(Return to all News and Updates)

“Wealth is the ability to fully experience life.” Henry David Thoreau 1817-1862 American naturalist, philosopher, and author. He wrote the book “Waldon,” a refection upon simple living in natural surroundings. The UK General Election. At the time of writing this commentary, the results of the General Election are still unknown although a Labour victory, with […]

Category: Financial Planning

As a business owner, offering a competitive salary, enjoyable office culture, and flexible working are all effective ways to attract and retain top talent. But did you know that, for many job hunters, a good benefits package is their number one priority when choosing a new role? Indeed, People Management reports that 55% of younger […]

Category: Financial Planning

Bryan Cranston was 44 when he landed the role of Hal on Malcolm in The Middle. Eight years later, he’d go on to achieve international stardom as the fascinating anti-hero Walter White in Breaking Bad. But this success didn’t happen overnight. Prior to Malcom in The Middle, Cranston had been a jobbing actor for 20 […]

Category: Financial Planning

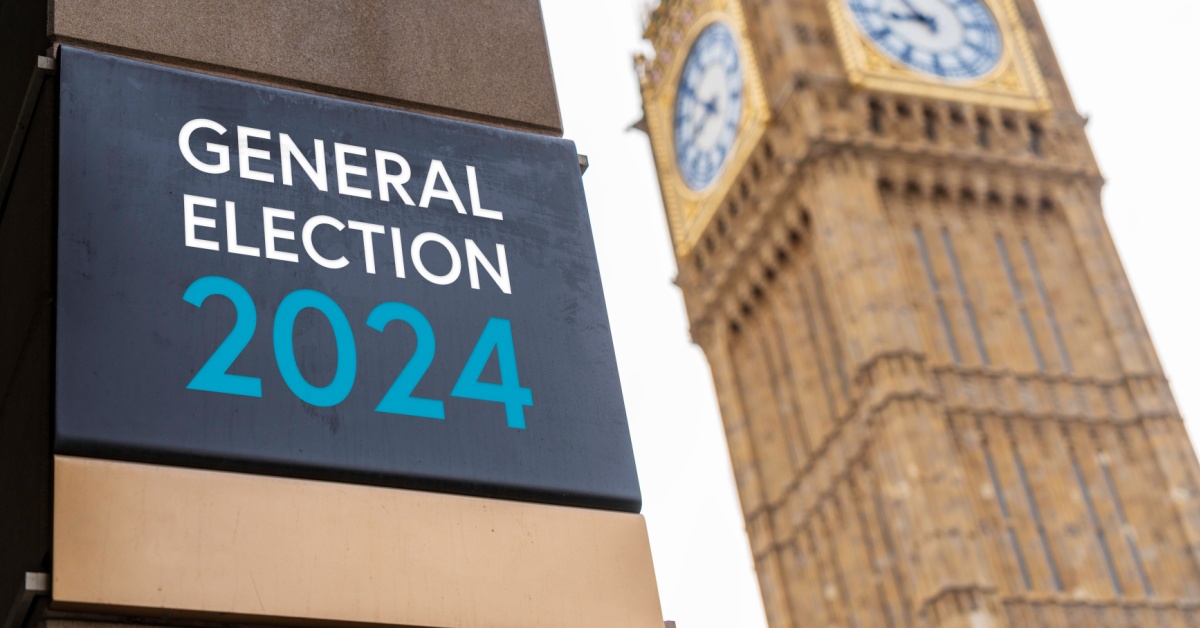

2024 has been called “the year of elections” with an estimated 2 billion people around the world heading to the polls. Voters in the UK will have their say on 4 July. Now that each of the main parties has published their manifestos, here’s what the 2024 general election could mean for your finances. Conservatives […]

Category: Financial Planning

The Clarion Investment Committee met on the 16 May 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets. Economic, Political and Business Snapshot Economics The UK economy grew by a greater-than-expected 0.6% […]

Category: Financial Planning

“Our greatest freedom is the freedom to choose our attitude.” Viktor Emil Frankl (26 March 1905 – 2 September 1997). Austrian psychiatrist and Holocaust survivor. He founded Logo-therapy, a school of psychotherapy that describes a search for a life’s meaning as the central human motivational force. Logo-therapy is part of existential and humanistic psychology […]

Category: Financial Planning

The Talented Mr. Ripley, written by Patricia Highsmith, was first published in 1955. It introduced the world to the charismatic young con man Tom Ripley for the first time, but not for the last. Most recently, you may have been enjoying Andrew Scott’s portrayal of the fictional fraudster in the Netflix adaptation Ripley. Though a […]

Category: Financial Planning

The Cable News Network (CNN) began broadcasting at 5 pm on 1 June 1980. While it was the first 24-hour news channel, it wasn’t long before competitors followed in CNN’s footsteps, ushering in the age of the 24-hour news cycle. The advent of the internet and social media has only served to exacerbate the endless […]

Category: Financial Planning

The Clarion Investment Committee met on 18 April 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets. Economic, Political and Business Snapshot Economics UK inflation fell to 3.2% in the 12 months […]

Category: Financial Planning, Investment management, Our team news