Category: Financial Planning

Bryan Cranston was 44 when he landed the role of Hal on Malcolm in The Middle. Eight years later, he’d go on to achieve international stardom as the fascinating anti-hero Walter White in Breaking Bad.

But this success didn’t happen overnight. Prior to Malcom in The Middle, Cranston had been a jobbing actor for 20 years, picking up small and one-off roles wherever he could. Despite not experiencing immediate success, he stuck to his long-term plan, and in the end, his perseverance paid off.

As Cranston’s story shows, patience and focusing on long-term goals can lead to amazing results. This is also true in the world of investing.

Some people think they can achieve the best profits by predicting market movements and buying or selling stocks at just the right time. However, our decades of investment experience have shown that “time in the market” is often better than “timing the market”.

So, read on to discover three reasons why being patient and holding investments over the long run could help you build your wealth and achieve your goals.

Because timing the market seems simple in theory, you’d be forgiven for thinking it’s easy to get right.

However, to successfully time the market, you need to buy and sell your investments at the correct moments, and this can be very difficult.

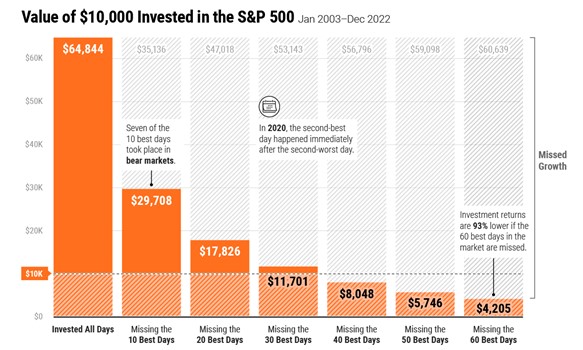

One problem investors face is that the market’s worst days often precede its best. According to a report by J P Morgan, between 1 January 2003 and 30 December 2022, 7 of the 10 best days for the S&P 500 happened within two weeks of the worst 10 days.

So, even if you successfully sell a stock at its peak, if you don’t buy it back at the right time, you could miss out on a potentially profitable price rally.

Worryingly, the cost of mistiming the market by just 24 hours could be substantial.

The below graph from Visual Capitalist shows how $10,000 invested in the S&P 500 between January 2003 and December 2022 would have performed. If you tried to time the market and missed out on just seven of the market’s best days over that 20-year period, you could have missed out on $35,136 in returns.

Source: Visual Capitalist

No matter what news outlets or investors may tell you, they don’t have a magic crystal ball. No one can know with absolute certainty when a particular stock will fall or rally, and if they say they do, don’t believe them!

So, rather than trying to miss the market’s bad days, it could pay to ride them out and focus on growing the value of your portfolio over many years.

When investing for the future, patience is key. Your aim is to achieve growth over many years, so it is important not to let day-to-day price fluctuations affect you.

However, with real-time price updates available on your phone 24/7, there may be times when you’re tempted to withdraw your money from the market.

If one of your investments drops in value, your instinctive reaction may be to sell the stock to mitigate any loss. You recently read about how humans have a tendency to be “loss averse”, so this is an understandable response. However, taking a big-picture approach and looking at historical market data could give you a fresh perspective.

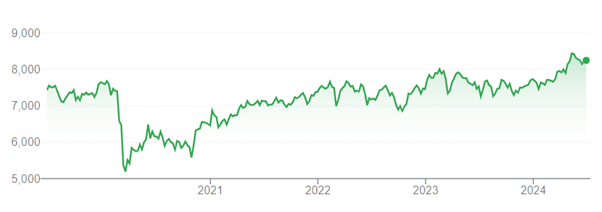

Many global stock markets experienced a drop in value following the outbreak of the Covid pandemic. As the below graph shows, the FTSE 100 price fell substantially in February and March 2020. But over the subsequent four years, the market recovered its value and, as the BBC reports, recently hit an all-time high.

If you’d tried to time the market and sold your investments in March 2020, you could have missed out on these subsequent years of growth.

Source: Google

Markets will always have bad days, but in the long run, they tend to recover and grow – a pattern we’ve seen play out time and time again. So, leaving your money invested could give you the best chance of returns as you work towards your long-term goals.

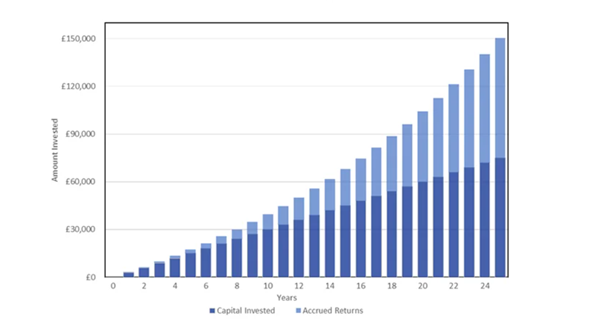

Compound returns can be your best friend when building wealth for your future, helping you grow your investment portfolio by a substantial amount in the long run.

This effect occurs when you receive “growth on growth”, including returns and dividends from previous years.

For example, if you invested £100,000 and generated a 5% return in the first year, your investments would have grown by £5,000, giving you a portfolio value of £105,000.

If you kept all of this money invested and again received a return of 5% in year two, your portfolio would grow by £5,250.

Thanks to this snowball effect, by keeping your money invested you could grow your portfolio by more each year, even with a constant return rate. The below graph shows how this could lead to your portfolio growing to an impressive size over time.

Source: Investec. Assumes that you invest £3,000 yearly with a 5% annual growth rate.

By holding investments over many years, your accrued returns could accumulate until they make up a significant portion of the value of your investment portfolio.

However, if you try and time the market, you could miss out on these compound returns.

At Clarion Wealth, we can help you grow your wealth and achieve your life goals.

To find out how we could help you build an investment portfolio to support your dream future, email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.