Category: Business

The Clarion Investment Committee met on the 14th of September 2023. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

The Office for National Statistics upgraded the UK’s Gross Domestic Product (GDP) growth estimates for 2021 from 7.6% to 8.7%, evidence that the UK’s recovery from the pandemic recession was faster than previously thought.

UK average house prices fell by 5.3% in the year to August, the sharpest annual fall since 2009, and mortgage approvals fell by 22% in the year to July. A number of UK mortgage lenders are now cutting mortgage rates amid the slowing housing market.

The total value of mortgage arrears in the UK rose in Q2 this year to the highest level in seven years.

UK inflation unexpectedly fell to 6.7% in the 12 months to August, down from 6.8% the previous month, in part due to a fall in restaurant prices. UK core inflation, which strips out volatile prices of energy and food, fell from 6.9% to 6.2% over the same period pointing to an easing of underlying inflation pressures.

Following the news, the Bank of England (BoE)’s Monetary Policy Committee, by five votes to four, elected to keep interest rates on hold at 5.25%, ending a run of 14 consecutive rate rises since December 2021.

The European Central Bank (ECB) raised interest rates by 25bp to 4%, the highest ever level since 2007.

The UK economy contracted by a greater-than-expected 0.5% in July, as consumption and production were hit by the wet weather and strikes.

In the 3 months to July, UK annual growth in average total pay, including bonuses, accelerated to 8.5% making the 15th consecutive rise in interest rates from 5% to 5.25% inevitable.

US inflation rose above expectations to 3.7% in August due to higher petrol prices. However, core inflation fell to 4.3%.

Goldman Sachs’s CEO David Solomon said that the chances of a soft landing in the US are now “materially higher” compared to a year ago, but inflation may prove stickier than anticipated.

Russia’s central bank raised interest rates by 100bp to 13% to halt the devaluation of the rouble and curb its rising inflation.

In a reversal of a recent trend of weak data, Chinese retail sales and industrial production grew more than expected in August.

US home prices rose for a fifth consecutive month in July, despite recent rate rises.

Money supply in the euro area contracted for the first time since 2010 as private sector lending and deposits fell, in the latest sign of a slowdown in the region.

The price of oil rose above $95 per barrel for the first time in almost twelve months following production cuts by Russia and Saudi Arabia. The development may reverse some of the falls in inflation seen in advanced economies.

European natural gas prices rose following strike action by workers at liquified natural gas facilities in Australia.

According to a BoE survey, UK businesses are planning to raise prices by 4.9% over the next year, the lowest reading since the invasion of Ukraine.

UK public health officials said that COVID variant BA.2.86 was spreading in England but that it was too early to conclude if it was more serious than previous variants.

Chinese property stocks fell after Country Garden reported a $7 billion loss in the first half of 2023 and China Vanke cancelled a $2 billion share placement.

UK airlines were hit by an air traffic control disruption that led to flight delays and cancellations over two days.

The FT reported that many western companies’ earnings reports highlight the slow recovery in China as a key downside risk for their businesses.

Apple unveiled four new iPhone models and two updated watches. Prices for the new iPhone 15 Pro Max will start at $1,199 but the share price of the technology giant fell after reports that the Chinese government has banned some public officials from using foreign-made phones including iPhones.

The UK competition authority upheld a ruling by the UK aviation regulator that forced Heathrow Airport to cut its landing fees.

Concerns grew in the UK that courts, hospitals, prisons, and other buildings across the public and private sectors in addition to at least 147 schools could contain reinforced autoclaved aerated concrete, which is prone to collapse.

Royal Mail is seeking to end Saturday deliveries to cut costs.

Businesses in London’s West End have criticised the government’s decision to stop tax-free shopping for tourists as having a greater effect on their business than the rising cost of living.

UK retailer Halfords announced rising sales driven by its car servicing and repair businesses despite a fall in cycling revenue.

