Category: Financial Planning

On Monday, 5 August, global markets tumbled amid mounting fears of a US recession.

While indices worldwide experienced significant declines, the Nikkei 225 in Japan stood out with its steepest drop in nearly four decades, highlighting the severity of the market’s reaction in Japan compared to other regions.

However, rather than precipitating an even bigger downturn, the Nikkei astonished observers by posting record-breaking gains the next day.

The volatility of those tumultuous 48 hours serves as a good example of how short-term fluctuations are inherent in investing. It also exemplifies the value of focusing on long-term objectives and remaining resilient in the face of short-term trends, whether positive or negative.

So, read on to discover what a terrible Monday swiftly followed by a “turbo-charged” Tuesday can teach you about patience when investing.

Figures released by the Bureau of Labour Statistics in August 2024 showed unemployment in the US to be rising considerably. This, combined with the relatively high federal interest rates implemented to tackle above-optimal inflation, led many analysts to predict a forthcoming recession in the world’s largest economy.

The knock-on effect was significant and markets around the world posted losses.

The Guardian reports that, on 5 August, the Nasdaq dropped by 6% and the S&P 500 fell by 4.2%. The Kospi in South Korea fell by 9% and the FTSE 100 was down more than 2% across the day. Indices in Germany, Australia, Hong Kong, and China also dropped.

The Nikkei 225, Japan’s benchmark index, fell by 12%, marking its biggest decline in 37 years and the heaviest one-day fall since the Black Monday crash in 1987.

However, the following day, the Nikkei jumped by 10.2% and recorded its biggest-ever one-day gain in points.

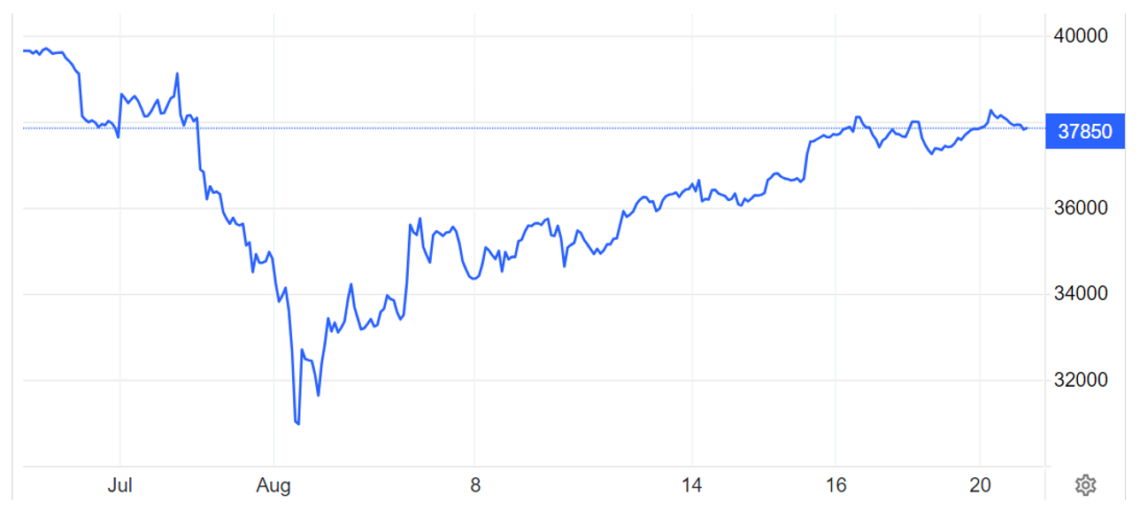

The graph below shows the performance of the Nikkei 225 over a one-month period between 20 July and 20 August 2024.

Source: Trading Economics

As you can see, the Nikkei started to fall at the end of July before the dip on 5 August. However, by 20 August, it had returned to the same levels it was at in July.

The extent of the fall and the subsequent rise of the Nikkei was significant, and it is indicative of the market’s ability to recover and recoup in the face of economic challenges.

