Category: Business, Financial Planning, Investment management, Thought pieces

“Old Age is like everything else. To make a success of it, you have to start young”. These words of wisdom from former US President Theodore Roosevelt may resonate with many of us as we face retirement—especially as that timeframe is getting longer.

When the first UK state pension came into effect in January 1909, the average life expectancy at birth was just over 53 for a female and around 50 for a male. There were formidable barriers to taking advantage of the state pension, the main one being that it was only available from age 70, an age which at the time was statistically beyond the reach of most people.

According to the Office for National Statistics (ONS), a male born in the UK today can expect to live for 79.2 years whilst a female can expect to live for 82.9 years. People collecting their state pension now can expect to live for another 21 years. Once you get past age 70, the chances of living to a ripe old age increases substantially. This is probably because if you have reached age 70 then you are either made of strong stuff or you have been looking after yourself well, or both. Recent statistics suggest that the number of people over the age of 85 will double by 2024.

Some people go to extreme lengths to achieve immortality. In Las Vegas recently, more than 2000 people attended a RAAD-fest. RAAD stands for “Revolution Against Ageing and Death”. A religious group in Florida who are devoted to living forever, regularly attend “The Church of Perpetual Life”.

Although we are living longer, many of our financial arrangements are wedded to thinking in the past and a major rethink of our financial assumptions is needed. For the super-rich billionaires of Silicon Valley, the fight against ageing has become an obsession as they strive for more time on earth to allow them to enjoy their vast riches. For the rest of us the emphasis is slightly different. Living longer is a blessing but not an unmixed one as we need to make sure that we don’t run out of money and our finances are resilient to change.

It becomes more important to ensure that we have enough income and capital to last our lifetimes. This means that we will almost certainly need to invest in a range of stocks and shares and suitable investment funds as history shows that this is the best way to ensure our savings will not be eroded by inflation in the long term.

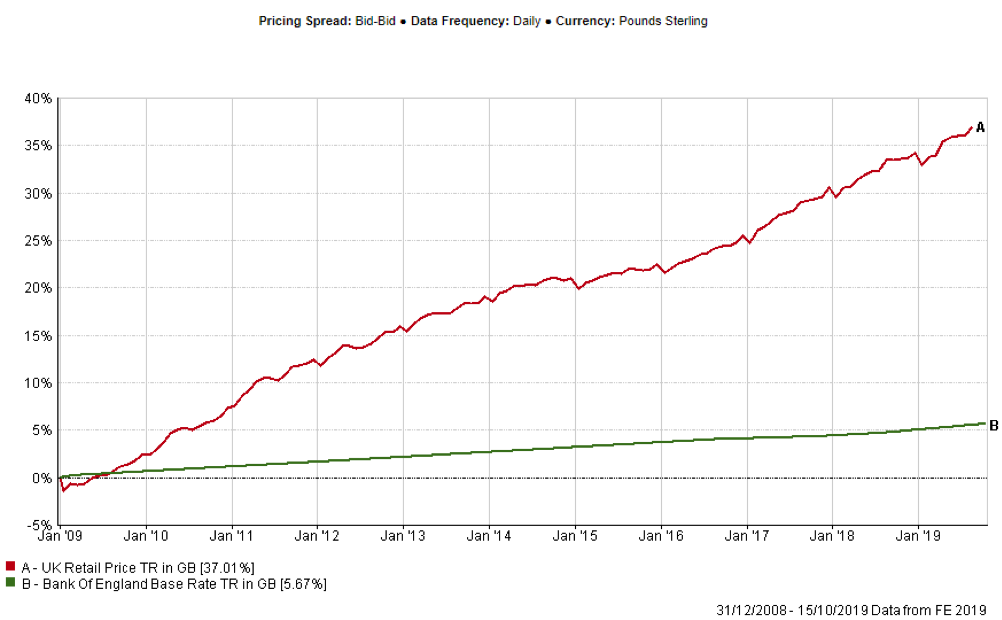

Think of the damage that inflation could do to your capital over the long term. Over time, inflation can reduce the real value of our savings as typically, the prices of goods and services increase year on year. Inflation is very bad news for cash savers as the purchasing power of money is eroded. Low interest rates, which Bond yields predict are set to stay low for decades to come, don’t help either as this makes it even harder to find returns that can keep pace with rising living costs. This is demonstrated in the following graph:

Whilst we can’t predict how much things will cost in future; we can model how historic inflation has depleted the real value of capital. For example, if you had left £100,000 in a bank account at the start of 2009, the value as of today’s date would be £105,670. The effect of Retail Price inflation over the same period means its purchasing power would have fallen to around £68,500.