German carmaker BMW announced a £600 million investment to build two new electric Mini models in Oxford, after securing a £75 million government support package.

Assets in the world’s 300 biggest pension funds declined for the first time in five years as “inflation and higher interest rates disrupted equity and bond markets worldwide”, according to WTW’s Thinking Ahead Institute.

French supermarket Carrefour has put stickers on shelves warning shoppers of “shrinkflation” on products with smaller contents but unchanged or rising prices. Carrefour said it wanted to put pressure on food producers to keep prices down.

Citigroup announced plans for the biggest reorganisation of its activities in 15 years, entailing significant job cuts.

The UK government unveiled plans to invest more than £500 million to salvage Britain’s biggest steelworks at Port Talbot in Wales.

Price cuts and higher wage bills pushed the UK arm of supermarket Lidl into a £75.9 million loss in the 12 months to March.

UK pub chain Stonegate, owner of the Slug and Lettuce brand, announced plans to raise beer prices by about 20p more per pint during peak hours due to cost increases.

James Timpson, CEO of UK high street repair chain Timpson, wrote in The Daily Telegraph that the rents paid by his company had fallen by 32% over the last six months.

A catastrophic flood hit the Libyan city of Derna, killing at least 20,000 people after the collapse of two dams, with casualties expected to reach twice that figure.

North Korean leader Kim Jong Un offered his full support to Russia’s Vladimir Putin in the “sacred fight” against the West.

US regulators approved new COVID-19 boosters from Moderna and Pfizer, after a sharp rise in new cases in the last month.

The UK Labour Party announced that it would “strengthen and increase statutory sick pay” by removing the lower earnings limit and removing the waiting period.

Pat McFadden, Labour’s shadow Cabinet Office minister and election co-ordinator, refused to commit a future Labour government to building the northern section of the HS2 railway line to Manchester just days after ministers voiced similar uncertainties.

Republicans in the US House of Representatives launched an impeachment inquiry into US president Joe Biden’s family business dealings.

The BBC reported Ukrainian sources as saying that the country’s counter-offensive has gained momentum and breached Russia’s first line of defences in the south.

UK foreign secretary James Cleverly visited China and called for a “robust and constructive” new bilateral relationship with Beijing.

Russia’s defence ministry confirmed that its new intercontinental nuclear ballistic missile designed to carry multiple warheads is ready for combat duty.

The UK’s health and security agency suggested speeding up the autumn COVID-19 vaccination programme to prepare for the new subvariant BA.2.86.

The US and Vietnam have tightened diplomatic links in a move designed to counter China’s growing assertiveness.

Birmingham City Council declared itself effectively bankrupt after facing a bill of £760 million to settle historic pay discrimination claims.

North Korea unveiled a submarine it claims can be armed with nuclear weapons.

Please click here to access the September Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Reassuring news on the macro front—namely that inflation appears to be buckling under the weight of 14 interest rate hikes, and relief that the BoE, after a cautionary pause in September, has probably only one more tightening move left in the bag has the making of a happy economic ending. But a couple of subplots could delay or even derail this crowning moment.

First monetary tightening has now reached a point where it could cause the economy to buckle too, something the Monetary Policy Committee acknowledges in its description of current policy as being restrictive.

Secondly, we are likely to have to endure higher interest rates past the point when inflation gets closer to the target, which means access to cheap borrowing stays closed off.

Recent falls in the CPI rate have been an important turning point in the inflation fight but flickering risks remain. Among the lingering symptoms worrying the Bank is the fast rate of pay growth. In the three months to July, average wages went up by 8.5%.

The Bank’s own surveys of businesses revealed that they expect wages to grow by more than 5% in the coming year.

Wages and labour market tightness cannot be ignored. Capital Economics says that history shows inflation only fades completely when a loosening in the job market drives the job vacancy rate down to normal levels and, if inflation is to fall to 2%, wage growth must be suppressed.

