Category: Financial Planning, Investment management

Based on legendary Japanese director Akira Kurosawa’s 1954 film Seven Samurai, The Magnificent Seven – released in 1960 and directed by John Sturges – has become one of the most iconic westerns of all time.

However, in recent months, you may have heard the term “Magnificent Seven” used in a different context.

First coined by Bank of America analyst Michael Hartnett in 2023, it’s become the go-to phrase for the seven biggest stocks in the S&P 500.

These large, technologically disruptive companies have seen huge growth in recent years, and many investors are betting on them to continue this upward trend.

If you are considering investing in the Magnificent Seven, it may be beneficial to exercise caution. Read on to learn more about these market leaders, and why it may pay for you to be wary when considering these stocks for your portfolio.

The Magnificent Seven are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Not only are they the seven biggest companies listed on the S&P 500, but they are also each known for their technological impact across multiple fields, and their impact on consumer lives.

These companies are big – Apple became the first company in the US to be worth $3 trillion in 2022 – and they are continuing to grow at impressive rates.

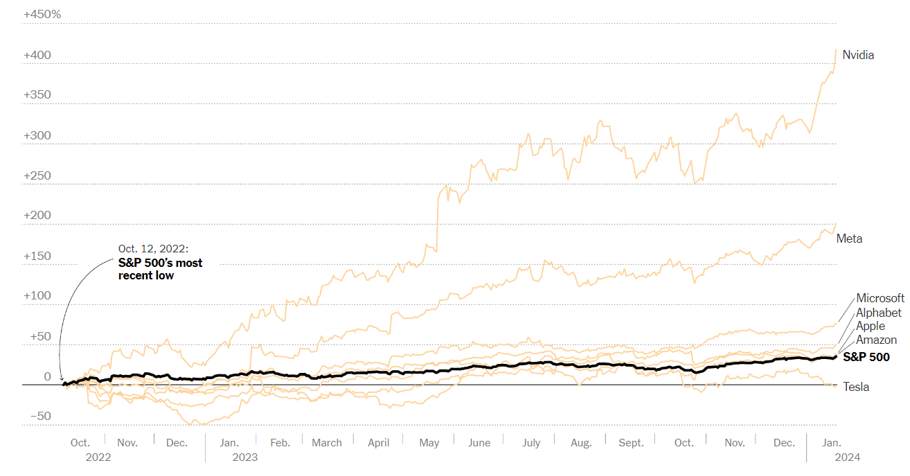

As reported by the Economic Times, in 2023, the Magnificent Seven as a group grew by 105%. As the below graph illustrates, the growth was led by chip manufacturer Nvidia.

Source: New York Times. Data from FactSet and accurate as of market close 19 January 2024.

Despite this strong historical performance, there are reasons for you to be cautious when considering investing in the Magnificent Seven.

One way we can weigh up how the companies of the Magnificent Seven may perform in the coming years is to study the long-term performance of the US’ largest companies in the past.

As reported by Professional Adviser, in 2004 some of the 10 biggest companies on the S&P 500 included AIG, Cisco Systems, Citigroup, IBM, Intel and Pfizer, all of which have significantly underperformed the S&P 500 since then.

The biggest company on the S&P 500 in 2004 was General Electric. In the following 20 years, their shares returned just 15%.

Additionally, of the 10 biggest companies listed on the S&P 500 in 2024, only one of 2004’s top 10 companies remains – Magnificent Seven member Microsoft.

Though we cannot draw direct conclusions about future performance based on historical trends, this information does suggest that we may not see members of the Magnificent Seven cohort remain among the biggest companies in the US in the coming decades. Consequently, you may not see the same kind of returns on these stocks in the future as you may have seen in the past.

One interesting thing about many Magnificent Seven companies is how closely their identity is linked to the company’s founder or CEO.

The most obvious examples are Tesla with Elon Musk and Amazon with Jeff Bezos. If something were to happen to a key individual at one of these companies, it could create a sudden change in their fortunes.

This kind of situation is unpredictable and so could be a source of risk for you as an investor.

With their vast resources, technological capability, and unique access to user data, it is no surprise that the Magnificent Seven have come under intense scrutiny from global commentators and lawmakers.

Because of this, these companies are almost constantly at risk of being affected by regulatory changes that could reduce their profitability.

To give just a few examples of the kinds of regulatory pressure these companies are under:

However, these companies have been facing regulatory scrutiny for years, and have still maintained impressive growth rates. They have become adept at fighting and adapting to legal challenges.

As an investor, it is important for you to weigh up this risk for yourself, and to seek professional advice if you feel you need it.

The S&P 500 is weighted to company size. As reported by the Wall Street Journal, the Magnificent Seven make up around 30% of the S&P 500. This means that falls in the values of Magnificent Seven stocks can result in a fall in the value of the S&P 500 as a whole.

If you are invested in an S&P 500 index fund or similar, you could have a lot of exposure to the Magnificent Seven. So, a fall in their value could negatively affect your portfolio, even if you haven’t directly invested in any of the seven companies.

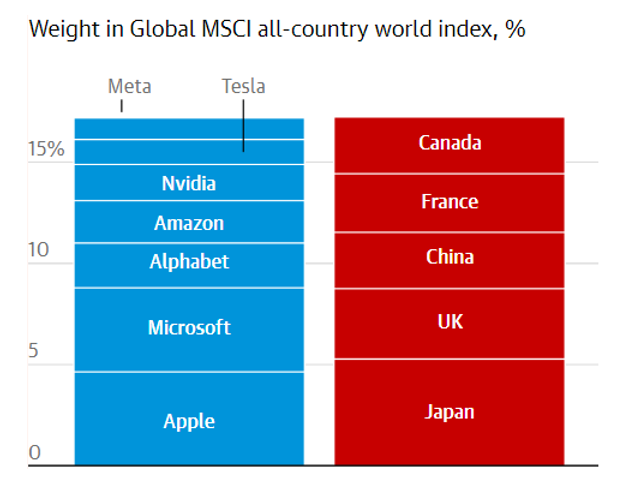

Diversification can help to reduce your overall investment risk and stabilise your returns. However, even if you were to invest in one of the broadest and most popular global funds – the MSCI All Country World Index (ACWI) – your portfolio may not be as diverse as you think.

The below diagram illustrates this phenomenon. Due to the size of US tech firms, by investing in the ACWI, you could have more exposure to Apple or Microsoft than you do to the entire stock market of the UK, China, France or Canada.

Source: The Guardian. Data from LSEG Datastream, S&P and Schroders. Note: data as of 31 August 2023

As a result, though you may believe your investments to be diversified, a large change in the value of any of the Magnificent Seven – or more widely the US tech sector – could have a larger than expected impact on the performance of your portfolio.

It’s easy to get caught up in the excitement when companies receive a lot of hype and see positive returns. However, over a long period it can pay to be consistent with your investment decisions, and not to be swayed by excitement or emotion over certain companies.

At Clarion Wealth, we can help you to build an investment strategy that works for you in the long term. Email [email protected] or call us on 01625 466360 to find out how we can help.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.