Category: Investment management

Buy low, sell high. As an investor, you’ve probably heard this maxim before and, on paper, it seems to make a lot of sense.

If you buy an investment product at a low price and sell it at a high price, you should make a nice profit. However, it is almost impossible to “time the market” perfectly in this manner. You never know when a market has reached a high as there may be even more growth in the future.

The US stock market has recently hit an all-time high – as have other international stock markets like the UK FTSE 100 and Japan’s Nikkei 225 – and continues to perform robustly. With these markets peaking, you may think that now is a bad time to invest, or if you already hold stakes in these markets, a good time to sell.

However, Schroders recently analysed stock market returns since 1926, and perhaps counterintuitively, concluded that now may in fact be a good time to invest in the US stock market, and other markets that are achieving all-time highs.

Read on to learn more about historical market trends following all-time highs, and how they may affect your investment strategy.

Instinctively, when you hear the term “all-time high”, you may think that this is a relatively rare occurrence. However, markets are at an all-time high far more often than you may think.

Through its analysis, Schroders found that, of the 1,176 months since January 1926, the market was at an all-time high in 354 of them – that’s 30% of the time.

When the market is at an all-time high, it may make you nervous about your investments. Investors often get anxious at these times and pull their money out of equities. You may think that a high market capitalisation means that it’s more likely to fall in value in the future, and you want to crystalise your returns now.

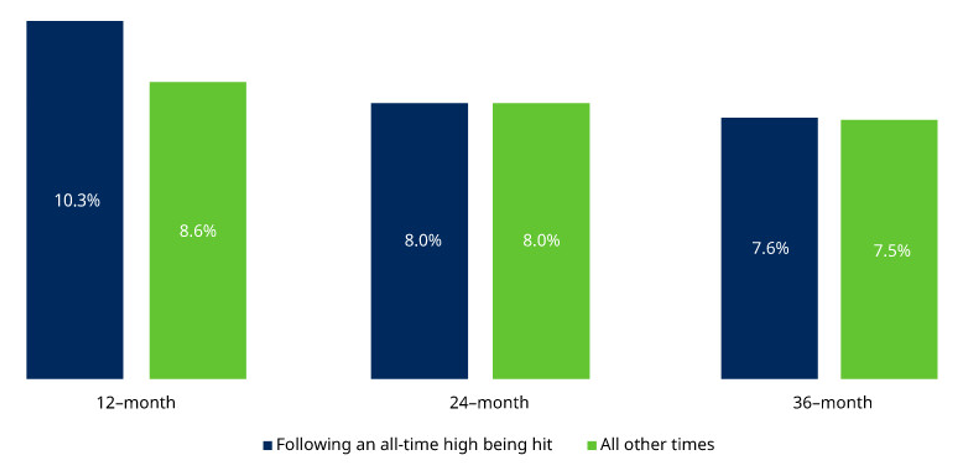

On the contrary, Schroders analysis found that 12-month returns following an all-time high have been better than at other times, or at least as good.

Source: Schroders

As the above graphic shows, in the 12 months following an all-time high, returns averaged 10.3% – that’s compared to 8.6% at other times. When looking at a 24-month and 36-month period, returns following an all-time high were the same or marginally better than at other times.

This analysis suggests that now could be a good opportunity to enter markets that have experienced all-time highs. Additionally, if you already have holdings in these markets, by selling at an all-time high, you could miss out on robust returns in the following 12 months.

However, before acting, it can be a good idea to speak to a financial planner about the pros and cons of an investment decision. At Clarion Wealth we can help you to build a portfolio that suits your life goals and your risk profile.

You’ve read how investing in a market at a peak can result in strong returns. Additionally, you can also benefit following an all-time high if you’re already invested in an equity before it peaks.

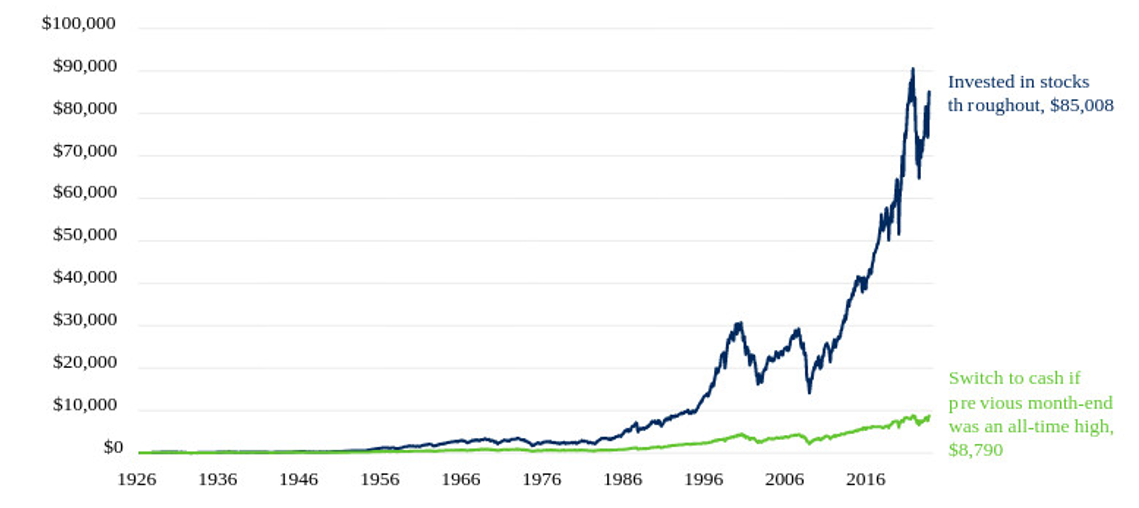

Though an extreme example, in its analysis, Schroders modelled how an investment portfolio would perform if you had invested $100 in the US stock market in January 1926 and left it, compared with the same investment, but with a strategy which switched out of the market and into cash for the next month whenever the market hit an all-time high.

Schroders found that by switching your investments to cash, your investment would now be worth 90% less than if you had just left the $100 invested in the stock market – that’s a valuation of $85,008 as opposed to just $8,790.

Source: Schroders

Of course, this is a strategy that no sensible investor would employ. However, it is a useful illustration to show how markets behave following peaks.

Schroders’ analysis helps to highlight a key principle of investing: consistency.

It can be tempting to react to current market conditions such as political events, market performance, or economic data. However, correctly predicting these events, and investing in such a way that you benefit from them, is incredibly hard to do.

Often, you’ll receive the best returns on your investments by leaving them untouched over many years.

That’s not to say you shouldn’t review your portfolio regularly – a non-reactionary assessment of your investments on a regular basis can be very beneficial.

Other techniques such as diversification can also help in achieving positive and sustainable long-term growth.

At Clarion Wealth, we have a team of Chartered financial planners who can help you build an investment portfolio that aligns with your needs and tolerance for risk.

Find out how we can help by emailing [email protected] or calling us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.