For that to happen the job vacancy rate needs to fall to around 2.5% from the current 3%. That in turn may require rates to stay elevated for a year or more, because even if by some miracle, supplies of labour increase, most of the decline in the vacancy rate would have to come through businesses being forced to retrench.

But could the BoE be spending too much time looking in the rear-view mirror and missing other factors, which will squeeze the economy and drive down inflation.

Whilst the transmission effect of higher interest rates has been dulled by the fact that most people with mortgages are on fixed rates, over time they will hit home. And in the meantime, there is no such transmission cushion for businesses.

The Institute of Economic Affairs argues that previous interest rate rises, should be given time to take effect before further action is taken, and the Institute for Public Policy Research agrees.

The BoE’s own calculations indicate that more interest rate rises will make no difference to inflation in the medium term. Doing nothing might be the hardest choice of all, but there is increasing evidence that is the path the BoE should be following.

But some commentators have little time for the folly of forecasting. Reality often proves the forecasters wrong. Economies have not slipped into recession and far from falling into an abyss, corporate finances are in good shape.

The economy has already absorbed a hefty amount of rate hikes and shown resilience. Growth rates hovering around 0.2% are nothing to write home about, but we have thus far avoided a recession, and the Bank expects a similar growth rate in the near term. The cost to the economy in the end, therefore, may be lighter than anyone could have guessed.

The IC discussed the anticipation of a ‘return to normal’ for financial markets as yield curves should normalize to an upward slope given higher inflation expectations.

The US Federal Reserve’s “higher for longer” policy mantra is predicated on high and sticky inflation. Inflation may have fallen from its peak but not yet by enough for the Fed to “pivot” and start to reduce interest rates. However, a significant slowdown in economic activity or renewed regional banking problems might encourage the Fed to act.

On the subject of US banks, the crisis has ebbed since March, but the dangers have not gone away. The dual prospects of slowing global economic and negative earnings growth for the coming quarters raise the risk of ‘intermittent’ rather than ‘deep’ recession.

Rising interest rates, unrelenting fiscal deficits, high government debt, reversing QE (Quantitative Easing), and high levels of market leverage, due to LDI (Liability Driven Investment) strategies, increase the risk of currency and bond market volatility.

Conversely, China, the world’s second-largest economy, officially slipped into deflation for the first time in two years as consumer prices fell 0.3%b. Prices had already flatlined for much of 2023, bucking the global inflationary cycle. The property market debt overhang also casts an ongoing shadow over any resurgent growth hopes in China.

UK gilt yields have spiked in response to unexpectedly strong inflation and labour market numbers. The persistent underlying strength of core inflation suggests the UK is fundamentally diverging from Europe and the US.

Recent interest rate rises have had a negative impact on demand in the housing market and the economy is avoiding recession (so far), but growth is sluggish.

Unemployment remains lower than expected at this stage of the economic cycle and strong wage inflation (and industrial action) persists.

Market expectations are for interest rates to be ‘higher for longer’ in the UK than elsewhere. The IC expects significantly large increases in fixed income volatility, but future returns given the rise in bond yields are favourable.

While acknowledging current uncertainty, the IC also remain positive on equity return expectations although future returns for the UK market may be hindered by higher for longer inflation and interest rates.

The key themes can be summarised below as:

In the Committee’s view central banks are likely to shift from the previous inflation target of 2% to a higher figure or a floating range, which will most likely be around 3 – 4%. The amount of economic destruction required to bring inflation back to a 2% target would be too great to be justifiable.

Coupled with multiple developed economies (US and Europe) trying to ease the reliance on supply chains from China, inflation is likely to be stickier, although much lower than current levels, than initially thought.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long-term.

Keith W Thompson

Clarion Group Chairman

September 2023

Creating better lives now and in the future for our clients, their families and those who are important to them.

