point, you may consider taking on greater risk early in your investment journey. This approach can be beneficial because a longer time horizon allows you to recover from potential short-term losses.

However, your risk profile is not static and it evolves over time. So, it’s a good idea to regularly review your portfolio and adjust your strategy as your goals and circumstances change.

A financial planner can help you assess your risk tolerance and align your investments with your objectives, ensuring your approach remains well-suited to your situation.

Defining your broader life goals – beyond simply reaching the compound investment tipping point – can help you maintain focus and discipline, even during periods of market volatility.

Clear goals provide a strong foundation for making thoughtful and reasoned decisions, rather than reacting impulsively to market fluctuations or aiming at an arbitrary target.

Your goals are personal to you, and so a financial planner can work with you to create a timeline and path toward your objectives to help ensure you stay on course to achieve them.

A financial planner can help you design a tailored plan aligned with your objectives. This could help your investments grow and, over time, they may even generate significant returns on their own.

To speak to a financial planner, get in touch.

Email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.