Category: Investment management

As an investor, you know that past performance is not a reliable indicator of future results.

However, when a particular stock is soaring, it can be difficult to ignore the hype and go against the crowd. But the above disclaimer is there for a reason and research shows that jumping on an investing bandwagon is not always an effective strategy.

Indeed, a study by Schroders found that high-performing US stocks often fail to keep up their momentum in the years that follow, and many go on to rank among the worst performers shortly afterward.

So, while chasing the latest hype might seem appealing, this approach rarely delivers consistent growth or long-term stability. Instead, it can open you up to unnecessary risks and market volatility.

Read on to discover more about why chasing investment trends can undermine your long-term success.

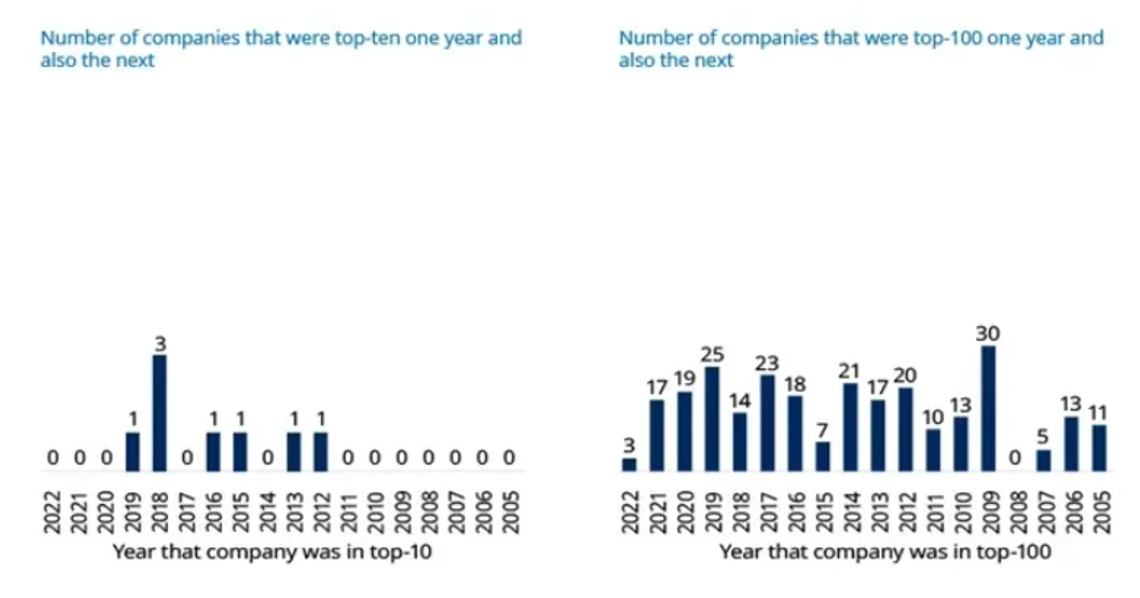

The research by Schroders looked at data from the MSCI USA Index in the 18 years between 2005 and 2022 (inclusive). They found that in 12 of the 18 years, not a single stock that was among the top 10 performers one year made it into the top 10 the next.

In five of the six years in which a top 10 performer did make the list again in the following year, just one company managed it. And in one year, three did.

And it’s not just the top 10 stocks that drop off, as companies in the top 100 also struggled to sustain their performance and maintain their ranking the following year.

The graphs below show the number of companies on the MSCI USA that ranked among the top 10 or top 100 performers in one year and maintained their position the following year.