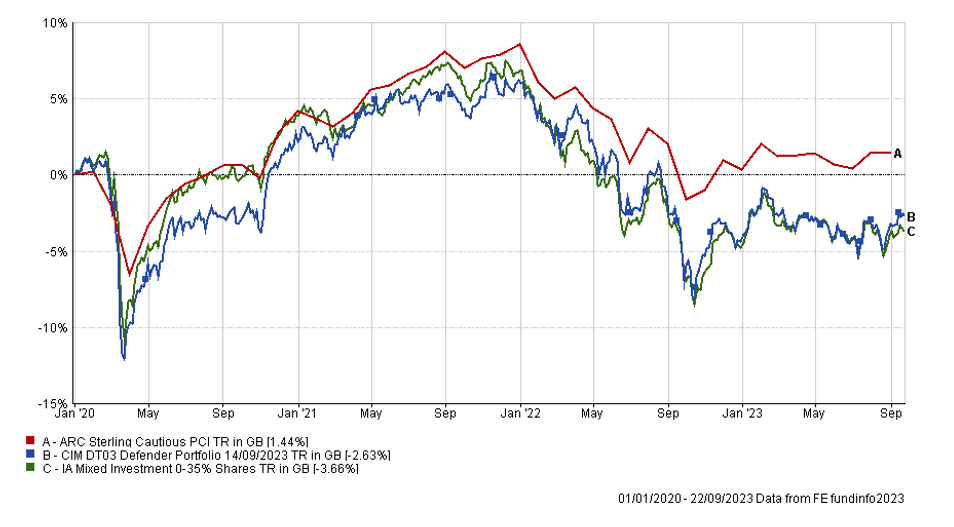

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

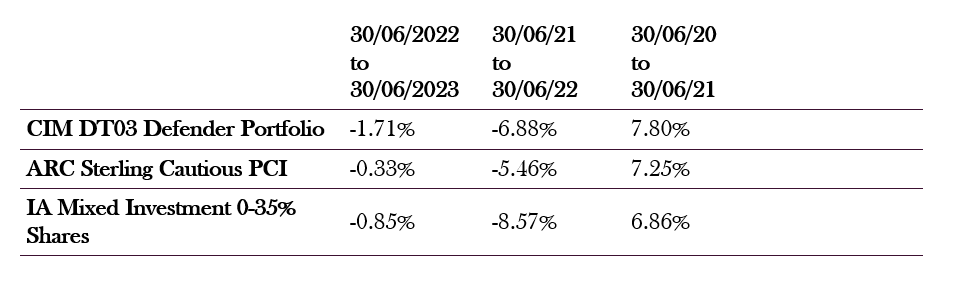

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

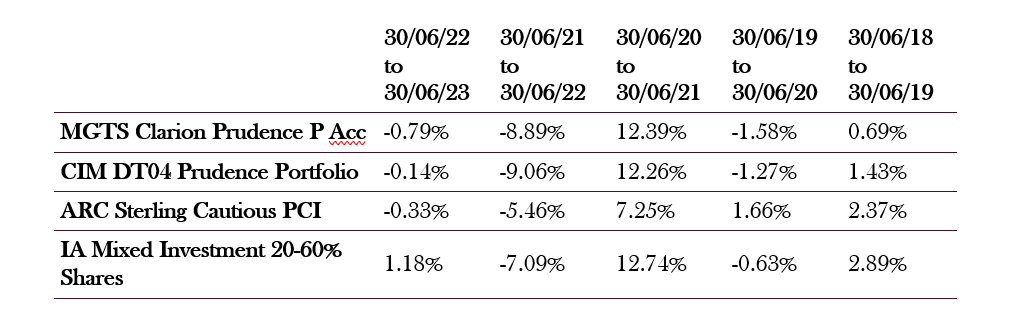

