Category: Financial Planning

If you’ve been following the 2024 Paris Olympic Games, you’ll likely have been enthralled by the incredible feats of athleticism on display.

But, as you’ll know, the work of an Olympian starts many months and years before the Games. Winning a medal requires preparation, mental fortitude, and patience – attributes that are also useful when building your financial future.

So, read on to discover what five legendary Olympians can teach you about reaching your financial goals.

At the 1972 Olympics, American swimmer Mark Spitz won an incredible seven gold medals – at the time, the most ever at a single Games. This record would stand for 36 years before it was beaten by Michael Phelps at the Beijing Olympics in 2008 (more about Phelps below!).

Spitz famously said: “If you fail to prepare, you’re prepared to fail.” This mantra helped him to achieve great sporting success, and it could also benefit you when it comes to hitting your financial goals.

Thinking ahead and setting goals can help you build a successful future for yourself. Goals-based financial planning could allow you to:

Without a plan, it’s hard to know how much you should be contributing to your savings, investments, and pensions now. Understanding where you want to get to, and what you want to achieve in your life, is the first step to building a plan that can help you to get there.

In an interview with McKinsey & Company, gold medal-winning decathlete Dan O’Brien said: “Consistency will win out in the long run, always”.

Born in Portland in 1966, O’Brien was a favourite to win gold at the 1992 Barcelona Games. However, after failing to clear the bar during the pole vault at the US Olympic trials, O’Brien didn’t qualify – an embarrassing debacle.

Unperturbed, O’Brien went on to win gold at the 1996 Atlanta Olympics, demonstrating the power of sticking to your guns.

Investors can learn a lot from this attitude. The markets can be tumultuous at times, and you may be tempted to react when your holdings fall in value. However, as you can read in our recent article, consistency and “time in the market” can help you ride out short-term uncertainty and give you the potential for long-term growth.

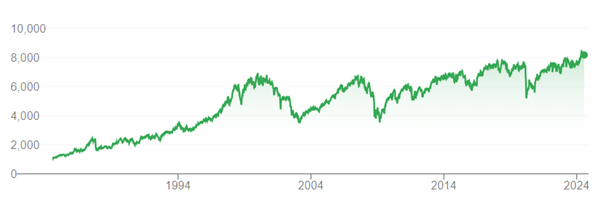

Historically, global events like the Covid pandemic and the 2007/8 financial crisis have caused markets to underperform in the short term. The below graphic shows the performance of the FTSE 100 over the past 40 years.

Source: Google

As you can see, following dips, the market has historically recovered and gone on to achieve new highs.

Additionally, remaining consistent by faithfully making your pension and investment contributions each month/year can also help you to stay disciplined and on course to meet your future goals.

At the 1976 Montreal Olympics, Nadia Comaneci achieved the seemingly impossible. Aged just 14, the gymnast scored the first ever perfect 10 at an Olympic Games.

This achievement was so unprecedented that the scoreboard at the Montreal Games wasn’t designed to show the number 10. So, when Comaneci received her result, the digital display flashed “1.00”.

Though the Romanian was young when she achieved sporting greatness, this success didn’t come overnight – it was the result of years of hard work.

In an interview with the Oklahoman in 2010, she said: “That’s the most important thing – correct little things every day that are going to get you to the higher level of accomplishment. You can’t jump from little things to big things. It just takes time and patience.”

When investing, everyone would love to see quick, lucrative returns. However, outcomes like this are rare and almost impossible to achieve.

Instead, investing with patience can give you the potential for positive returns.

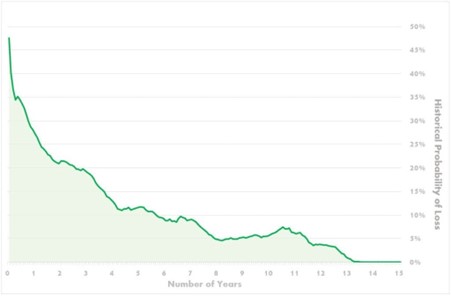

The below chart from Nutmeg shows your chance of making a loss when holding investments over several years. You can see that, the longer you hold your investment the lower the percentage chance of losses.

Source: Nutmeg

So, by following Comaneci’s advice and practising patience, you could reduce your chances of losses when investing.

Michael Phelps is arguably the most famous Olympian of all time and, inarguably, the most successful. Throughout his Olympic career, he amassed a staggering 28 medals – 23 of which were gold.

Despite his success, Phelps approached swimming with the mindset that, as long as he knew he’d given his all, he was happy.

He said: “I can only control my own performance. If I do my best, then I can feel good at the end of the day.”

Many things happen outside of your control. When investing, this could be a large global crisis like a pandemic, macroeconomic data, geopolitical shifts, or a smaller event like a change in legislation.

External factors like these can affect the performance of your portfolio in the short term. Sometimes you may be able to mitigate any negative effects of these shocks, but often these events can’t be predicted.

But don’t worry – as Professional Wealth Management reports, history shows that 90% of geopolitical events have not changed the direction of the world economy.

So, if you experience a period of poor performance due to an external shock, it’s important to remain disciplined and focus on the things within your control.

You may remember the heartbreaking story of Paula Radcliffe at the 2004 Athens Olympics.

At the time, the British long-distance runner held the women’s marathon world record of 2:15:25 and was seen as Team GB’s best hope for a gold medal.

However, two weeks before the Olympic marathon, Radcliffe suffered a leg injury and was put on a course of anti-inflammatory drugs. This affected her stomach, and she was forced to withdraw from the race just four miles from the finish line.

In a 2011 Guardian interview, Radcliffe was asked what her guiltiest pleasure was. She replied: “I don’t feel guilty in having pleasure!”

When creating a financial plan, though there are practicalities to consider, we believe it’s also essential to factor in all the things you want to achieve with your life.

Life is for living after all, and enjoying the fruits of your labour can be what makes all your hard work worth it. A financial planner can help you create a strategy that helps you to cross off items from your “bucket list” of life goals, helping you achieve the “pleasure” you desire.

There’s a lot you can learn from Olympians, but for financial advice tailored to you and your goals, talk to us at Clarion Wealth.

Email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.