(Return to all News and Updates)

With Inheritance Tax (IHT) receipts reaching record highs in the 2022/23 tax year, you’ve perhaps never been more likely to leave your loved ones with a bill when you pass away. IHT is a tax on the estate, including possessions, money, property, and some lifetime transfers, of someone who has died. Yet, despite an increasing […]

Tags: estate planning, Inheritance tax

Category:

Financial Planning

“In this world nothing can be said to be certain, except death and taxes.” Benjamin Franklin, American statesman and Founding Father In the complex world of financial planning nothing is certain. We therefore regard our clients’ financial plans as “living documents” to be reviewed and adapted as families grow and goals change. However, the […]

Tags: gifts, Inheritance tax

Category:

Financial Planning

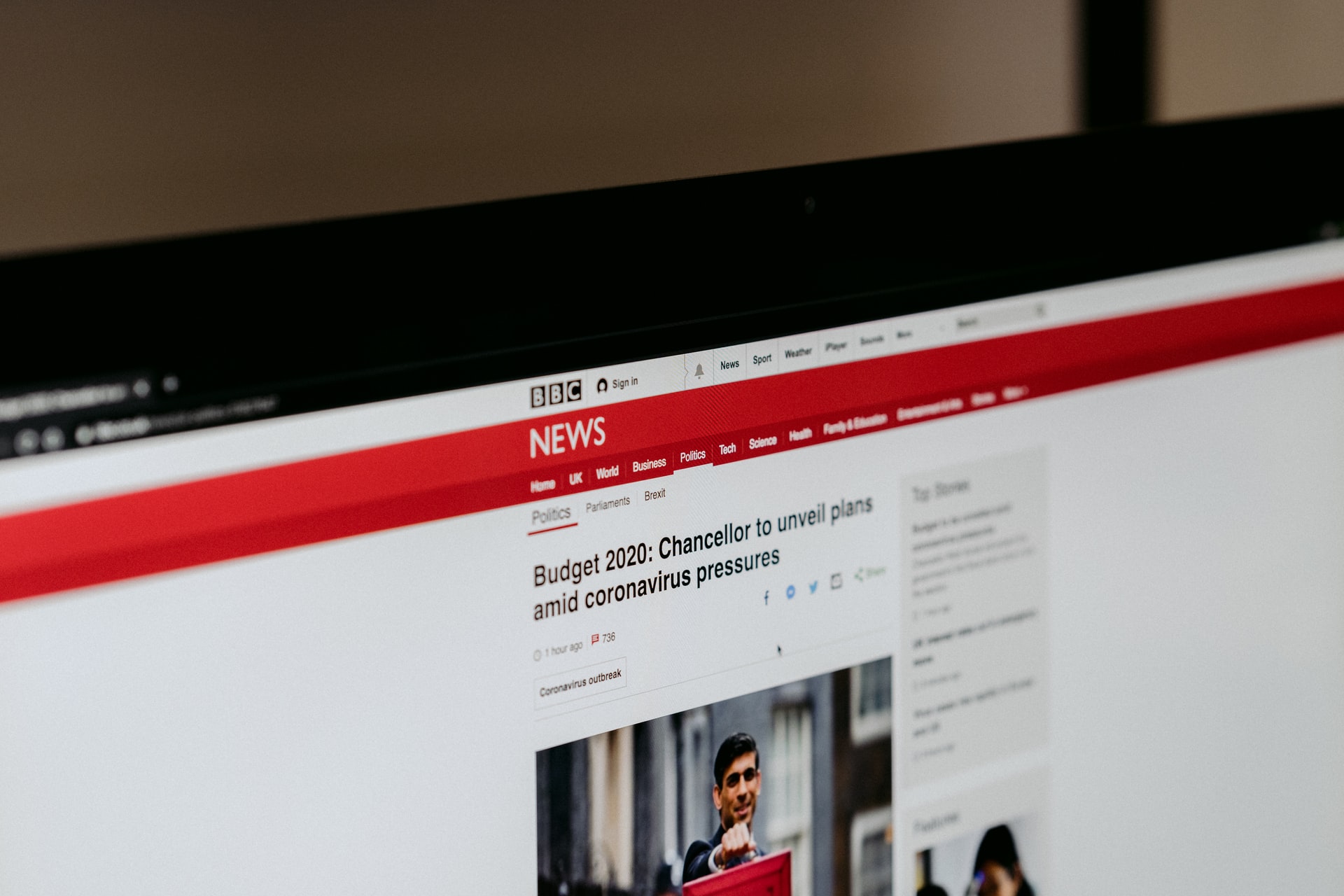

Delivered against a backdrop of stock market turmoil and a deepening coronavirus crisis, Chancellor of the Exchequer Rushi Sunak’s first Budget could not have been more dramatic. The Bank of England announced an emergency rate cut just hours before Mr Sunak promised to do “whatever it takes” to protect the UK economy from the coronavirus […]

Tags: Entrepreneur's Relief, Inheritance tax, Tax, The Budget

Category:

Financial Planning