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

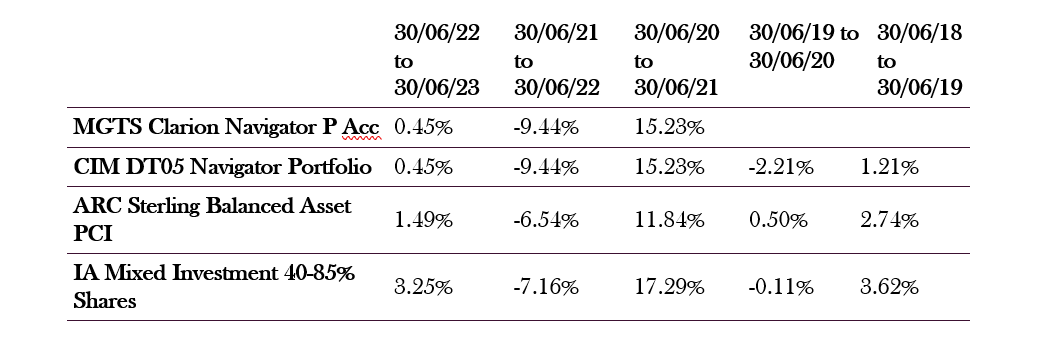

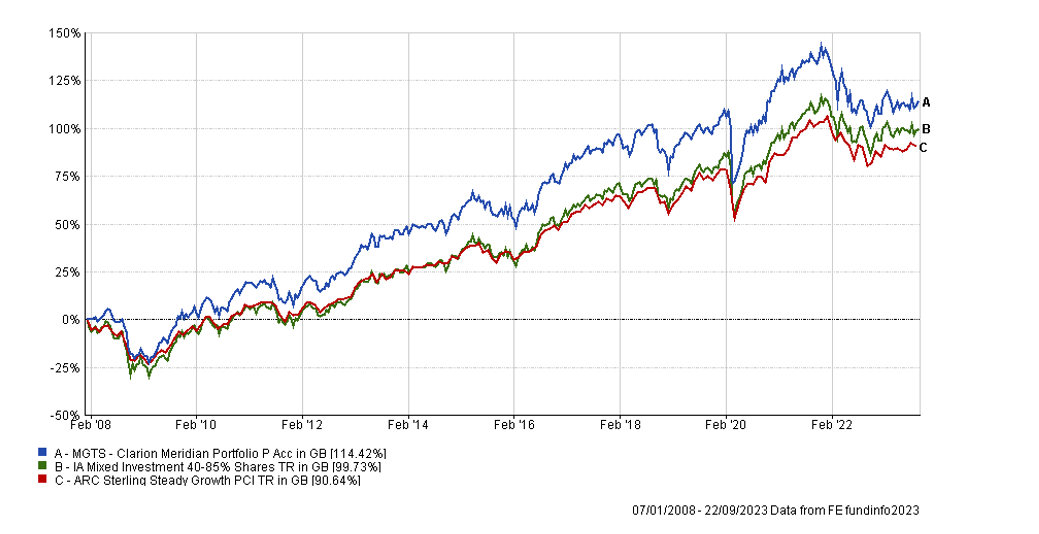

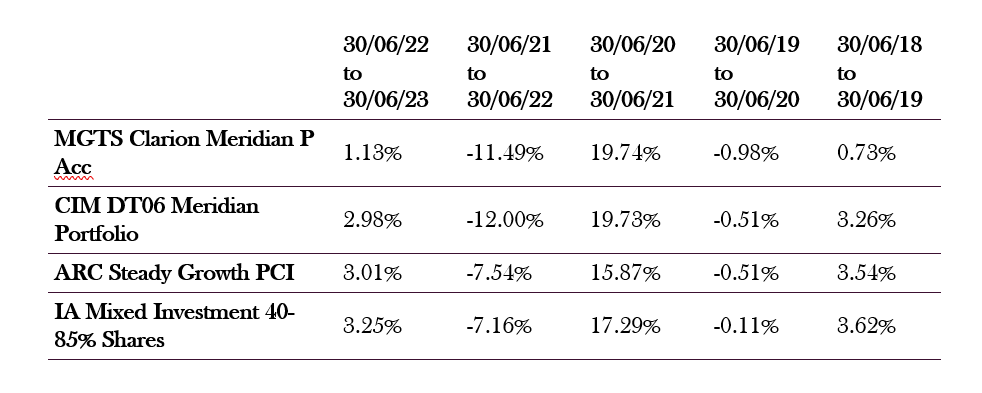

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

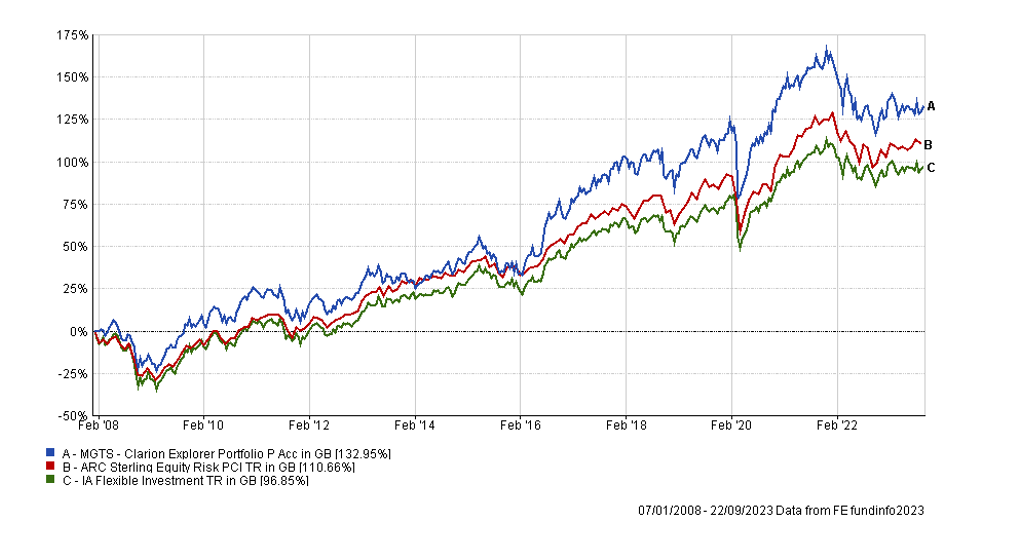

