Tags: Russia, stock markets, Ukraine

Category:

Investment management

“Down cycles are not fun. But they form the basis for enormous future profitability.” – Steven A. Schwarzman. American billionaire businessman and philanthropist and Chairman of The Blackstone Group, a global private equity firm.

The war in Ukraine grinds on with tragedy around every corner but Russia is finding the going far more challenging than it ever anticipated.

However, despite the terrible unfolding humanitarian crisis, the conflict has somehow become yesterday’s story. Looking at two reliable measures — global Google searches and stories published each day by Bloomberg with the word “Ukraine” — interest in the subject has dwindled.

There is at least one reason Ukraine is attracting less attention. To quote a recent article in the Financial Times:

“The conflict in Ukraine is settling into a battle over Donbas, a region of Eastern Europe engulfed in war for eight years. Eight years during which time most people paid no attention to it. As such, the market volatility emanating out of Ukraine is on an inexorable decline. Surprises and shocks are still likely to occur from time to time, but what happens in Donbas will stay in Donbas.”

It is natural that the situation does not hog attention in the way it did in the first few days after the invasion. Yet it is remarkable that interest is now lower than in early February, when most believed that there was not going to be a war.

Does this make sense? Not really. Recent news flow includes the following:

Victory for Kyiv is a strategic imperative for world peace, and we continue to hope and pray for a quick end to the conflict, but the possibility of a peaceful solution is now looking less likely than at any point in the last three months. At least as viewed from here, the Russian regime is fraying, while the flow of senior politicians to Kyiv suggests the West is escalating with no clear objective, enchanted by the idea that it might be possible to inflict an outright defeat on Putin.

In the meantime, the utter futility of it all continues to shock and unnerve everyone in the free world in equal measure.

After a strong bounce back from the pandemic in 2021 the pace of global growth was always set to slow this year, but that slowdown is coming faster than expected due to rising inflation, the war in Ukraine and a new COVID wave in China. The International Monetary Fund (IMF) recently cut its forecast for global growth in 2022 from 4.4% to 3.6% and downgraded prospects for 2023.

The message from the IMF is that the global recovery is spluttering. A unique Inflationary environment is the big problem.

As the world emerged from lockdown earlier this year people started to enjoy themselves once again, leading to global demand increasing rapidly. By itself, a rise in demand would normally lead to price increases – this is known as “demand-pull” inflation. However, where this inflationary environment differs is the exacerbating circumstance of drastically limited supply. Whilst the global economy ground to a halt in 2020, governments (through the furlough scheme) and some companies, continued to pay their workforce not to be at work – people were still getting paid whilst the global economy was producing far less. Consequently, what we have seen is a surge in demand with supply drastically depleted.

In simple economic terms, raising the demand curve and lowering the supply curve drives prices higher, leading to inflation.

The latest UK official data shows that inflation in April hit the highest level in almost 40 years. The speed and force of the upturn in inflation has been remarkable; just over a year ago UK inflation was running at under 1.0%.

High inflation is hitting lower-income households the hardest. Lower-income households spend a higher share of their incomes on energy and food, which prices are rising rapidly. The Institute for Fiscal Studies estimates that headline inflation of 9% translates into an effective rate of 11% for the bottom 10% of earners and an inflation rate of around “only” 7% for the top 10%. Indeed, higher-income earners are better placed on all counts – with lower inflation, faster growth in pay, higher levels of saving and lower levels of unemployment than lower-income consumers. Averages conceal these vital distributional effects.

Wages are very unlikely to keep pace with inflation this year, pointing to a severe squeeze on consumer spending power. The polling group GfK recently reported that their measure of UK consumer confidence had dropped to the lowest level since the series started in 1974.

Central banks led by the UK and the US are set for an aggressive round of interest rate hikes in a show of strength as they step up the fight against inflation. Higher interest rates will lead to higher debt servicing costs which will also weigh on economic activity.

Although forecasts for growth have fallen markedly in recent months, the IMF, and most other forecasters, expect the world economy to dodge a recession. On average most assume a continued, if bumpier, and much slower, recovery. That may be the most likely outcome although we have three central scenarios ahead of us. They are:

Not long ago, there were real hopes of a return to “Goldilocks” — an economy that is not too hot and not too cold. Now, the ideal outcome would be a “Sully” — an economy that somehow engineers a soft landing just as Captain Chesley Sullenberger once managed to safely ditch a passenger jet on the Hudson River. At present, the manoeuvres to get the economy to slow down gently without tanking look as difficult and perilous as those undertaken by Captain Sullenberger as he tried to avoid crashing into Manhattan. But it could happen, and perversely the surprises of the last few months might just make it easier to execute such a landing.

What we need is a “growth scare,” one that is sufficient to stop central banks freaking out but not large enough to plunge the world into recession. And with all parts of the world facing near-term problems, a growth scare is now a distinct possibility. Combine China’s property slump (and lockdowns) with a massive squeeze on real incomes in Europe, plus tighter financial conditions in the U.S., and maybe the world economy will deteriorate just enough to put the authorities on a more cautious policy path.

We are at an important turning point for the global economy as it emerges from the pandemic and the global recovery takes hold. With a little help from the disasters around the world, the Fed and other central banks might just successfully navigate a “Sully Landing.”

The last 40 years has been a period of steadily declining inflation and interest rates, a transformation that has boosted asset prices and created a golden era for investors. In the US, the real return on equities averaged 9.2% a year between December 1981 and December 2021, far outstripping growth in average real earnings of 0.5% a year and overall GDP (Gross Domestic Product) growth of 2.7%.