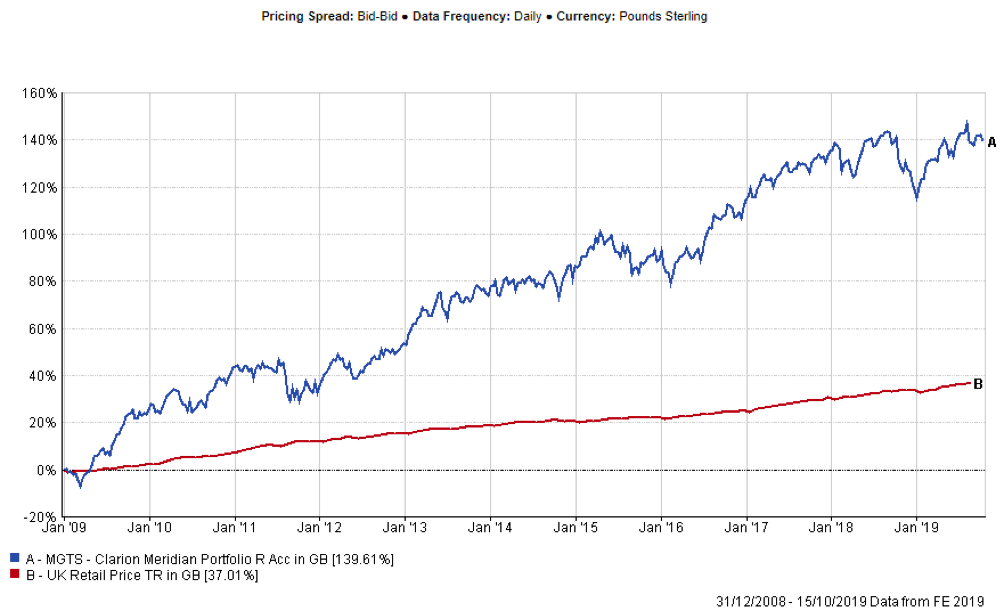

The same capital invested in the Clarion Meridian Portfolio Fund would have grown to £239,610, which after taking into account the effects of inflation, would be £202,460 in real terms. This performance of the Clarion Meridian Portfolio Fund versus Retail Price inflation is highlighted in the following graph:

Inflation is a market force that is impossible to avoid completely but by planning for it and putting a strong investment strategy in place, it is possible to minimize its impact on our savings and long-term investment plans. Our own spending, our personal inflation rate, can fluctuate too. We need to prepare for the effects of our expenditure rising, then perhaps levelling off or even falling, then rising again.

Whilst the cost of living is outside our influence, and our personal cost of living could fluctuate, some factors in maximizing a retirement pot are easier to control.

Investing in equity markets can be disconcerting at times particularly when markets get rocky and volatility increases. It can be tempting to exit to avoid loses but history has shown that financial markets go up in the long run despite short term fluctuations. Staying invested and not trying to time markets can make a big difference to returns. Research shows that over a 30-year period, average US investors trying to time the market would have received an annual return of less than 4% compared to an average market return over that timeframe of more than 10%; a tremendous difference particularly when taking into account the effects of compounding.

Assessing your preferred individual risk tolerance is also crucial to achieving your goals. A typical investing maxim recommends that as we get older, we should invest in less risky assets but bearing in mind ever increasing longevity, it is possible to take on more risk when you consider your time horizon and personal circumstances. A controlled, sensible degree of risk could produce better returns over the medium to longer term. Being too cautious, often referred to as ‘reckless caution’ can be every bit as damaging to investment and savings as being too adventurous.

The Clarion lifetime cash flow modelling tool can help you prepare for any potential inflation shocks down the long road to and in retirement. With our help you can better understand the impact of living longer and the effects of inflation on your retirement so that you can make more informed decisions about the capital and income you may need for a longer, more fulfilling life.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.