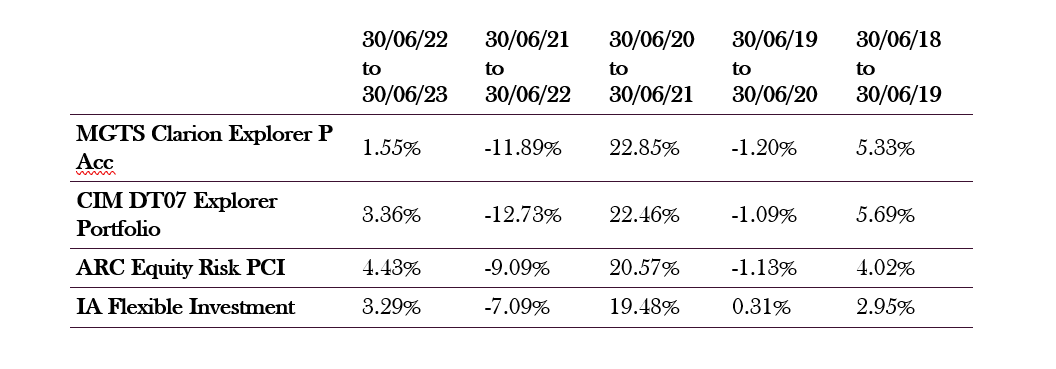

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

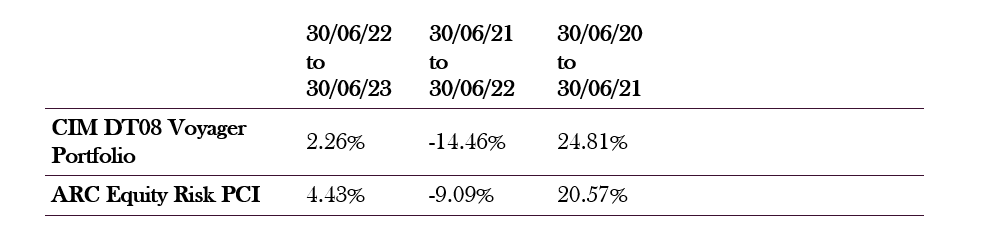

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

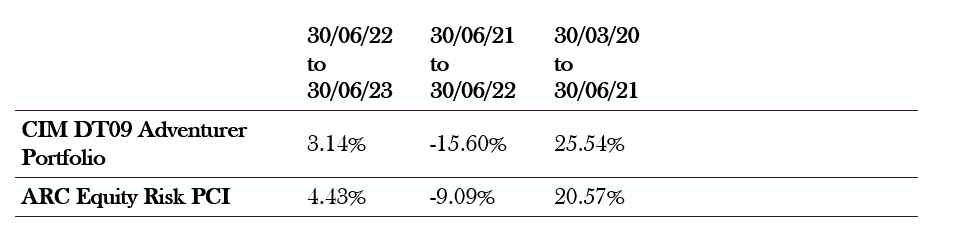

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