Source: Schroders

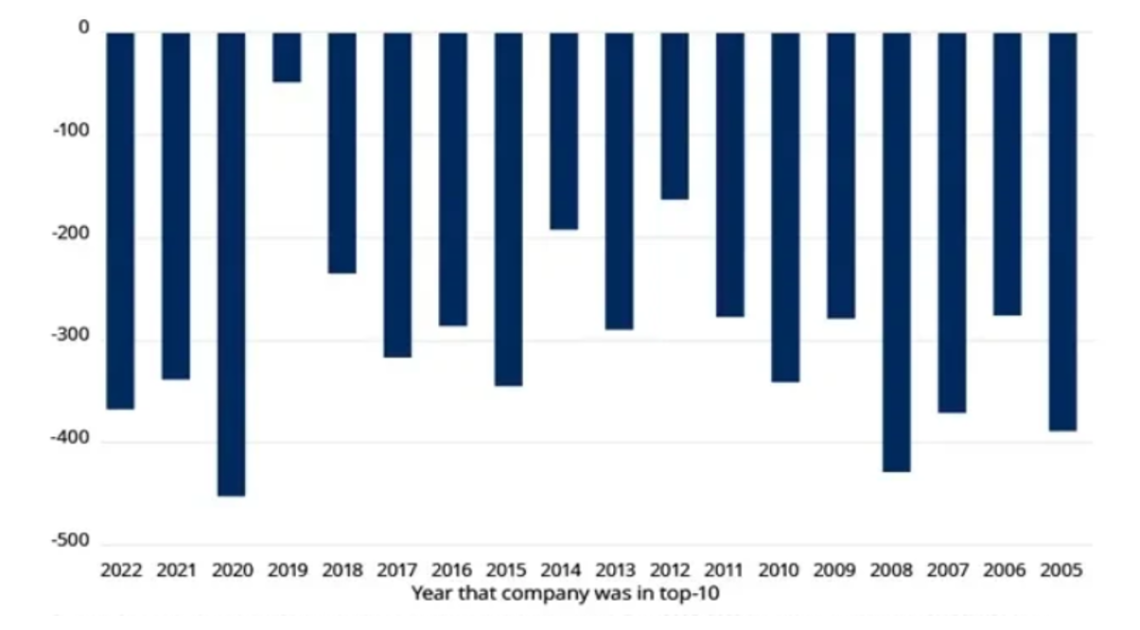

Moreover, the average decline in ranking has been significant.

In 14 out of the 18 years analysed, the average top 10 performer fell to the bottom half of the performance rankings the following year. They were also more likely to be among the worst-performing stocks than the top ones.

The graph below shows the average ranking change for the top 10 performers on the MSCI USA compared to the previous year.

Source: Schroders

As you can see, the average fall of a stock after reaching the top 10 is considerable, dipping by more than 200 places in 15 of the 18 years.

And these trends extend beyond the MSCI USA Index. The research also revealed that in 11 of the past 18 years, the average top 10 performer in both Japan and the UK slipped to the bottom half of the performance rankings the following year. In Germany, this occurred in 14 out of the 18 years studied.

So, in light of the study’s findings, it is important to reiterate that past performance is not a reliable predictor of future results. Chasing returns from high-performing stocks could expose you to unnecessary risks as the dip in ranking could signal a significant drop in value.

Herd mentality, also known as “herding,” is a cognitive bias that financial planners often warn against. It can occur when a particular stock or sector experiences a surge in popularity, prompting large numbers of investors to rush in to try and capitalise on its returns.

However, as you saw earlier, high-performing stocks are unlikely to maintain their gainful performance over the long term. So, attempting to chase their gains is unlikely to be a sustainable investment strategy. While it’s possible to get lucky, the odds are stacked against you.

Following the herd toward the latest short-term trend or fad can lead you to make impulsive decisions, which could result in losses once the excitement has faded. For example, you may end up buying at an inflated price and then selling at a loss once the bubble bursts.

The companies that tend to do well in the long term typically grow steadily rather than being the hyped top performers. Instead of following the influence of the crowd, adopting a more disciplined approach that focuses on your long-term goals rather than short-term trends may be a more reliable and resilient strategy.

In addition to focusing on long-term time horizons, success and stability in investing often relies on having a diversified portfolio aligned with your risk tolerance.

A diversified portfolio enables you to capitalise on growth opportunities across multiple markets while avoiding the potential risks of timing your entry or following a short-term trend. It can also help reduce your vulnerability to fluctuations in any one area.

So, rather than chasing the latest high-performing stock, portfolio diversification can help you reap the returns of multiple markets while also protecting you against potential downturns.

A financial planner can work with you to help you stay focused on your long-term goals rather than being distracted by the latest high performer. They can also help you diversify your portfolio, ensuring it aligns with your risk tolerance and long-term goals.

To speak to a financial planner, get in touch.

Email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.