Indeed, declines of 10% or more are not uncommon and happen in global markets more often than you might think – yet historically, markets have rebounded, delivering strong long-term returns.

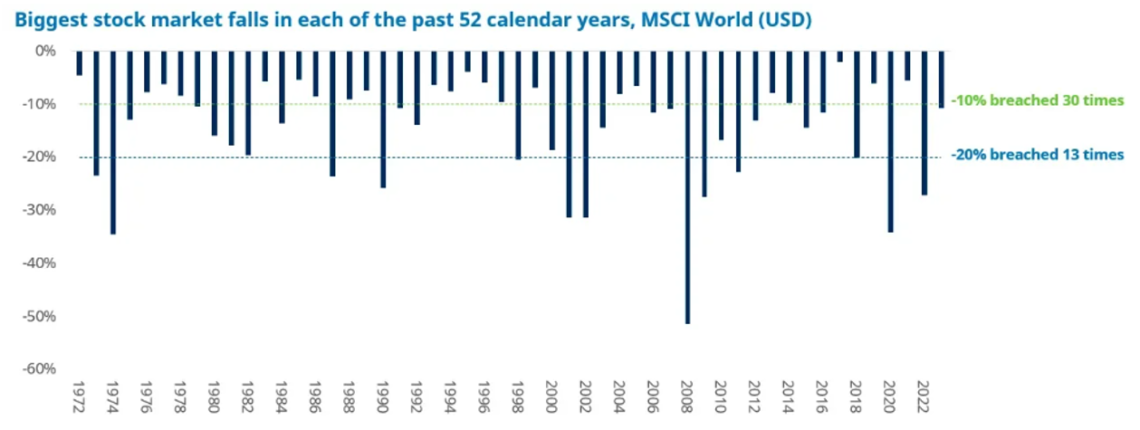

Research by Schroders found that world stock markets (represented by the MSCI World Index of more than 1,400 large-cap stocks across 23 developed economies) experienced 10% falls or more in 30 of the last 52 years. More substantial falls of 20% occurred in 13 of those years.

The graph below shows the biggest stock market falls since 1972 on the MSCI World Index and marks the number of times a 10% or 20% fall was recorded.

Source: Schroders

Despite these regular dips, global markets have delivered strong annual returns across this period overall. Data published by Curvo shows the MSCI has had an average compound annual growth rate of 7.39% over the last 25 years.

This suggests that staying in the market, focusing on long-term goals, and remaining patient amid downturns can be a pragmatic strategy for achieving sustained success.

Although it is important to remember that past performance is never a reliable indicator of future performance, further research by Schroders reveals that exiting the market during historical downturns would have likely cost you in the long run.

For example, investors who chose to liquidate their holdings in 1929 at the start of the Great Depression and move to cash would have had to wait until 1963 to break even again from returns on their cash. Conversely, those who stayed invested would have broken even in 1945, a full 18 years earlier.

Similarly, investors who shifted to cash in 2008 during the financial crisis, would still not have broken even today, while those who remained invested would have recovered in around 2013.

Even though an investor who stayed in the market during the crashes in 1929 and 2008 would have suffered further losses over the subsequent few years, their recovery would still have been quicker than those who chose to exit.

While markets have already rebounded after the dip on 5 August, further volatility cannot be ruled out – though many analysts are no longer predicting a recession in the US.

Amid dips of the sort recently seen in the Nikkei and other global markets, it is hard to not be influenced by emotions or investor biases and choose to ditch stocks for cash.

However, as the historical data suggests, liquidating your holdings in response to a big market fall has typically not been a good strategy in the long run. Indeed, the swift recovery of the Nikkei after the biggest drop in decades is telling of the market’s tendency to rebound after a downturn.

So, remaining patient and resilient in the face of dips and fluctuations is often a better strategy for ensuring long-term stability and success than liquidating your investments.

A financial planner can help you navigate market fluctuations, keeping you on track with your long-term goals and minimising the effect of a downturn on your finances.

To speak to a financial planner, get in touch.

Email [email protected] or call us on 01625 466360.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.