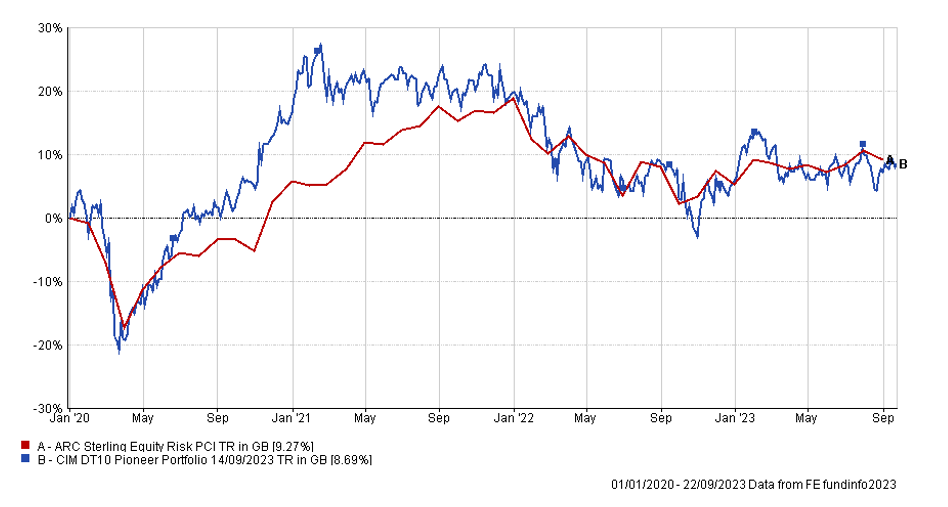

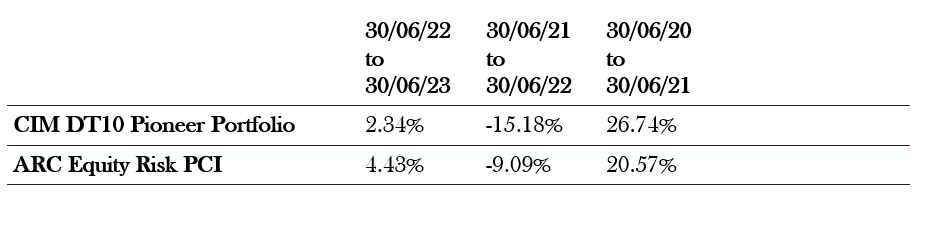

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email enquiries@clarionwealth.co.uk.

Click here to sign-up to The Clarion for regular updates.