But investors are now worried that the age of low inflation and low interest rates is ending. Since the turn of the year, we have seen heightened volatility in both equity and bond markets, with a combination of high inflation, rising interest rates and the crisis in Ukraine significantly weighing on investor sentiment. Uncertainty remains extreme and stock market volatility is an inevitable consequence as investors switch from risk on mode to risk off mode and visa versa.

Global equity markets have fallen over 12% since January. Chinese equities and European stocks have seen larger declines with China suffering from renewed lockdowns and Europe vulnerable to the fallout from the war in Ukraine as well as disruption to the supply of Russian energy.

The American equity market’s heavy exposure to technology stocks, for many years a source of strength, has hit performance with weakening consumer demand and expectations of higher interest rates taking a toll on tech stocks. Shares in Netflix have fallen more than 67% this year after announcing declining subscriber numbers. Shares in Microsoft, Apple, Google, Amazon and Meta (formerly Facebook) have also declined. Earlier this month Apple reported higher sales and profits but warned that supply chain problems and factory closures in China could cost the business $8bn in the current quarter.

A classic ‘risk off’ rotation is taking place, with safer, defensive stocks such as utilities and consumer staples outperforming growth-dependent sectors including retail and consumer discretionary. Shares in large cap businesses have outperformed smaller companies which are less resilient and more vulnerable to weakening growth. Emerging market equities have underperformed developed markets. Value stocks, those offering higher dividends, such as oil or commodity businesses, have done better than growth stocks which offer the promise of future gains.

This process has created some strange winners, among them UK equities which for more than ten years have lagged behind the Euro area and US markets. A limited exposure to tech and a significant weighting in oil and commodities, and financials, has helped the UK market this year, as has the UK’s lower exposure to the effects of the war in Ukraine. UK large cap equities are up slightly since January compared to the double-digit losses seen in the UK small cap index and main European markets.

In times of uncertainty investors tend to seek safety in government bonds. But rapidly rising inflation, which reduces the income from bonds, has instead caused bonds to sell off. The Bloomberg global aggregate bond index has fallen by over 10% this year

Inflation is the big enemy of investors and savers. The hope is that, like previous outbreaks of inflation in 2008 and 2011, this one will prove short lived with slower growth, higher interest rates and an easing of supply problems generating sharp falls in inflation through 2023.

In the meantime, the dilemma for investors is that risky assets yield the best returns over the longer term. Warren Buffett, who has been using the fall back in stock markets to make major buys this year despite the current uncertainty, says “inflation swindles the bond investor. It swindles the person who keeps their cash under the mattress. It swindles almost everybody except those who invest wisely”. With inflation at 10%, and bank rates still only 1%, the ultimate ‘safe’ investment, cash, cannot protect the real value of capital.

Seasoned equity investors observe that risky assets have come through the shocks and volatility of recent years in decent shape, and they will do so again. More positively, we continue to believe that stock market shocks are when investors really earn the returns in excess of the pitiful interest on risk free savings, Diversification and dividends diminish the pain of falling prices and reward patient investors. For example, investors in British companies can expect higher dividends this year than previously forecast, as rising oil and commodity prices brighten the outlook for shareholder pay-outs. UK listed companies are on track to pay out £92 billion to shareholders in 2022.

Assessing the situation today, the good news is that corporate profitability, as reported in recent results, has generally been resilient. Stock markets are now reasonably priced after the recent falls compared to long term averages. Many sound companies are trading on extremely attractive valuations, from which we believe they can deliver strong shareholder returns and a high-income stream.

The average valuation of companies in the Clarion portfolios is at a significant discount to the broader stock market. The Clarion portfolio funds, and model portfolios are diversified into cyclical, defensive, commodity and financial companies, with a balance of both growth and value stocks. There is a broad mix of sectors and geographic exposures, within the context of well diversified actively managed portfolios.

Whilst there is considerable uncertainty today with the inevitable consequence that short term volatility is uncomfortably high, we believe that the Clarion investment portfolios can continue to fulfil clients’ objectives of delivering long-term capital growth. In fact, it could be argued that the current sell-off presents a great opportunity to add to positions at increasingly attractive valuations.

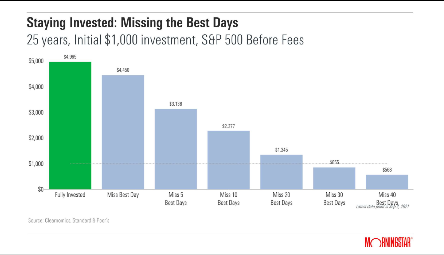

To conclude and appreciating how times like these can be unsettling for clients, we would like to share this chart from Morningstar which demonstrates the benefit of time in the market. The chart shows that for an investor who attempts to “time the market” and misses out on just the 10 best days in the stock market over a 25-year period, the return would be less than half the amount made by remaining invested at all times.

Please refer to The Clarion Investment Diary for a real-time summary of the key points discussed at the Investment Committee meeting held at the Clarion offices on 11th May.

As always, we thank you for your continued support and we look forward to updating you regularly throughout 2022. We invite you to get in touch if you have any questions and finally, we wish you all an enjoyable Platinum Jubilee weekend.

Keith W Thompson

Clarion Group Chairman

May 2022

Creating better lives now and in the future for our clients, their families and those who are important to them.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email enquiries@clarionwealth.co.uk.

Click here to sign-up to The Clarion for regular updates.