Tags: Explorer, funds, investments, Meridian, Prudence

Category:

Financial Planning,

Investment management

Minutes of the Clarion Investment Committee held at 2pm on March 26, 2020 by video link.

Committee members in attendance: –

| Keith Thompson (KT) | Chair/Director |

| Ronald Walker (RW) | Founding Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

| Adam Wareing (AW) | Director of Operations (Clarion Wealth Planning) |

| Jacob Hartley (JH) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 13th February 2020 were agreed by the committee as a true and accurate record.

Since the outbreak of the coronavirus the Investment Committee have had regular video link meetings to keep up with events, discuss investment strategy and to review the Portfolios Funds. It is perfectly natural at times like this for investors to succumb to activity bias where in difficult and uncertain times the tendency is to take some sort of action and make the mistake of crystallising losses by selling investments. The committee firmly believe it is best to ride out the storm and to resist making any changes to the portfolios other than to rebalance in favour of equity funds. This will enable us to benefit fully from the rebound in markets whenever that may occur.

Please click here to access our March Commentary with an update on the coronavirus and summarising the Investment Committee’s current thoughts and strategy.

At the time of writing, markets have shown signs of stabilising and whereas it is too early to say whether this will lead to a significant recovery there are encouraging signs that markets are finding a floor. Any good news in the fight against the virus in the next few weeks is likely to lead to a further sharp recovery.

Last week saw one of the biggest equity market rallies of all time, accompanied (or maybe caused by) a tightening of credit spreads and a return to more orderly market conditions. Whether this is a blip in a downtrend, or a sign that the worst is behind us, only time will tell. The worst (in market terms) may be over although volatility is likely to remain high for some time to come. Pessimism about the path and devastating effects of the virus is likely to persist until new cases and deaths show signs of peaking.

Liquidity has been dealt with by central banks, solvency by governments and capital markets, and the virus will be defeated by the current lock down seen across the world. China and South Korea continue to show us the way out of this, having dealt with the virus first these countries have already seen a dramatic fall in new cases.

(see country breakdown at https://www.worldometers.info/coronavirus/ ).

On the economic front we are starting to see companies issue trading updates to inform investors of the impact of this crisis on their businesses. Almost universally profits are falling substantially and dividends are being withdrawn; no company intending to access government support can justifiably pay out dividends to shareholders. These dividends will be reinstated in due course. Some companies are reporting revenues down by 80-100%, completely unprecedented amounts, as the lockdown takes effect. A number of them are asking shareholders for funds to tide them through. This will continue as companies come to grip with their circumstances. It is all orderly though. The corporate sector is extremely adaptable and capital markets are open to fund businesses who need it.

It is likely that the rate of growth in infections will fall in the coming weeks. The lockdown, if adhered to, will work in reducing social contact which is the main cause of the spread of the disease. We could then see the gradual return to normality, similar to the experience in China and South Korea. This could in turn be accompanied by a rapid return of economic activity. A return to normality will be a psychological boost for both individuals and markets.

Alongside huge central bank and government support, this could result in a very strong environment for risk assets. There is, of course, a small chance lockdown doesn’t work, or that the virus evolves, but we continue to believe that the odds are strongly in favour of humankind, and therefore in the long term investors.

The cost of all the government stimulus will of course be expensive to tidy up. There are some positives though. First, governments can borrow cheaply, 10 year gilts are yielding just 0.4%. Secondly, governments can spread the cost over a long time. 20% of GDP seems a lot in one year, but 2% over 10 years less so. In this the biggest crisis of our generation, 2% of our income each year for 10 years to solve it is very manageable.

The committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

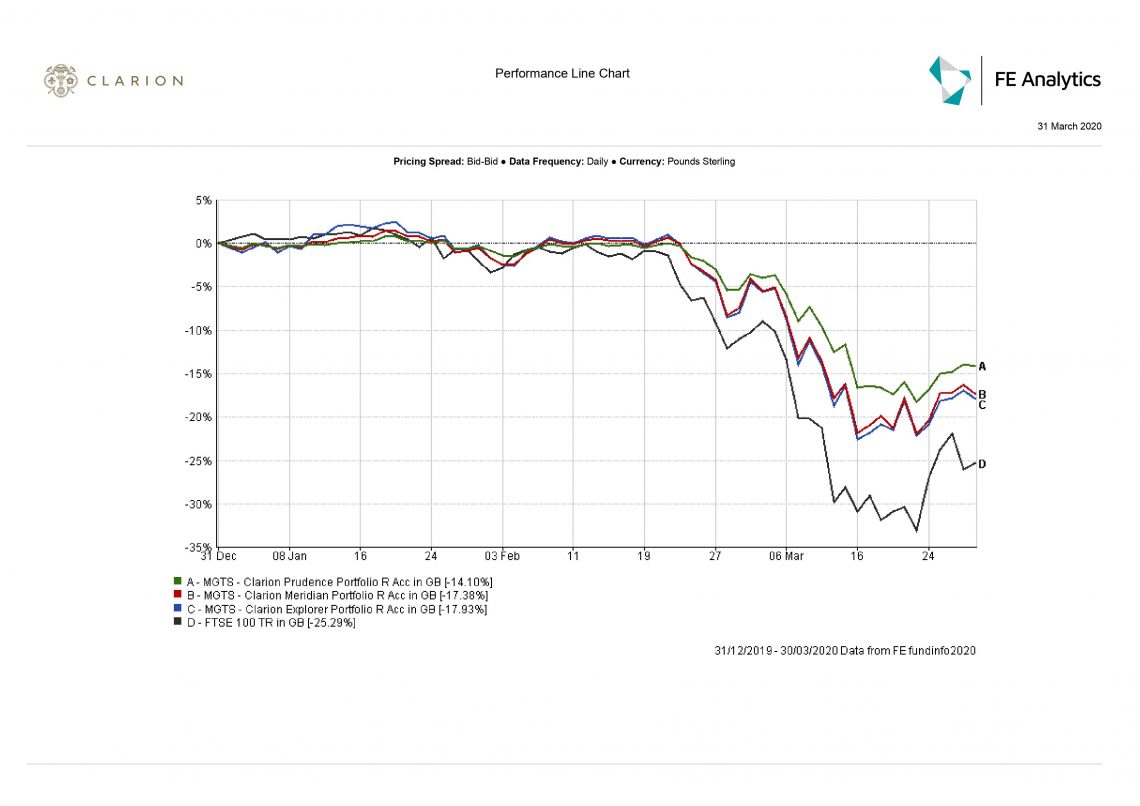

We are confident in our fund selection process and the Clarion Portfolio funds are performing well relative to peers. Our weighting towards Asia has worked in our favour as Asian Markets have fallen less than Western Markets. We feel we insulated capital well on the downside, and we are firmly focused on maximising the opportunity ahead.

90% of the underlying funds in Prudence, Meridian, and Explorer have outperformed their respective benchmarks over 12 weeks. All underlying holdings are highly liquid. The funds are very well positioned to benefit from a return to growth in the economy and remain slightly overweight equities.

We are in regular contact with our fund managers who are taking full advantage of the current situation to invest in solid growth companies with strong balance sheets at bargain basement prices.

Investments have an interesting characteristic in that generally the cheaper they get the less people want to buy them. Very few other consumer purchases have that characteristic. We think our role, on your behalf, is to carefully move in the opposite direction. When investments we want to own get cheaper we will manage our risk and where appropriate buy more of them. It is impossible to know if we will get another market sell-off, but if we do and investments become even cheaper they will become even more attractive.

The committee approved the strategy of all the funds and confirmed it is in line with the mandate.

There were no changes to the model portfolios.

None of note. Next Investment Committee Meeting is April 23 but the committee intends to have 30-minute meetings on a weekly basis.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.