Category: Thought pieces

Sam Petts, financial planner at Clarion, takes a closer look at cryptocurrencies and the bitcoin phenomenon.

Cryptocurrencies are created by running powerful computer servers which solve mathematical problems to generate codes, which can then be sold off to investors.

Bitcoin was the earliest and now the biggest digital currency created in 2009. The digital currency has come a long way since the first ever transaction in 2010, when the purchase of two Papa John’s pizzas in America for 10,000 bitcoins from another bitcoin enthusiast marked what is believed to be the first ‘real world’ transaction.

Throughout 2017, Bitcoin gained considerable momentum and caught the attention of many investors and the mainstream media alike – the question then begs, is it worth investing in?

A digital currency is essentially used to make payments of any particular value without paying fees. It runs on a ‘blockchain’, which is fundamentally a decentralised ledger kept running by ‘miners’ whose powerful computers crunch transactions and are rewarded in bitcoins.

It uses decentralised technology for secure payments and storing money that doesn’t require banks or people’s names. It was proclaimed at the start as a way to liberate money in a similar way to how the internet made information free.

People see value in money that’s free from government control and the fees that banks charge, as well as the backing of the blockchain, to verify transactions.

However, Bitcoin has been seen as an instrument for private, anonymous transactions, and for these reasons has been actively used by criminals and money launderers for the dark economy.

The legal status of bitcoin varies considerably from country to country and is still undefined and changing in many of them. While some countries have openly allowed its use and trade, others have banned or restricted it. Regulations are constantly being reviewed due to its changing nature and increased amount of media attention.

Early holders of digital currencies are alleged to make up a large proportion of the market place and contribute to making the prices notoriously volatile.

Its original purpose was as a new type of currency, but it has become ineffective because of the price fluctuations, with daily volatility being seen at four or five times that of standard asset classes. The recent introduction of a tradable futures contracts also adds to these movements.

The authorities in some of the bigger markets are also beginning to review practices which is adding to unpredictable prices.

Recent press comments have stated that South Korea’s government is working on a bill to ban cryptocurrency trading amid a clampdown on virtual currencies in one of the world’s most exuberant markets.

It has also been reported that China is also preparing to target factories that create digital currencies by restricting their electricity supply, according to state media reports. Though digital mining has not yet been outlawed in China, the Chinese authorities have signalled their disapproval of cryptocurrencies because of concerns they will undermine the traditional banking system. They also wish to lower the risks in an already volatile system.

At Clarion Wealth, we would advise against investing in such markets.There is no doubt that the underlying block chain technology has the potential to make a big impact in the future, but predicting which cryptocurrency will flourish is not adviseable. There is little concrete evidence to form a basis of advice as it no longer functions as a currency and has no intrinsic value.

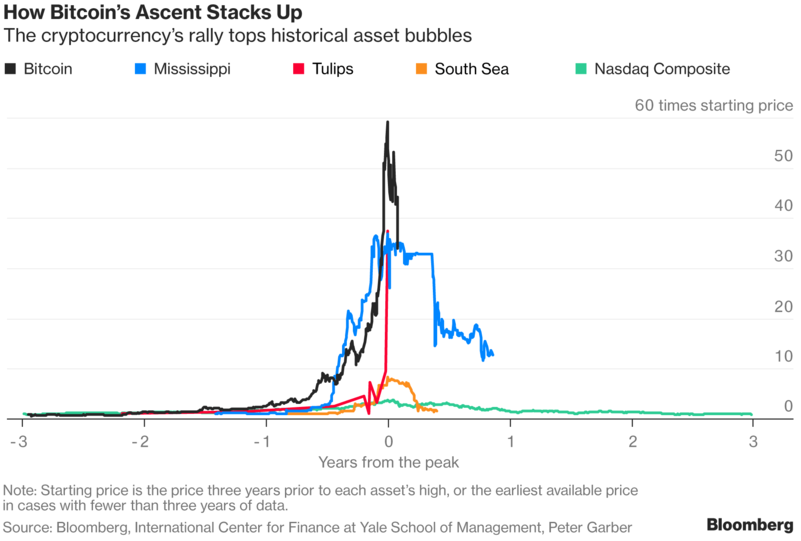

Whether it be the Tulip mania of the 1600s or the dot.com bubble in the late 1990s, comparisons of the euphoria are being seen today. Recent comments from known investor Warren Buffet were that cryptocurrencies will ‘come to a bad end’.

We watch from afar with interest but advise clients to proceed with extreme caution when approaching this type of speculation.

The graph below indicates the rise and fall of some famous asset bubbles.

At Clarion Wealth we will continue to do what we do best; true financial planning and lifetime cash flow strategies to provide comfort and confidence for our clients. We will continue to have a balanced, long term view of the world and ignore short term noise.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.